By Jason Fordney

Negative day-ahead prices surged in CAISO during the first quarter as combined surpluses of solar and hydroelectric output frequently left the market upside-down.

Prices went negative during 51 hours in the day-ahead market over the three-month period, compared with just three hours in all of last year, the ISO’s Department of Market Monitoring said.

“This is something we first just started seeing in this quarter,” Senior Analyst Gabe Murtaugh said during a July 31 call to discuss the department’s first-quarter report.

Negative prices indicate that the cost to procure wholesale power was at or below $0/MWh, which happens when there is an oversupply of solar power and other renewables while demand is relatively low.

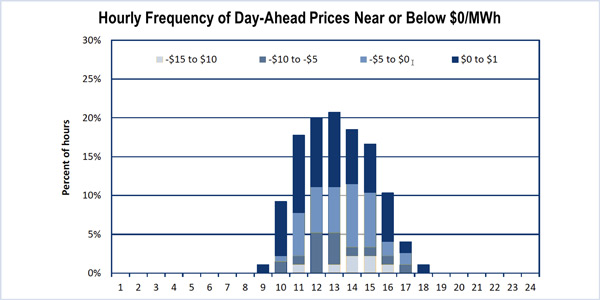

Negative prices occurred in the day-ahead market during about 10% of the hours in the 11 a.m. to 3 p.m. time frame during the first quarter. They also happened more frequently during weekends when electricity loads were lower.

Real-time prices also dipped frequently into negative territory during the quarter, occurring at about 10% of intervals in the 15-minute market and 13% of intervals in the five-minute market.

The negative pricing has become central to the debate around renewables in California, with some arguing that it is the result of a rush to integrate renewables without completely accounting for or understanding their impact on reliability and markets.

CAISO average energy prices decreased sharply in the first quarter, from about $35/MWh in December 2016 to about $23/MWh in March. This coincided with increased renewable output and low loads, the Monitor said. Prices in the 15-minute market are consistently lower than day-ahead prices and moved in about the same direction and magnitude each month.

“On average, five-minute market prices in March were notably low at about $17/MWh. This was the lowest average monthly five-minute market price during the past several years,” the Monitor said in the report.

CAISO also curtailed more renewable generation in the quarter, rising to a high in March of nearly 6%, compared with peak curtailment less than 3% a year earlier. Renewable curtailment rose above 80,000 MWh in both February and March, compared with less than 60,000 MWh in March 2016, according to ISO data.

During nearly all first-quarter intervals when prices were negative, the market economically dispatched generation down and CAISO did not have to curtail self-scheduled generation.

Prices at times surged above $750/MWh at certain times because of generator ramping limitations when solar resources rolled off the system at sunset.

“During these intervals, steep increases in net load exceeded flexible ramping capacity procured through the flexible ramping product and required the power balance constraint to be relaxed because of insufficient available incremental energy,” the Monitor said.

Congestion in the Western Energy Imbalance Market (EIM) continued to isolate PacifiCorp-West (PACW) from CAISO and PacifiCorp-East (PACE), the Monitor said. This drove down prices in PACW and Puget Sound Energy compared with the ISO and the rest of the EIM.

Arizona Public Service and PSE joined the EIM in October 2016, adding new transfer capacity. This reduced congestion between APS, CAISO and PACE, the Monitor said. EIM market prices in the APS area were close to those in NV Energy, PACE and CAISO.

The Monitor earlier this month said that bid limits placed on PacifiCorp, NVE and APS are no longer needed because of increased transfer capacity in the EIM. (See CAISO Monitor Says EIM Bid Limits No Longer Needed.)

The report reiterated the Monitor’s recommendation that the ISO’s congestion revenue rights auction be eliminated and replaced with a market or locational price swaps based on bids for CRRs. (See CAISO Monitor Proposes End to Revenue Rights Auction.) CAISO is in the midst of an initiative to investigate the efficiency of the auction.