By Michael Kuser

WESTBOROUGH, Mass. — A substantial increase in new clean resources would lower Forward Capacity Auction prices, “crowding out” many existing resources — but their ability to do so will depend on the level of offer mitigation, according to an analysis commissioned by ISO-NE.

ISO-NE last year asked Analysis Group to assess outcomes in the Forward Capacity Market under six resource expansion scenarios evaluated in the second part of the 2016 Economic Study. (See scenario descriptions below.)

Todd Schatzki of Analysis Group briefed the Planning Advisory Committee on Thursday on the study, which assumes all current market rules. The study assumes retirements of 2,457 MW by 2025 and 4,668 MW by 2030. Absent retirements, Schatzki said, there’s limited need for new resources.

“Given low load growth, given what’s going on behind the meter and given that there is not necessarily a lot in the queue that is coming in, absent some market price signal, you’re not going to get new resources coming in,” said Schatzki, who prepared the report with colleague Christopher Llop. “You’re not going to get prices raising back up towards the cost of new entry unless some new resources get in the system.”

Capacity and Energy Market Implications

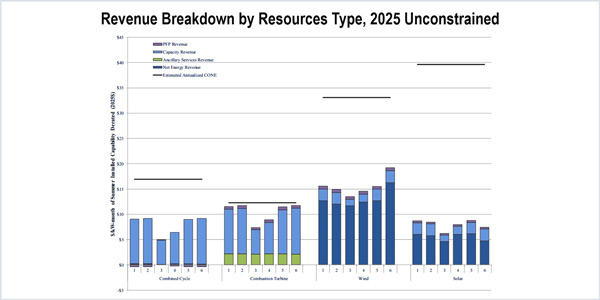

Total Forward Capacity Market payments in 2025 are projected to range between $2.1 billion in Scenario 3 (“Renewables Plus”) to $3.8 billion in Scenarios 2 (“ISO Queue”) and 6 (“RPS + Geodiverse Renewables”), with energy market revenues projected between $7.7 billion and $8.8 billion.

| Analysis Group

Scenarios with renewable additions would require additional revenue streams from outside the ISO-NE markets because they have a higher cost of new entry, the study says. Substantial expansion of clean resources as in Scenario 3 “would lower FCA prices, crowding out existing resources.”

“As the quantity of new clean resources added to the system increases, the cost (per MWh or MW) of supporting clean resources increases. The gap in revenue requirement (for new entry) needs to be filled by other sources because of decreases in revenues from both the FCM and energy markets.”

These impacts would depend on what portion of new renewables participate in the capacity auction and the extent of offer mitigation under the minimum offer price rule. The study assumes continuation of the current 200 MW/year renewable exemption, evaluating mitigation levels through sensitivity analyses.

Under four of the scenarios (1, 2, 5 and 6), the combination of energy, ancillary services and capacity revenue is sufficient to support the entry of new gas-fired combustion turbines. But market revenues are insufficient to incent the development of all other new resources assumed to enter the market in each scenario and none of the scenarios provides sufficient revenues for new combined cycle plants.

| Analysis Group

“Clean” resources — including offshore wind, hydro imports, battery storage and behind-the-meter solar, — would require other revenues, such as state renewable portfolio standards. “Needed revenues increase with the expansion of clean resources, as these resources reduce prices in both the energy and capacity markets,” the study says.

Total payments in the ISO-NE markets range from $9.7 billion to $15.6 billion, excluding ancillary service payments. The total payments do not include the costs associated with state policies.

ISO-NE completed Phase I of the Economic Study earlier this year and in June will issue the final part.

Robert Ethier, vice president of market operations, outlined the scope of work and for background information referred participants to a study on Forward Capacity Auction results published in December 2016.

Six Resource Expansion Scenarios

The resource expansion scenarios were:

- S1 = RPS + Gas: Physically meet renewable portfolio standards and replace generator retirements with natural gas combined cycle units.

- S2 = ISO Queue: Physically meet RPS and replace generator retirements with new renewables and clean energy.

- S3 = Renewables Plus: The region retires older generating units, physically meets all state RPS and adds renewables/clean energy, energy efficiency, solar PV, plug-in electric vehicles and storage.

- S4 = No Retirements (beyond FCA 10): Meet RPS with new resources under development and use alternative compliance payments (ACPs) for shortfalls. Add natural gas units.

- S5 = ACPs + Gas: Meet RPS with new resources under development and use ACPs. Replace all retirements with natural gas units.

- S6 = RPS + Geodiverse Renewables: Scenario 2 with a more geographically balanced mix of on/offshore wind and solar PV.