By Jason Fordney

CAISO and Pacific Gas and Electric have asked FERC to reconsider its decision last month to approve only some of the utility’s requested transmission rate incentives related to more than $1 billion in planned grid improvements.

The ISO and the utility on Sept. 25 filed separate requests for FERC to rehear a determination that PG&E had not justified all of its proposed “abandoned cost” recovery, which allows it to recover from its customers the costs of abandoning construction for reasons beyond its control. (See FERC Approves PG&E Transmission Cost Recovery.)

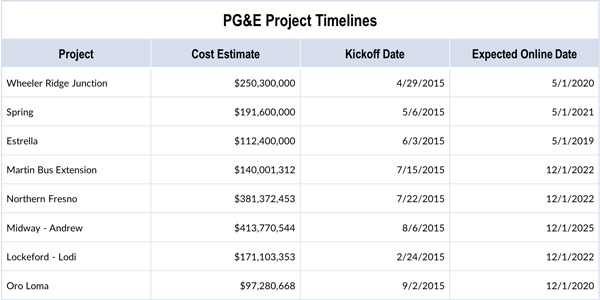

PG&E in its rehearing request called the incentive request “narrowly tailored” and said it faces significant challenges in developing the greenfield projects that are not in an existing right of way (EL16-47). The utility had requested 100% recovery of costs for any of the eight projects if they are abandoned, but FERC approved incentives for only three of them. The utility said it has already invested $68 million in construction and that the projects face risks, including environmental permitting, siting authority and potential impacts of from California’s renewable energy goals.

“Consequently, under a rigid application of the effective-date limitation imposed in the orders under review, PG&E now faces an unexpected risk of loss equal to 50% of that initial $68 million investment,” the company said, adding that “if allowed to stand, this outcome will create a disincentive for PG&E to make similar investments in the future.”

PG&E said that while the requested incentives would allocate to ratepayers 100% of the risk of abandonment for reasons beyond a utility’s control, “FERC’s orders here shift 50% of that risk for a defined period (before the issuance of a project specific declaratory order) to the utility and its shareholders. This reallocation makes investment in new transmission projects riskier and less attractive.”

CAISO’s filing contended that each project meets FERC’s standard because it was approved by the ISO as part of a regional planning process and that “CAISO approved these specific projects to meet identified reliability needs on the CAISO system.” Project sponsors such as PG&E have an obligation to obtain approvals and rights if the projects are approved as part of the ISO’s annual transmission planning process.

CAISO said it has canceled other projects approved in annual plans and that it is currently assessing whether to cancel other previously approved projects, so “the risk of abandonment is not hypothetical.” When developing its 2015-2016 plan, the ISO canceled 13 PG&E low-voltage transmission projects it had previously approved.

Southern California Edison on April 7 filed a similar request for abandoned cost recovery upon which the commission has yet to rule (EL17-63). The petition requested approval of incentives for a package of transmission improvements totaling about $1.3 billion, approximately $903 million of which are recoverable in transmission rates.

While the California Public Utilities Commission had objected to PG&E’s incentive rate request, FERC rejected the state regulators’ arguments about PG&E’s transparency and cost control.

Earlier this month, FERC in a different proceeding also rejected a protest from the PUC over incentive rate adders the commission had approved for PG&E in 2016. (See FERC Upholds PG&E ISO Incentive Adder, Rebuffs CPUC.)