By Rory D. Sweeney

VALLEY FORGE, Pa. — PJM’s Capacity Construct Public Policy Senior Task Force has been working at a torrid pace to develop potential rule changes in time for next year’s capacity auction.

After little more than four months of meetings, PJM and stakeholders have offered four proposals to fix what many see as flaws in the RTO’s capacity construct. The main issue is how to accommodate state actions — such as energy credits or tax incentives, which subsidize certain generation types — without allowing them to influence clearing prices.

The Two-Stage Proposals

PJM led with a “repricing proposal” released as supporting material for FERC’s May 1-2 technical conference on the topic. (See PJM Stakeholders Offer Different Takes on Markets’ Viability.)

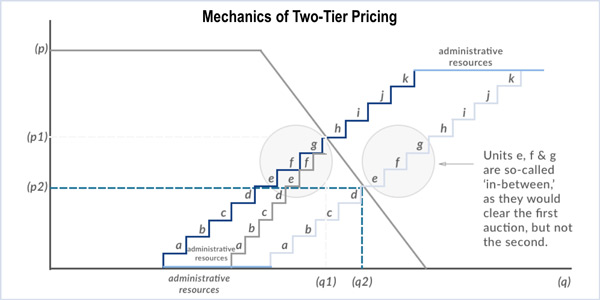

The RTO envisions a two-stage auction in which the first stage includes subsidized units and creates a “suppressed capacity price” using PJM’s standard variable resource requirement (VRR) demand curve. The second stage replaces subsidized units with a “reference price offer reflecting what would be a competitive offer from a unit of that type and vintage.” This would create a higher “restated price” more in line with pure competition that all cleared units would receive, unless states instructed PJM to pay its subsidized units less. Units that didn’t clear under the “suppressed” price would not receive capacity payments, even if they clear under the “restated” price.

| NRG

LS Power and NRG Energy responded at the task force meeting July 17 with proposals to tweak the two-stage approach. Both were designed to address those units that slipped between the auctions, which NRG referred to as “in-between” units. LS took the route of adjusting price, while NRG focused on adjusting quantity.

LS calls its proposal the “clearing price impact election model.” It factors the output of subsidized units into the second stage, resulting in a lower subsidized clearing price. Generators would have to elect when they submit their bids whether they would accept a lower subsidized price, which PJM would estimate before the auction. Those who won’t accept the lower price don’t clear, and the final clearing price would be adjusted upward as their output is eliminated from the supply. This would discourage units from creating price suppression by bidding low, LS argues.

NRG’s approach would also determine prices with and without subsidized units. Subsidized units would receive the subsidized price, and unsubsidized units would receive the unsubsidized price. The “in-between” units that clear the auction in the unsubsidized price but not in the subsidized price would clear and receive the unsubsidized price. The quantity of all offers would be reduced proportionally to ensure the entire auction cost is no higher than the total for the auction using the unsubsidized price.

Other Perspectives

Two other stakeholders took drastically different approaches.

Exelon, which has been battling for more than a year to secure state subsidies for some of its nuclear fleet, argued why such subsidies shouldn’t be mitigated in PJM’s auctions. More than 10 GW of resources “receive longstanding state support to enter/remain the market,” Exelon says, with the largest category being small- to medium-sized coal plants in regulated states.

“Resource adequacy objectives have been met at a reasonable cost despite the material impact on the marginal clearing price,” according to Exelon’s report. “Mitigation is unnecessary.”

“This is a very complex topic and we tried to bring some data and performance results into the conversation, realizing that other stakeholders may have different perspectives,” said Exelon’s Sharon Midgley, who presented the proposal.

Last Tuesday, the second day of the two-day task force meeting, American Municipal Power called for a smaller role for the Reliability Pricing Model, with public power permitted to meet most of their capacity needs through long-term bilateral contracts. AMP’s Ed Tatum argued that RPM is an “administrative construct … not a market,” and that PJM and its stakeholders “have to stop focusing on price and let a market do its thing.” Since 2010, PJM has made at least 27 major filings changing RPM, he said.

| Exelon

AMP’s plan would hinge on annual determinations of capacity obligations for load-serving entities, with a capacity auction several months before the delivery date, rather than three years. It would also eliminate the single clearing price created by the VRR curve in favor of a mechanism to match individual buyers and sellers. (See related story, Public Power Takes its PJM Gripes to Congress.)

| NRG

Several RPM structures would be maintained, such as resource must-offer requirements, the RTO reliability requirement, demand response participation and the Capacity Performance system of bonuses and penalties. The group also proposed a penalty on LSEs that fail to secure necessary capacity.

Stakeholders from both supply and demand pushed back, largely concerned that the plan would impede price transparency.

“Those customers who are signing up specifically to hedge their capacity costs, if they don’t know what the price that they’re paying is, that’s very difficult for them to hedge,” EnerNOC’s Katie Guerry said.

Joe Bowring, PJM’s Independent Market Monitor, had a much simpler solution.

“You can’t be partly regulated and partly not. You have to choose, and states have a whole range of options,” he said. “If states want to take it back [and fully regulate the industry], that is absolutely within their authority. What they shouldn’t do is take actions that are not in their authority. … If you subsidize two or three particular units … you’re suppressing the price of energy compared to what it would have been and you’re putting other units that are now economic at risk. That’s why I continue to repeat that subsidies are contagious.”

He said there’s no sense in “trying to work out complicated ways to make subsidies work in markets when they really can’t.”

“To me, the problem that has been identified is that competition is working,” Bowring continued. “Competition is a nasty business. Competition puts people out of business on a regular basis. I think it would be very difficult for the PJM markets in their current form to adapt to any more fully regulated states. … It would mean a significant change because the current structure of fully competitive markets is not compatible with a mix of generators with revenues based on cost-of-service regulation and generators with revenues dependent on markets.”

After the meeting, Bowring submitted recommendations that provide a definition for subsidies and call for developing an extended minimum offer price rule for all subsidized units that would be reviewed annually.

The task force has another two-day session planned for Aug. 2-3, at which Bowring’s recommendations and an update to the proposal from LS will be discussed. Other meetings are scheduled for Aug. 23, Sept. 11 and Sept. 26. The task force’s issue charge calls for any results to be delivered by the end of the year.