By Tom Kleckner

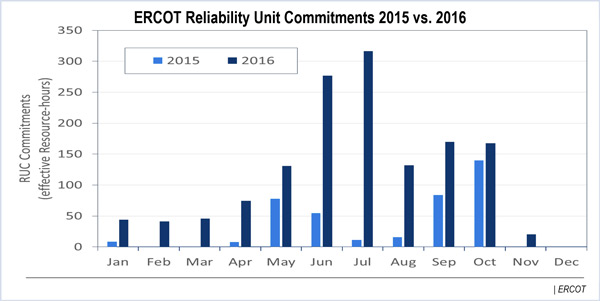

AUSTIN, Texas — ERCOT reliability unit commitment (RUC) activity increased more than three-fold in 2016, staff said at the Technical Advisory Committee meeting last week.

The number of instructed resource hours jumped from 411 in 2015 to 1,514 last year. Most of the activity occurred during the high-demand summer months, with almost 98% of the hours (1,481) noted as addressing congestion, primarily in the North and Houston zones, and the remaining 33 hours for capacity shortages.

No resource hours were committed for ancillary service shortages, voltage or reactive support, system inertia or in anticipation of extreme cold weather or startup failures.

“Although we saw a large increase in the total number of RUC commitments, we thought it was interesting to find the average dispatch limit and base points [metrics] stayed fairly similar,” said ERCOT’s Dave Maggio, manager of market analysis and validation.

According to Maggio’s report, 170 resource hours were dispatched above the low dispatch limit (a resource’s minimum production level in order to be dispatched). For 127.1 of those hours, the RUC-instructed resource was mitigated and the LMP was less than the RUC offer floor. He said the RUC-instructed resource was not mitigated for 39 hours and the LMP was less than the RUC offer floor, indicating a problem with its energy offer curve.

“If you remove the opt-out hours and just look at when the RUC occurred, it’s telling us that for 84% of the resource hours, the unit was never even dispatched off its [low sustained limit],” Barnes said, referring to a resource’s minimum sustained production capability. He painted Reliant Energy as not being in the “all-RUC-is-bad camp,” but in the “RUC-is-too-conservative” camp.

“In terms of what we’re getting for our money, [based on the results,] it’s arguable RUC didn’t always need it,” Barnes said. “If the unit was never needed to move 1 MW off its LSL [this often], we probably should be looking at the design of the RUC process. Is it too conservative or not?”

Potomac Economics’ Beth Garza, director of ERCOT’s Independent Market Monitoring group, pointed out to the TAC that 478 of the hours were bought back through the use of the resources’ opt-out status. Those resources are then excluded from RUC settlements as if the commitment never happened.

“There continues to be, from my perspective, great uncertainty in the market about how to opt out, and the specific process by which that can occur,” she said, reiterating what she called one of her “common themes.”

“It seems to me there’s a widespread lack of understanding of the specific actions that have to be done right now, versus after [NPRR] 744 is implemented. … The process will change.”

NPRR 744 was passed by the TAC and the Board of Director’s last spring and is scheduled to be implemented June 27-29. It is intended to improve the process used to notify ERCOT of a decision to opt out of a RUC order.

With the change, qualified scheduling entities (QSEs) that submit bids and offers on behalf of resource entities or load-serving entities will be required to opt out of RUC settlement by telemetering a resource’s status during the first interval it is online and available.

“This allows the entity that got RUCed to opt-out without using telemetry status,” Maggio said. The NPRR helps the ERCOT system, he said, “because the decision for employing the price adder [occurs] simultaneously.”

Noting about 600 of ERCOT’s RUC-committed resource hours took place in June and July, Garza said she believes much of that was a deferral by market participants in making their own commitment decisions.

“In deferring that decision, RUC is going to step in at some point and make a decision on your behalf,” she said. “To the extent we can get people to opt-out appropriately, there may not be a market impact. I think there’s a question there: Is [RUC] bad? Is it helping us get to better commitment decisions across the market? Opting out helps with that part as well.”

Several stakeholders pointed to the 33 resource hours instructed for capacity and questioned whether they should be in ERCOT’s market design.

“It’s created uncertainty around outcomes during those time periods that impact pricing during a capacity shortage,” said Citigroup Energy’s Eric Goff. “Hopefully, we have a significant price signal to get generators to commit themselves. If we don’t, that’s an even bigger problem.”

Morgan Stanley’s Clayton Greer suggested expanding ancillary services as another tool that could be used to “provide the same service.”