By Rich Heidorn Jr.

Exelon officials said Wednesday they will press PJM to enact rule changes boosting off-peak prices and are confident nuclear subsidies in New York and Illinois will survive court challenges.

The comments came as Exelon reported second-quarter earnings of $80 million ($0.09/share), a drop from $267 million ($0.29/share) a year earlier, as its generation division saw a $250 million loss.

Adjusted operating earnings for the quarter were $509 million ($0.54/share), down from $604 million ($0.65/share) in 2016, reflecting the end of the reliability support services agreement for its R.E. Ginna nuclear plant in New York, increased nuclear outage days and lower realized energy prices. Those negatives were partially offset by rate increases that boosted utility earnings and zero-emission credit revenue ($0.05/share) for the Ginna, Nine Mile Point and James A. FitzPatrick nuclear plants beginning April 1.

Joe Dominguez, executive vice president of governmental and regulatory affairs and public policy, said federal district court rulings rejecting challenges to the New York and Illinois ZEC cases suggested opponents will have a difficult time prevailing on appeal.

“The district court decided these cases at a very preliminary stage, whereas a legal matter the courts had to assume all the facts that the plaintiffs pled were accurate. Those facts were not accurate, but even under the plaintiffs’ versions of the case, the courts found that they had no legal claim whatsoever,” Dominguez said. “In both decisions, the district courts rejected the entire waterfront of the plaintiffs’ claims beyond the … procedural issues. That speaks to how high a hill they will need to climb on appeal to reverse those decisions.”

David Gaier, spokesman for plaintiff NRG Energy disagreed. “We don’t think we’re down for the count at all,” he said.

Initial briefs are due Aug. 28 in the plaintiffs’ appeal of the ruling on the Illinois ZECs, pending before the 7th U.S. Circuit Court of Appeals. The plaintiffs plan to ask the 2nd Circuit Court to review the New York ruling.

Lobbying Position Improved

Dominguez said the court rulings have helped Exelon’s lobbying posture in other states considering ZEC-type programs. He said opposing lobbyists have cited the legal questions as risks for policymakers, saying “‘Why would you take a tough vote on this only to have it overturned in the courts?’ These decisions resolve that issue.”

CEO Chris Crane said “we remain hopeful” that Pennsylvania officials will enact similar subsidies to prevent the closure of Three Mile Island. (See Seeking Subsidy, Exelon Threatens to Close Three Mile Island.)

Dominguez said, however, that pricing carbon emissions in the wholesale markets would be preferable to ZECs. “It’s more clear to us now than ever that federal wholesale markets need to evolve to fully incorporate attributes like resiliency, fuel diversity and the environmental qualities of the generation resources. If the markets don’t evolve, then the markets are going to have a diminished role in energy policy going forward. We are committed [to markets] but the markets should be well-functioning. Our commitment to markets only extends so far as it provides the best outcomes for our customers.”

Dominguez said the company was heartened by PJM’s plan for energy market changes that would allow baseload generators such as nuclear plants to set clearing prices in off-peak hours. The RTO has said it will file the changes with FERC by the first quarter of 2018, with implementation targeted by summer 2018. “We are going to push very hard to make sure that happens,” promised Dominguez, who said the changes should increase off-peak energy prices and reduce capacity prices. (See RTOs to Congress: Don’t Lose Faith in Markets.)

Not Considering GenCo Spin-off

Crane said that although Exelon believes it is undervalued by Wall Street, it is not considering spinning off its generating unit into a separate company. He cited the “synergies” between its generation fleet and its distribution utilities. Exelon noted that all its utilities scored in the top quartile of the Customer Average Interruption Duration Index and that Baltimore Gas and Electric and Commonwealth Edison achieved their best-ever System Average Interruption Frequency Index scores.

“We are differentiating ourselves from any other merchant generator in the business. [We have] strong balance sheets, a different class of assets, very well run and fairly matched to our load books. So, we like where we’re at and wouldn’t speculate on anything else,” he said. We “really can see the value creation and want the market to recognize it as we do execute on what we say.”

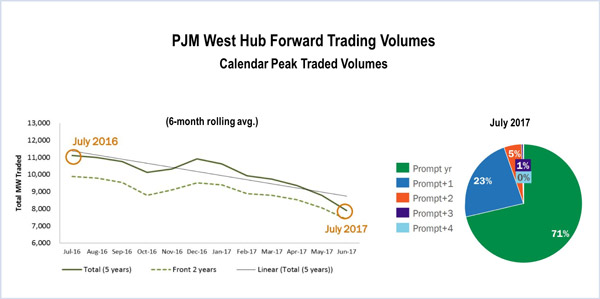

CFO Jack Thayer told analysts Exelon believes future power prices will be higher than suggested by forward curves, whose liquidity has declined over the past year. Trades for 2020 and beyond represent only 6% of the futures volume at the PJM West hub on the ICE and NASDAQ exchanges, he said.

“We would note that our fundamentals group has a more constructive view on power markets than these illiquid forward curves suggest, but we appreciate that there is perceived safety in using the forwards,” he told the stock analysts on the call. “However, when running your numbers, we would just encourage you all to appreciate what is underpinning those forward prices.”