By Rich Heidorn Jr.

An appellate court on Friday overturned FERC’s 2014 order setting the base return on equity for a group of New England transmission owners at 10.57%, saying the commission failed to meet its burden of proof in declaring the existing 11.14% rate unjust and unreasonable.

“Because FERC failed to articulate a satisfactory explanation for its orders, we grant the petitions for review,” a three-judge D.C. Circuit Court of Appeals panel ruled in an opinion written by Senior Judge David B. Sentelle. The court vacated the order and remanded the case to the commission for additional proceedings (15-1118).

It is unclear how the court’s ruling will ultimately affect the rates for the TOs, which include Emera Maine, Northeast Utilities, Central Maine Power, National Grid and NextEra Energy.

Much may depend on who is appointed by President Trump to fill the vacancies that have left FERC with only two commissioners, one short of a quorum. “Under a new FERC composition, nominally under a ‘pro-infrastructure’ administration, there is potential for the environment to be more favorable for transmission ROEs,” UBS Securities analyst Julien Dumoulin-Smith said in a research note Monday.

But the court’s ruling provided ammunition for state officials seeking a lower rate, saying FERC’s analysis was “unclear.”

Attorney David Raskin, who argued the case for the TOs, referred questions to Emera, which did not respond to requests for comment. A spokesperson for the Connecticut attorney general’s office said it was reviewing the decision and declined further comment. FERC also declined to comment.

2014 Ruling

In the 2014 ruling, the commission voted 4-0 to change the way it calculates ROEs for electric utilities, moving to a two-step discounted cash flow (DCF) process it has long used for natural gas and oil pipelines that incorporates long-term growth rates.

But the commission split 3-1 over its first application of the new formula, tentatively setting the ROE for the New England TOs at three-quarters of the top of the “zone of reasonableness,” a departure from the prior practice that used the midpoint in the range (EL11-66-001). (See FERC Splits over ROE.)

The commission’s ruling resulted from a complaint filed in 2011 by New England state officials and others who contended the 11.14% base ROE was unreasonable because interest rates had fallen since the commission established it in 2006.

Both the New England TOs and state officials representing customers appealed FERC’s order to the D.C. Circuit, saying the commission had failed to meet the requirements under FPA Section 206 for setting a new ROE. The appeals followed a second FERC order rejecting rehearing requests.

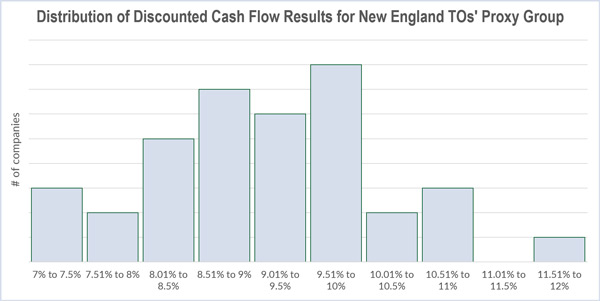

The TOs and customers did not challenge FERC’s use of the two-step methodology or the resulting zone of reasonableness, which the commission tentatively set as 7.03 to 11.74%, a reduction from the 2006 ruling that set the range at 7.3 to 13.1%. Rather, they challenged FERC’s setting of the base ROE within the new zone.

The TOs said the order should be vacated because it failed to find that the existing ROE was unjust and unreasonable before setting a new ROE. The states contended that FERC arbitrarily placed the new ROE at the midpoint of the upper half of the zone of reasonableness.

Section 205 vs. Section 206

FERC’s authority to set transmission rates is governed by Sections 205 and 206 of the Federal Power Act.

TOs may seek a rate change under Section 205 and are not required to show that a previous rate was unlawful. But the states’ challenge that prompted the 2014 order was filed under Section 206, which requires FERC to determine whether an existing rate is unjust and unreasonable before it can impose a new rate. “The burden of demonstrating that the existing ROE is unlawful is on FERC or the complainant, not the utility,” the court noted.

Instead of first finding that their base ROE was unjust and unreasonable, FERC decided that 10.57% was the just and reasonable base ROE and that the existing 11.14% ROE was unlawful as a result, the TOs said.

FERC contended its determination of a new just and reasonable base ROE was “sufficient” by itself to prove that the existing ROE was unjust and unreasonable.

The court disagreed. “Because it was a Section 206 proceeding, rather than a Section 205 proceeding, FERC bore the burden of making an explicit finding that the existing ROE was unlawful before it was authorized to set a new lawful ROE. FERC, however, never actually explained how the existing ROE was unjust and unreasonable,” the court said.

“Although we defer to FERC’s expertise in ratemaking cases, the commission’s decision must actually be the result of reasoned decision-making to receive that deference. Without further explanation, a bare conclusion that an existing rate is ‘unjust and unreasonable’ is nothing more than a talismanic phrase that does not advance reasoned decision-making.”

ROE Incentives

Because FERC failed to meet its dual burden under Section 206, the court said it did not need to rule on the TOs’ complaints that the commission’s ruling also violated their due process rights by failing to put them on notice that it would reconsider previously approved ROE incentives in addition to the base rate.

The states challenged only the TOs’ base ROE, and not the incentives. But because the ruling reduced the upper end of the zone of reasonableness from 13.1% to 11.74%, FERC noted that the TOs’ total ROE including incentives must remain within the zone. Although the commission chose a higher position within the range, the TOs’ ROE was reduced because the new formula reduced the top end of the zone.

Where in the Zone?

In setting the ROE at the 75th percentile of the zone, the commission majority sided with the TOs and rejected arguments by FERC trial staff and consumer representatives, who had argued for continuing the commission’s traditional use of the zone’s midpoint, which would have put the ROE at 9.39%.

Commissioners Cheryl LaFleur, Philip Moeller and Tony Clark said the change was justified because of the unusually low interest rates at the time; it had “less confidence” that “a mechanical application” of the midpoint of the DCF zone would result in an ROE high enough to allow the TOs to attract investment capital. Commissioner John Norris dissented, saying there was insufficient evidence to support setting the rate so high.

The court questioned the FERC majority’s reasoning.

“On the one hand, it argued that the alternative analyses supported its decision to place the base ROE above the midpoint, but on the other hand, it stressed that none of these analyses were used to select the 10.57% base ROE.”

FERC said “alternative benchmark methodologies” and additional evidence supported its conclusion that the midpoint would be too low. But the court said “none of the analyses necessarily suggested that a 10.57% ROE was a just and reasonable base ROE. Thus, the only conclusion FERC drew from these analyses was that transmission owners were entitled to an ROE somewhere above the 9.39% midpoint.”

The court noted that 10.57% was higher than 35 of the 38 data points FERC used to construct its DCF zone of reasonableness. It also said 89% of the state commission-authorized ROEs that FERC consulted were below 10.57%.

FERC also cited three alternative benchmark methodologies as “informative.” The risk premium analysis supported a base ROE between 10.7 and 10.8%; the Capital Asset Pricing Model produced a midpoint of 10.4%; and the expected earnings analysis had a midpoint of 12.1%.

“It is not our job to tell FERC what the ‘correct’ ROE is for transmission owners, but it is our duty to ensure that FERC’s decision is ‘the product of reasoned decision-making,’” the court said. “While the evidence in this case may have supported an upward adjustment from the midpoint of the zone of reasonableness, FERC failed to provide any reasoned basis for selecting 10.57% as the new base ROE.”

Michael Kuser contributed to this article.