By Rich Heidorn Jr.

WASHINGTON — A key natural gas trade group released a study Thursday that contends it is not fuel diversity but the presence of “reliability attributes” that policymakers should seek for the good of the grid.

And how does natural gas-fired generation fare on that report card? Very well, thank you.

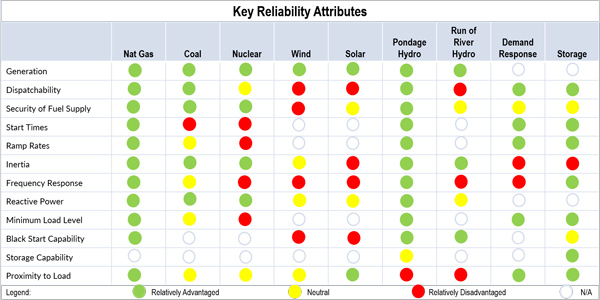

The study, done by The Brattle Group for the American Petroleum Institute, concludes that gas-fired generation is “relatively advantaged” in all but one of the 12 attributes it identified, which included the ability to provide ancillary services, fuel security and proximity to load. Gas excelled on every measure except for storage capability.

| API/Brattle Group study

The next best alternative source was pumped hydro with 10. Nuclear and coal, the potential beneficiaries of policies favoring traditional “baseload” generation, fared far worse at five and four respectively, as did wind (one) and solar (two).

Ancillary Services’ Growing Importance

The report calls for RTOs and ISOs to further develop markets for ancillary services, which it said are becoming increasingly important because of the rising share of intermittent renewable generation.

“Policy and market design had not focused on ancillary services until relatively recently. After the provision of energy, generation resources historically had the capability to provide more ancillary services than systems required,” the report says. “Renewables increase the uncertainty and variability in net load and make ramps larger, thereby increasing the ancillary service requirements. In addition, higher renewable penetration depresses energy market prices. This reduces margins earned by resources in the energy market and increases the need to compensate resources for the ancillary services they provide.”

In a press briefing, API Chief Economist Erica Bowman said her organization wants “to push back against” state policies that seek to maintain coal and nuclear plants “at any cost.” API absorbed the smaller America’s Natural Gas Alliance (ANGA) in 2015.

API and its affiliates have been “100% against” policies providing state-backed funding streams for nuclear plants, spokesman Mike Tadeo said.

API said the report was not ordered to counter Energy Secretary Rick Perry’s grid reliability study, which critics have said is designed to benefit coal and nuclear generation. Bowman added, however, that she hoped the Energy Department researchers “use [the findings] as a resource.”

Perry told a House Appropriations subcommittee Tuesday that the report would be released by the end of June, but a department spokesperson said later it would not be ready until July.

Beyond the Reserve Margin

Bowman said grid operators’ traditional reliance on reserve margins — the difference between installed capacity and peak load projections — is no longer sufficient.

“In reality — and NERC has also talked about this — that needs to transition to looking at these other attributes as well,” she said.

Most of the grading on the 12 attributes is likely to be uncontroversial. Also included in the list were generation capability; dispatchability; start times; ramp rates; inertia; frequency response; reactive power; minimum load level; black-start capability; and proximity to load.

But Brattle’s description of gas as “relatively advantaged” regarding the security of its fuel supply supply — along with coal, nuclear and pondage hydro — may come as a surprise to officials in PJM and ISO-NE, which have been encouraging gas generators to add dual-fuel capability. Gas generators can lose their access to fuel during winter peaks, when heating load with firm contracts takes precedence.

The study concedes that — unlike coal and nuclear fuel — “natural gas is rarely stored in large quantities on site,” adding “some natural gas-fired plants have the capacity to burn distillate oil stored in tanks on-site in the event of a natural gas supply interruption.”

It also acknowledges that gas supplies “can be interrupted due to a lack of capacity when demand is very high” — singling out New England’s pipeline capacity constraints — but says “firm supplies have very low probability of interruption.”

| PJM

Unmentioned in the study is that many gas-fired plants have interruptible contracts because operators say firm pipeline contracts are too expensive.

In its 10-K report for 2016, Calpine — North America’s largest operator of natural gas-fired power plants — warned investors that pipeline constraints “could interrupt the fuel supply” to its plants in PJM, although “some” have dual-fuel capability.

Brattle defended the omission, saying the paper was about compensating units for their reliability attributes, not about the cost of interruptible contracts. “The authors note that cost and environmental attributes may also affect market design. This paper focuses solely on reliability attributes and on the appropriate principles for compensating resources that provide those reliability attributes.”

‘A Lot of Affordable Gas’

Bowman rejected the idea of maintaining coal and nuclear plants as a price hedge in case gas prices rise from their current lows, insisting that the addition of natural gas and renewables has resulted in the most diverse generation fuel mix in history.

She cited a 2016 study by IHS that said the U.S. has 1,400 Tcf of natural gas recoverable at $4/MMBtu — a two-thirds increase over 2010 estimates. The U.S. consumed 27.5 Tcf in 2016.

“There is a lot of affordable gas out there,” she said. “So I guess the real question is how much are you willing to pay for that hedge? I would argue that that would be a lot higher than looking at where natural gas resource affordability is today.”

Wind, Nuclear, Coal Groups Respond

Two competing trade groups weighed in with responses to the API/Brattle study.

“Decades of engineering experience demonstrates that a reliable electricity system needs a diverse portfolio of generation technologies, including nuclear and natural gas,” said Maria Korsnick, CEO of the Nuclear Energy Institute, in a statement. “A close reading of the Brattle study reinforces the conclusion that grid reliability would be hopelessly compromised without nuclear energy, and we’re at a loss to explain why API is advocating such a risky scheme.”

Michael Goggin, senior director of research for the American Wind Energy Association, the API-Brattle Group report findings are “largely consistent” with those of the Analysis Group in a report recently commissioned by AWEA. “Both reports conclude that the increasingly diverse grid, with the addition of renewable and natural gas generators and the services they provide, is operating reliably and, importantly, that markets are the preferred way to ensure the grid continues to secure the services it needs to remain reliable at the lowest cost to consumers. Notably, neither report finds that ‘baseload’ itself is a grid service necessary for reliability.”

Goggin disputed Brattle’s designation of wind as “relatively disadvantaged” in frequency response, saying wind turbines “can provide frequency response that is an order of magnitude faster than conventional power plants, and today are meeting a large share of ERCOT’s need for frequency response when system frequency is high.” He also said wind and solar plants “have excellent ability” to regulate reactive power — a characteristic Brattle rated as “neutral” — and said the report failed to grade the ability to ride through voltage and frequency disturbances. “Had API examined this, it would have found that wind plants, … thanks to their power electronics, far exceed the capability of conventional power plants to remain online following a grid disturbance,” he said.

“Though the API-Brattle report’s generation assessment downplays the significant reliability capabilities and contributions of modern wind turbines, we believe the commonalities between the reports are more notable,” Goggin said.

Paul Bailey, CEO of the American Coalition for Clean Coal Electricity said “backing up more renewables with new natural gas-fired generation will not solve” the challenges facing the grid. “First, natural gas would have to be available at all times to back up more renewables. However, a significant fraction of natural gas supplies for electricity generation is based on non-firm contracts, which means there is no guarantee that gas will be available all the time. For example, approximately 40% of the gas is supplied under non-firm contracts in PJM and MISO.”

Bailey said increased natural gas could make the grid less resilient. “On the other hand, coal plants are fuel secure because there is a large supply of coal (an average of 90 days) at each plant,” he said. “This is why FERC should adopt regulatory changes that properly value attributes, such as on-site fuel storage, that enhance grid resilience.”