Editor’s note: An earlier version of this story incorrectly used data from the ERCOT North zone, and not the Houston Hub.

By Tom Kleckner

ERCOT’s Houston Hub saw real-time prices spike as high as $1,251/MWh on Monday during an early fall heat wave.

Hub prices first cracked $1,000/MWh during the 15-minute interval ending at 1:45 p.m. on Oct. 9, and then again during each of the 11 intervals between 2:30 and 5 p.m. The systemwide hub average peaked at $520.59/MWh during the 3:15 p.m. interval.

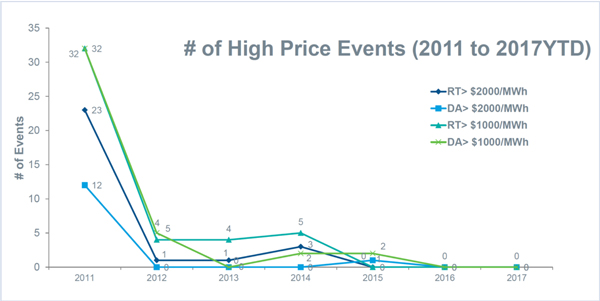

According to ERCOT data, the Houston Hub has now produced 47 intervals of $1,000/MWh this year. That’s the most since 2011, the first full year of the nodal market, when the hub recorded 163 high-priced events. It only had 87 occurrences in 2012-2016.

Congestion has long been an issue in the Houston zone, but the high temperatures caught the market with several plants on maintenance outages.

Speaking during a Tuesday webinar, Dinesh Madan, an ICF technical director, said scarcity pricing has been “almost missing from this market.” Madan pointed to a volatile market, thanks to an overabundance of wind energy and short load forecasts.

“ERCOT is a weather-and-wind story now,” Madan said. “In 2016, the story was wind. In 2017, the story was weather.”

In 2016, wind resources generated 2,024 MW more than their forecasted output coinciding with the summer peak. In 2017, the market’s peak load was 3,428 MW below forecast, thanks to a milder summer. With ample reserves (and lower loads), ERCOT was able to withstand 2016 and 2017 peak loads despite generation outages exceeding forecasts by 1,780 MW and 2,713 MW, respectively, during each summer’s peak.

Monday’s spike came as Texas temperatures soared into the mid 90s. The ISO set a new record for October peak demand at 62,263 MW — just above projections — during the hour ending at 5 p.m., breaking the previous mark set the year before by more than 2.3 GW.

Houston Hub prices peaked at $34.11/MWh on Tuesday, when temperatures and ERCOT load both dropped.

Reservoir of Retirements

During the same webinar Tuesday, ICF Senior Vice President Judah Rose also addressed Vistra Energy’s recent decision to retire three aging coal-burning units in East Texas. (See First Shoe to Drop? Vistra to Retire 3 Texas Coal Units.)

He referred to a “reservoir” of potential retirements among ERCOT’s coal fleet, driven by fat reserve margins, low gas prices and cheaper renewable resources. Rose also pointed out that many of the coal plants, once reliant on cheap, local lignite — including Vistra’s Monticello plant — now depend on Powder River Basin coal brought in on rails from the Rocky Mountains.

“Almost ironically, these plants are facing the least environmental pressure in a long time,” Rose said, referring to the Trump administration’s efforts to roll back the Clean Power Plan. (See EPA to Announce Clean Power Plan Repeal.)

He said the Energy Department’s recent Notice of Proposed Rulemaking to FERC to support out-of-market baseload plants would likely have little effect on Texas coal units, as the agency has no jurisdictional authority over ERCOT.

Any FERC policy “will not provide additional revenue,” Rose said. “The exit of these plants will be related to low power prices.”

Rose said ICF will be watching ERCOT’s reserve margins, which the ISO forecasts will be 16.3% next year. The firm expects that margin to dip below the planning reserve margin of 15.6% in 2019.

“That’s significant, because generally, when you start getting below 15% in markets, you have the potential for all hell breaking loose,” he said. “You get a lot of potential for price spikes.”

The Monticello retirement may provide $1 to $2/MWh of upside in scarcity equilibrium in 2019, Rose said.