By Glen Thomas

As I walk the halls of National Association of Utility Regulatory Commissioners meetings, I hear a lot about the “grid of the future” or “grid modernization.”

According to the North Carolina Clean Energy Technology Center’s “The 50 States of Grid Modernization” report, more than 30 states are exploring “grid modernization” to various degrees. New York is knee-deep in Reforming the Energy Vision, Ohio is doing “Power Forward” and Illinois is pursuing “NextGrid.” These are all terrific initiatives, and these state’s utility commissions should be applauded for their efforts to proactively realize that the traditional electric utility service business model is changing and unless utilities and regulators get in front of certain issues, consumers will ultimately pay the price later.

These grid modernization efforts are driven by several factors that stem from technological innovations changing consumer needs for electricity in the face of aging infrastructure. While different states have different dynamics and different solutions, they are fundamentally addressing the same challenge. Fortunately, these challenging circumstances are leading to creative thinking and solutions that are more than just throwing money at the problem.

Changing Dynamics

Similar to these state-led efforts that focus on the retail electric delivery system, a parallel re-examination of our wholesale energy markets is long overdue. For a variety of reasons, the dynamics in our wholesale markets are changing. Flat peak consumer demand year over year, low-cost natural gas-fired generation, the proliferation of subsidized intermittent resources (with no fuel costs) and an increasingly flat supply stack, combined with market rules that have not kept pace, have all contributed to a wholesale power market in which units that produce relatively inexpensive power and are needed for reliability are in significant financial stress and at risk for closure.

Just last month, Energy Secretary Rick Perry recognized that the power industry “has experienced massive change in recent years, and government has failed to keep pace.” The much anticipated Department of Energy “Staff Report to the Secretary on Electricity Markets and Reliability” called for FERC and RTOs to reform market rules in order to promote grid resilience and proper energy price formation. In many respects, the DOE report recognizes that if certain low-cost plants do not receive proper price support in the current market, those plants will likely retire, leading to higher costs to consumers over the long term.

Energy price formation is not a new issue, and FERC has taken positive steps to improve it over the last several years. FERC, through Order 825, has made significant changes to the settlement of energy transactions and the triggers for scarcity pricing. PJM and the other RTOs are in the middle of implementing these reforms. While their impacts have yet to be realized, they nonetheless offer great promise.

Energy Price Formation 2.0

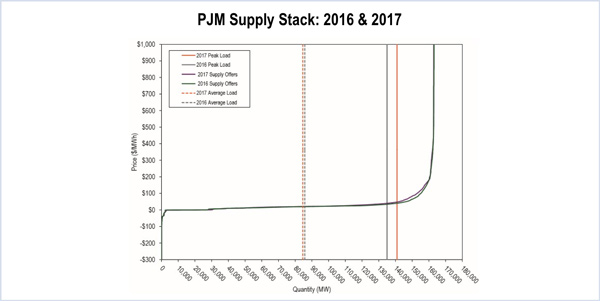

While the reforms to date have been important, it is time for the next step — Energy Price Formation 2.0, if you will. As a result of technological advances and current market conditions, PJM has a glut of units that participate in the market at roughly the same low price. LMP was developed based on a supply stack and a sloped supply curve, but today’s supply “stack” looks more like a flat piece of glass. In today’s market, new natural gas combined cycle plants, baseload coal plants and most nuclear plants can produce power at prices that by historical standards would be considered a bargain.

The fact that there is a bounty of low-cost resources available to meet demand means that prices will be less volatile and costs to consumers of electricity will be lower over time. The last two summers in PJM bear witness to the fact that high temperatures and higher-than-normal demand did not lead to significant upward pressure on electricity prices in PJM (see chart below).

As a result of these current market conditions, it takes longer for those higher-cost peaking plants to be dispatched and set the energy price. While good for consumers at the present moment, if market rules are not altered, consumers will lose the benefits associated with the plethora of low-cost resources, as those resources will be forced out of the market because of insufficient revenues. In such a scenario, higher-cost resources will move closer to the front of the supply stack, run more often, set the clearing price at a higher level and cost consumers more over time.

Clock is Ticking

PJM has suggested a series of energy market reforms to allow consumers to continue to benefit from this abundance of low-cost resources. PJM has proposed that energy prices should be set by the units that are running to serve consumer needs and unit flexibility should be rewarded, not punished. The current rules do not do this and instead rely on out-of- market payments to specific operationally constrained, low-cost units that must run for reliability purposes. Ultimately, such a regulatory paradigm does not send the appropriate price signal to either the flexible or inflexible unit. While such a market design may have worked against an actual supply stack with material differences in price among resources, it falls short in the current “flat” market.

The wholesale power market of today is not that same as the wholesale power market of 10 years ago. To date, wholesale markets have delivered enormous value to consumers. In order for the value to continue for the next 10 years, regulators, consumers and other stakeholders need to recognize and respond to the changes that are already here. The clock is ticking. We all need to get to work.

Glen Thomas is president of PJM Power Providers Group (P3), which represents independent power producers.