WILMINGTON, Del. — PJM and its Independent Market Monitor remain at odds over whether price-based offer updates should be connected to cost-based offers and specified in each unit’s fuel-cost policy.

At last week’s Markets and Reliability Committee meeting, PJM’s Lisa Morelli outlined the RTO’s planned Manual 11 revisions for implementing intraday offers. The presentation was the culmination of a long debate at August’s Market Implementation Committee meeting, where stakeholders pressed PJM and the Monitor to find as much common ground on the issue as possible. (See “Stakeholders Push PJM and IMM for Consensus on Intraday Offers Rules,” PJM Market Implementation Committee Briefs: Aug. 9, 2017.)

Morelli’s presentation outlined where PJM and the Monitor continue to differ on linking a unit’s price-based offer to its fuel-cost policy. The RTO believes there’s no need for them to be linked, but the Monitor says updating price-based offers should be limited to simultaneously updating cost-based offers, which must be specified in the unit’s fuel-cost policy.

“We think it’s the only way to ensure that the timing of price-based offers and cost-based offers don’t permit the exercise of market power,” Monitor Joe Bowring said. “What we’re concerned about is this will result in one-way optionality for the generators to raise prices during the day but not be required to reduce costs when gas costs go down.”

The two sides will continue to seek compromise until the September MRC meeting, but they will have to pursue separate Tariff revision proposals if they haven’t reached agreement by then, Morelli explained. It could come as a new problem statement for stakeholders to consider, she said.

On energy-offer verification, PJM and the Monitor also remain divided over whether self-certification by the curtailment service provider is sufficient validation for demand response. The Monitor says it is not.

“The main arbiter in this is really FERC,” PJM’s Rami Dirani said. “So FERC has to really decide whether this approach is actually the proper approach going forward.”

There is also some difference of opinion on the exception process for verifying offers that are not consistent with a unit’s fuel-cost policy, verifying offers over 1,000/MWh and verifying operating reserve credits for verified offers over $1,000/MWh, but PJM believes the two sides are moving toward a compromise.

Summer-only DR to be Studied

Stakeholders approved by acclamation a problem statement and issue charge regarding summer-only DR, but not before state and consumer representatives pushed for additional revisions.

The proposal came out of the Seasonal Capacity Resources Senior Task Force, which culminated in a seasonal resource aggregation filing and approval at FERC late last year, PJM’s Scott Baker explained. However, RTO staff pared the problem statement’s scope down to eliminate other seasonal resources, such as wind, hydro or energy efficiency.

John Farber with the Delaware Public Service Commission asked for a friendly amendment that specifically noted analyzing the load forecast would be in the scope of the group.

“One of the values of DR is to manage the peak. A managed peak costs less than one that’s not managed,” he said.

Greg Carmean, executive director of the Organization of PJM States Inc., noted the Energy Policy Act of 2005 stipulated that unnecessary barriers to DR participation in the markets be removed. “I haven’t seen where PJM has gone back and evaluated whether or not their annual product actually is a barrier to demand response,” he said.

Stu Bresler, PJM’s senior vice president of operations and markets, said that the RTO’s strategy paper on DR indicates how it intends to move forward on the issue. The problem statement identifies several items that are already considered out of scope, including loss-of-load expectation analysis; seasonal capacity procurement or developing a seasonal market; re-establishing non-Capacity Performance products such as base capacity; or limited DR.

The initiative is following through on the strategy paper’s list of goals. PJM’s Pete Langbein said the Demand Response Subcommittee will be working on those in sequential order.

“I think this problem statement is a continuation on working on valuing DR,” Baker said.

Greg Poulos, executive director of the Consumer Advocates of the PJM States, said recent PJM rule changes have “hit hardest” on residential DR viability, “so this is great to see PJM taking these efforts.”

“The current construct is a barrier for residents to participate,” he said. He asked that PJM reconsider DR’s potential as a capacity product, but Baker declined to include the amendment.

Eclipse Hot Takes

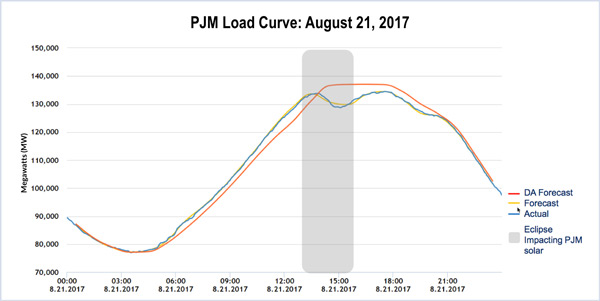

PJM’s Ken Seiler provided some initial observations on PJM’s response to the Aug. 21 solar eclipse, saying the analysis will be used to better prepare for the 2024 eclipse, whose path of totality is expected to cross over PJM’s western edge.

Operationally, he said the RTO performed without incident. “We had enough regulation; we had enough reserves.”

About 2,200 MW of solar generation was lost, he said, but that remains largely an estimate as about three-quarters of it is behind-the-meter generation. Only about 500 MW was grid-connected and directly observable.

“The real surprise” came when operators saw CAISO and MISO curtailing units in expectation of lower demand, he said.

“We thought the load would be pretty much flat,” but PJM also saw a load drop similar to other grid operators, Seiler said. PJM had a load of about 133,600 MW about 1:45 p.m., which dropped to 129,500 MW an hour later.

Weather likely accounted for some of the decline. Certain regions saw temperatures drop by up to 10 degrees Fahrenheit, which “does seem to correspond fairly significantly with the load drop,” he said. The weather forecast predicted temperatures in the 90s, but the average was around 85, he said. Additionally, unpredictable “pop-up” storms materialized in the footprint, which have a dampening effect on temperature.

“Certainly, wind and weather and cloud cover provided some level of impact,” he said.

However, human activity seemed to also play a major role. PJM found through discussions with the Nest home thermostat supplier that the company had advised customers that they could cut back on air conditioning during the eclipse to compensate for the reduction in solar output, resulting in a 750-MW drop in load.

Additionally, people departing from their normal business day to view the eclipse caused a reduction. PJM received reports that some manufacturing facilities delayed lunch and instead shut down during the eclipse.

Stakeholders Approve Misc. Actions

Stakeholders endorsed by acclamation several manual revisions and other operational changes:

- Manual 11: Energy & Ancillary Services. Revisions, along with others associated with the Regional Transmission and Energy Scheduling Practices document, were developed as part of the implementation of Coordinated Transaction Scheduling, a new real-time energy scheduling product across the PJM-MISO interface.

- Tariff and Operating Agreement revisions that clarify the two-year limit on requests for billing adjustments.

- Joint operating agreement and Tariff revisions to develop a pro forma agreement for dynamic scheduling. (See “OC Discusses Pro Forma Agreements for Pseudo-Ties, Dynamic Schedules,” PJM OC Briefs: July 11, 2017.)

— Rory D. Sweeney