By Amanda Durish Cook

In a departure from previous years, the 2017 Organization of MISO States-MISO resource adequacy survey suggests the RTO will have sufficient capacity to meet near-term planning requirements.

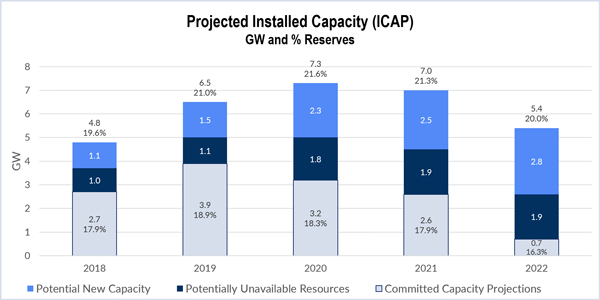

The annual results show the RTO will have 2.7 to 4.8 GW of excess resources from 2018 to 2022, translating into a 16 to 22% reserve margin — “sufficiently” above the 15.8% planning reserve margin requirement, according to MISO.

“The MISO region will have ample electricity-generating resources to meet expected demand while also maintaining an adequate supply of reserves for the next five years,” the RTO said in a statement. “The results show an improved resource adequacy outlook compared to last year.”

MISO Executive Director of Strategy Shawn McFarlane said this year’s range represents a 2 GW increase over the range predicted by last year’s survey.

“For the first time in the survey, we show adequate capacity resources,” he said during a special June 16 conference call to discuss results.

More than 96% of MISO’s load responded to the survey, according to the RTO. “We’re glad to see another high participation rate,” said OMS president and Indiana Utility Regulatory Commissioner Angela Weber.

The rosier results can be attributed to lower demand forecasts and a lukewarm growth rate of 0.5%, down from 0.8% in 2016, the RTO said. Its forecasted 2018 summer peak of 125.1 GW is down 2.5 GW from predictions made earlier in the year, it said. (See MISO Slims Summer Reserve Prediction.)

Changes to the way the RTO counts megawatts available as capacity might have also boosted the results. Weighted averages in this year’s survey included a 35% share of projects in the definitive planning phase of the interconnection queue, a change made to address stakeholder concerns that the survey was producing overly conservative capacity forecasts. (See OMS-MISO Survey Moves Ahead with New Calculation.)

Weber said the process of the survey and results continue to improve.

“Capturing resource adequacy for a moment in time remains an important tool,” she added.

Last year’s survey forecasted that the RTO would exceed its then-projected 15.2% reserve requirement by 0.9 GW — or 0.7% above the 2017 requirement — and that it could face a capacity shortfall by 2018 under a worst-case scenario. (See OMS-MISO Survey: Generation Shortfall Possible.) The 2015 survey concluded that a shortfall could occur by 2020.

This year’s results show that two zones still face capacity shortfalls in 2018, but MISO said that “load-serving entities in these areas should be able to reliably acquire capacity from outside their zones to meet these needs.” Zone 5 in Missouri is expected to have a 0.3-GW shortfall, while Zone 7 in Lower Michigan could come up short by 0.7 to 1 GW. Shortfalls in both areas are predicted to persist into 2022. All other local resource zones are expected to have surpluses ranging anywhere from 0.4 to 1.6 GW in 2018 and 0.2 to 1.5 GW by 2022, except Indiana and Kentucky’s Zone 6, which has the potential for either a 0.7 surplus or a 0.4 shortfall by 2022.

Zone 4 in Southern Illinois showed the greatest improvement: Its 1.6-GW forecasted deficit became a 0.7-GW surplus in this year’s survey after MISO reduced load, added 0.4 GW of new resources and factored in the increased availability of existing resources in the zone.

“Several units at 1.8 GW that were previously expected to retire were determined to serve MISO load at the committed level,” McFarlane said of Zone 4.

Minnesota, Wisconsin and the Dakotas’ Zone 1 was limited to 600 MW in exports in 2018 due to a capacity export limit. Exports from MISO South’s Zones 8, 9 and 10 were limited to 1.2 GW because of the continued MISO South-to-Midwest constraint from the use of SPP’s transmission.

Some stakeholders asked how MISO predicted capacity import and export limits, given that the RTO does not calculate limits more than a year in advance. Laura Rauch, MISO manager of resource adequacy coordination, responded that MISO does estimate out-year import and export limits, but added that export limits only have a “minimal” impact on survey results.

MISO predicts when new transmission will relieve constraints, and the Zone 1 transmission constraint that limits exports to 600 MW is expected to disappear by 2022, Rauch said.

Xcel Energy’s Randy Oye asked MISO to provide more detail about how it determines future export limits and transmission constraints, a subject McFarlane said would be discussed at a July 12 Resource Adequacy Subcommittee meeting addressing the zonal breakdown of survey results.

An unforeseen demand increase could affect survey results “unless balanced by policy or market forces.” He warned that results are “highly sensitive” to the same load forecasts largely responsible for the excesses shown in the survey.

“We appreciate continued collaboration with the Organization of MISO States to provide this outlook on supply and demand in the MISO region,” CEO John Bear said. “This forward-looking view informs and enables collective actions by states and MISO members to ensure continued resource adequacy.”