By Robert Mullin

In a sprawling decision, FERC last week rejected requests for rehearing by multiple energy sellers implicated in market manipulation during the Western Energy Crisis of 2000/01 (EL00-95-289).

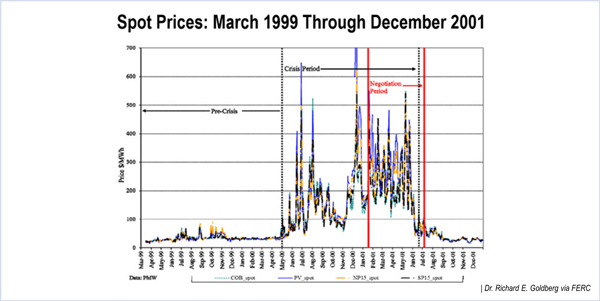

The sellers — which include Hafslund Energy Trading, Illinova Energy Partners, MPS Merchant Services, Shell Energy North America and APX — had asked the commission to reconsider previous findings related to the disgorgement of overcharges the companies raked in from May to October 2000, the so-called “Summer Period” of the crisis, which ultimately cost California ratepayers billions of dollars.

FERC’s Jan. 27 order centered on issues stemming from Opinion 536, issued in 2014. (See related story, FERC Reopens Western Energy Crisis Refund Proceeding.)

‘Appropriate Remedy’

In that decision, the commission set out what it deemed the “appropriate remedy” for the anomalous bidding, false export and false load scheduling tariff violations engaged in by the companies in an effort to drive up market clearing prices during the crisis: the disgorgement of any payments received in excess of a marginal cost-based proxy price.

A subsequent opinion required that companies found to have engaged in those practices would be forced to disgorge overcharges for all sales made during trading intervals in which market prices were affected by any of the companies’ tariff violations.

FERC dismissed as moot rehearing requests by MPS, Illinova, Hafslund and Shell that called into question the commission’s previous findings of tariff violations by the companies. The commission pointed out that the 9th U.S. Circuit Court of Appeals had already determined that FERC’s orders on those matters were final and that the commission “reasonably concluded that the sellers engaged during the Summer Period in the practices deemed tariff violations.”

The commission also denied a request for rehearing by MPS and Illinova in which the two companies contended that FERC’s requirement that an individual seller disgorge profits not directly connected to any violation they committed represents an award of retroactive refunds to buyers rather than disgorgement. The two companies had complained that FERC’s disgorgement remedy is limited to the return of profits obtained illegally. The commission countered that the 9th Circuit has recognized that the Federal Power Act “gives FERC authority to order refunds if it finds violations of the filed tariff and imposes no temporal limitations.”

FERC rejected an argument by all five companies challenging the validity of the marginal cost-based proxy price methodology being used in the proceeding. “The commission has affirmed the presiding judge’s finding that the marginal cost-based proxy methodology … provides for a credible proxy of prices in a normal competitive environment,” the commission wrote.

The commission also rebuffed the companies’ argument that they should not be responsible for disgorgement of profits from all sales affected by the tariff violations by any of the market’s participants. Commissioners said they found persuasive the arguments of a California expert witness that the tariff violations had “intertemporal” effects on the state’s market during the crisis.

The commission also rejected a contention by MPS and Illinova that the prices established by the CAISO and now-defunct California Power Exchange markets were contract rates subject to the public interest standard of review embedded in FERC’s landmark Mobile-Sierra decision.

“The prices set by the CAISO and CalPX auction markets do not constitute contract rates because they result from a generally applicable auction mechanism set forth via tariff,” rather than from an arms-length transaction between two parties, the commission said.

The CAISO and CalPX tariffs did not contain the terms of a public interest standard of review, the commission noted.

The commission also denied a request by Exelon, the successor-in-interest to AES NewEnergy, for a rehearing on the issue of the fuel costs the company submitted to offset its refund amounts.

“The commission considered the full array of evidence, noting certain CAISO records submitted by Exelon related to the transaction, but ultimately finding that Exelon had not ‘clearly linked any evidence of its actual incurred costs to the resource and sale at hand,’” the commission said, citing language in a previous ruling. The commission reiterated a requirement that fuel cost information be “clearly linked” with a resource and an energy sale and “easily verifiable by supporting evidence.”

Settlement Agreements

In two other orders stemming from the energy crisis, FERC rejected two of California’s motions to preserve remedies or refunds against other non-settling parties as a condition for concluding settlement agreements with Illinova and MPS (EL00-95-299, EL00-95-300).

California had asked for the commission to affirm that a settlement with either company would not release non-settling parties from facing the possibility of having to disgorge profits from energy sales inflated by tariff violations committed by Illinova and MPS. The state argued that FERC’s failure to grant the motion would make future settlements impossible by reducing the liability of the remaining sellers and incent them to wait for others to settle first, thereby deterring California from settling with any of them.

In denying California’s motion, the commission stated that it “has dismissed from the proceeding parties that settled … before and during the instant proceeding, excluded the conduct of non-parties from the scope of the proceeding and emphasized that the trading hours impacted by the settled parties’ tariff violations will not be included in disgorgement amounts due from the remaining respondents.” The state failed to provide a compelling reason for the commission to reverse that long-standing practice, the commission added.

The commission noted that it was not ruling on either settlement agreement and directed California to notify FERC within 30 days whether it wished to revise or withdraw from the agreements.