By Michael Kuser

A $40/ton carbon charge in New York state would have “a relatively small impact” on customer costs, ranging from a −1% to +2% change in total customer electric bills, according to an analysis released by NYISO and the state Department of Public Service on Friday.

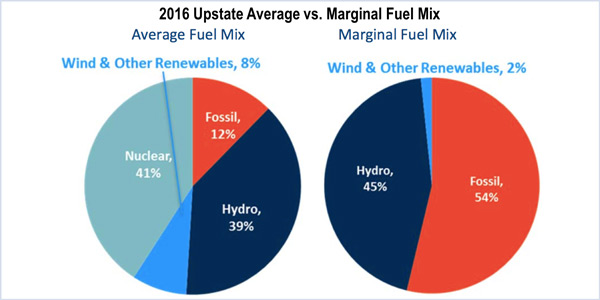

The much-anticipated report by the Brattle Group on pricing carbon into generation offers and reflecting it in energy clearing prices was prompted by the Public Service Commission’s decision to subsidize upstate nuclear plants through zero-emission credits (ZECs). Fossil fuel generators would incur a penalty based on their level of carbon emissions.

| NYISO

The study is meant to develop an approach to value carbon in the wholesale energy market as an instrument of state policy while “providing appropriate price signals to incentivize investment and maintain grid reliability,” NYISO CEO Brad Jones and PSC Chairman John B. Rhodes said in the preface.

Costs and Benefits

Although average wholesale energy prices would increase under a $40/ton carbon adder, about 50% of the cost could be offset by returning carbon revenues to customers; another 18% by reduced prices for renewable energy credits and ZECs; and an additional 23% by “dynamic effects on investment signals,” the report said.

While more economic gains from the program would go to producers than to consumers, customer costs would not rise significantly, the report said. A supplemental carbon charge would increase wholesale electric energy prices beyond the rises prompted by New York’s Clean Energy Standard and the Regional Greenhouse Gas Initiative. However, “returning carbon revenues to customers and other factors would offset most of the customer cost impact. The exact magnitudes are uncertain, but the net impact on customer costs remains relatively small under all assumptions considered.”

The $40/ton adder would reduce CO2 emissions by 2.6 million tons per year, or 8% of today’s emissions, by incentivizing cost-effective market responses not available through the CES and RGGI alone — and the analysts said the estimate of CO2 emission reduction “is probably conservatively low.”

Gavin Donohue, CEO of the Independent Power Producers of New York, lauded the report in a statement: “Incorporating the value of carbon into the marketplace ultimately benefits ratepayers and demonstrates that private investment is best for the continued success of New York’s energy markets. Though this process is only in the early stages, what we accomplish here could be a model on the national stage.”

In a blog post, Jackson Morris of the National Resources Defense Council said, “The concept of a carbon adder is laudable and worth exploring. And it has clear potential to cut carbon pollution — but only if the state and NYISO get the design right and, in the process, avoid some important legal and policy pitfalls.”

The report concludes by suggesting topics of further study. For example, market design affects carbon charges, and different designs create new models of revenue allocation and border adjustment. Also implied are potential refinements “to REC and ZEC procurement for allocating the risk of future changes in carbon prices between customers and suppliers,” the report said.

NYISO and the DPS will hold a conference on Sept. 6 to solicit stakeholder feedback on the reasonableness of modeling assumptions, especially their dynamic effects. The report said that although New York has no specific emissions reduction target for the electricity sector, the state’s commitment to reducing carbon emissions from power generation “is expressed monetarily in its ZEC payments to upstate nuclear plants … starting at $43/ton CO2 today and rising to $65/ton by 2029.”

Relative cost of reducing emissions with Upstate and Downstate Wind | NYISO

The ZECs are part of the CES, which mandates reducing greenhouse gas emissions by 40% by 2030, from a 1990 baseline, and by 80% by 2050. It also calls for renewables to meet 50% of the state’s energy needs by 2030.

ZEC Challenges

The Electric Power Supply Association and several of its members had filed suit against New York’s ZEC program, claiming that it intruded on FERC’s authority over interstate electricity sales. A federal judge in New York on July 25 dismissed all claims in the suit, finding the state’s ZEC program constitutional. Earlier in July another federal judge had dismissed similar challenges to Illinois’ program. (See New York ZEC Suit Dismissed.) EPSA has appealed the Illinois ruling and plans to challenge the New York dismissal as well.

Jones previewed the Brattle report in May at a FERC technical conference devoted to the issue of reconciling public policy and wholesale electricity markets in New England, New York and PJM, and also at a congressional energy hearing in July. He said New York hoped to implement the plan in the markets within three years. (See RTOs to Congress: Don’t Lose Faith in Markets.)

PJM also is considering a similar mechanism, while New England has rejected carbon pricing as impractical and overly expensive. (See ISO-NE Two-Tier Auction Proposal Gets FERC Airing.)

Some stakeholders who oppose NYISO’s carbon pricing plan have already questioned the current market design, particularly regarding capacity markets. Before and after the technical conference in May, FERC asked for comment on five potential paths toward harmonizing public policies and wholesale electricity markets, including the path chosen by New York. (See We Read 79 FERC Comments so You Don’t Have to.)

Economist James F. Wilson said the commission should eventually phase out the capacity constructs or convert them to voluntary mechanisms. Cliff Hamal, managing director of Navigant Economics, said “the most fundamental assumption” underlying capacity markets — setting capacity prices based on the cost of building new gas-fired generation — may no longer be valid.