By Amanda Durish Cook

MISO’s Steering Committee recommended that all but one of a handful of the Independent Market Monitor’s oft-repeated recommendations be included on the 2018 Market Roadmap as potential market rule changes.

Most of the recommendations have already been brought up in Market Subcommittee meetings or are part of past State of the Market reports.

MISO’s 2016 stakeholder redesign process dictates that for issues to be discussed in stakeholder meetings or added to the Market Roadmap list, they must first be submitted to the Steering Committee for a committee assignment. The Market Roadmap is a prioritized and tracked list of market revision goals that stakeholders and the RTO agree to pursue in stakeholder meetings.

The Steering Committee made the decision to move the following recommendations forward during a May 24 conference call:

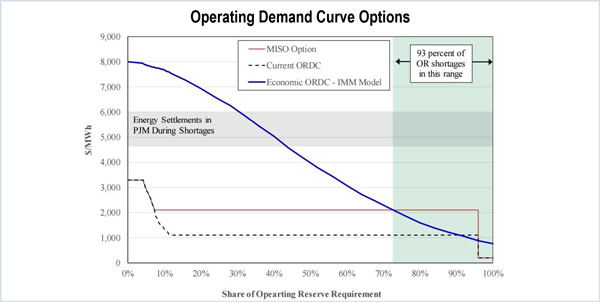

- Improving shortage pricing by revising the operating reserve demand curve to reflect a higher value of lost load. (See “Patton Seeks Increase in VoLL,” MISO, IMM Differ over Scarcity Pricing Changes.)

- Establishing regional reserve requirements and cost allocation through expansion of a 30-minute reserve product. MISO stakeholder relations staff member Justin Stewart said the issue might be too similar to a project already on the Roadmap that will create short-term capacity reserves, so the Steering Committee added the Monitor’s recommendation to the existing project candidate.

- Changing the day-ahead margin assurance payment and real-time offer revenue sufficiency guarantee (RSG) payment rules and performance incentives to reduce gaming. The Monitor last year suggested some wind generators were deliberately over-forecasting to collect more RSG payments; the issue is expected to surface in this year’s State of the Market report. (See IMM Report Highlights Outages, Wind Over-Forecasting.) Stewart said the issue was similar to an existing Roadmap project to tighten thresholds on uninstructed deviations from dispatch orders, which is currently in the software development phase. Steering Committee members nevertheless assigned the Monitor’s suggestion new candidate status.

- Creating a method for validating wind suppliers’ forecasts and using the results to alter dispatch instructions if needed, and improving forecasting incentives by modifying deviation thresholds and settlement rules. The two wind recommendations were added to an existing Roadmap candidate covering dispatchable intermittent resource modifications.

The one recommendation not added to the Roadmap was that MISO consider the economic cost of congestion, not just reliability, before granting planned outages. We Energies’ Tony Jankowski said the issue has existed “for over 10 years.”

“You’re venturing down a road here of what’s acceptable congestion or excessive congestion. … I don’t see this as being a simple Roadmap item,” he said.

Other stakeholders agreed to table the issue, with some predicting the topic will be raised again in the next State of the Market report. Last month, MISO stakeholders took up a separate outage issue, debating whether resources on extended outages should be barred from participating in future Planning Resource Auctions. (See MISO May Bar Units on Extended Outage from Capacity Auctions.)

The deadline for submitting candidates for consideration in the 2017 Market Roadmap project selection was May 11. Market improvements submitted after the deadline will be considered for prioritization in the 2018 Market Roadmap process.