By Michael Brooks

WASHINGTON — PJM Independent Market Monitor Joe Bowring on Thursday warned that state plans to subsidize unprofitable generating resources present “a very real threat” to wholesale electricity markets.

The subsidies in question come in the form of zero-emission credits for uneconomic nuclear plants, which were included as part of New York’s Clean Energy Standard and are intended to aid the state’s transition away from fossil fuels and into renewables.

Exelon has been pushing for similar treatment for its nukes in Illinois, while FirstEnergy has said it will seek financial assistance for its Ohio plants.

“I don’t believe that any of the subsidies are being driven initially by state policy,” Bowring said during his PJM 2016 State of the Market Report presentation. “They’re being driven by the specific requests of generation owners about particular units because those units are not profitable. We would not be talking about the units in Illinois or Ohio if the capacity market prices had been higher and those units were profitable.”

Social goals — such as the reduction of carbon emissions to reduce the effects of climate change — can be accomplished through market-based solutions, such as a price on carbon, Bowring contended.

“Economists everywhere agree that … the most cost-effective way to do that is have a carbon price,” Bowring said. “It’s certainly not by picking individual power plants that are low carbon.”

To protect the markets from the effects of the subsidies, Bowring advocated for applying PJM’s minimum offer price rule (MOPR) to all existing resources. The rule currently covers only new subsidized gas-fired plants.

“Action is needed to correct the MOPR immediately,” the Monitor said in its report. “An existing unit MOPR is the best means to defend the PJM markets from the threat posed by subsidies intended to forestall retirement of financially distressed assets. The role of subsidies to renewables should also be clearly defined and incorporated in this rule.”

Bowring expressed concern that Illinois and Ohio could set a precedent for other states, calling the subsidies “contagious.” The Monitor views the threat as so severe that in January it filed as an intervenor in support of independent power producers opposing New York’s ZEC program.

“The ZEC program is not consistent with the operation of a competitive wholesale electricity market,” the Monitor told the New York Public Service Commission, adding that the program would artificially suppress NYISO, dissuade the construction of new generation and, if extended, “result in a situation where only subsidized units would ever be built.”

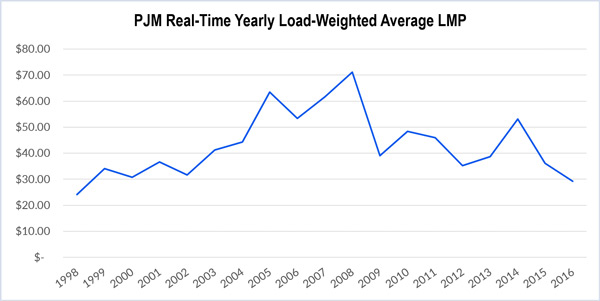

Record-low LMPs in PJM

The Monitor found that PJM’s energy, capacity and regulation markets were competitive during 2016. The average real-time, load-weighted LMP was $29.23/MWh, 19.2% below the previous year and the lowest since the competitive wholesale market commenced operation in 1999 — “which is fairly astonishing,” the Monitor noted.

Fuel prices were the main drivers: Gas prices were very low, while those for coal remained flat. High output from efficient combined cycle units — despite flat load growth — also played a significant role.

All those factors translated into a competitive market, Bowring said.

“New combined cycles have been added because of competitive markets,” he said. “They’ve been added because of the fact that we have a capacity market. … But for PJM overall markets, we probably would not have seen that level of entry of highly efficient combined cycles.”

As a result, net income for new combustion turbine and combined cycle units were up 21% and 14%, respectively. Meanwhile, profits decreased for new coal (54%), diesel (86%), nuclear (26%), wind (19%) and solar (28%).

Total transmission congestion costs fell by $361.6 million (26.1%), the result of low prices and smaller price differences across constraints.

Capacity Market

Capacity prices were lower last year than in 2015, except in the PSEG zone. Capacity revenue accounted for 43% of total net revenues for new combustion turbine plants, 32% for new combined cycles and 23% for new nuclear.

Total installed capacity last year rose 2.7% to 182,449 MW. As of Dec. 31, 101,474 MW were in the generation interconnection queue, with combined cycle units accounting for 68.3% and wind projects 14.4% of capacity. The Monitor expects gas to surpass coal in installed capacity this year.

Demand Response

Total payments to demand response resources decreased by $163.2 million (20.1%) to $655.7 million. Bowring attributed the decline to low prices, which undercut incentives to reduce power usage.

The capacity market remains the primary source of income for DR, making up 99% of its revenue — something Bowring is still not happy with, as he continues to advocate its removal from the capacity market. He said stakeholders are seriously considering the “best way” to manage those DR resources within the market.

“It’s important to understand our perspective here, which is not anti-DR at all,” Bowring said. “We’re very much pro-DR. We think it’s essential to making markets work. We want more people to have the option … to reduce demand and save capacity revenues.”