By Michael Kuser

Avangrid third-quarter earnings fell 9% to $99 million on weaker-than-expected wind production, which the company said was partially offset with improved operations elsewhere. Year-to-date profits were still up 8%.

“The third quarter historically sees the least amount of production from wind resources, and this third quarter was even below that,” CEO James P. Torgerson said during an Oct. 24 earnings call. “We have been implementing best practices and cost management across all of our business, so the new rate plans in Networks and the cost management we’ve implemented helped to offset the low wind resource, which was really 5% below our normal.”

The company’s two primary lines of business are Avangrid Networks, comprising eight electric and natural gas utilities in New York and New England, and Avangrid Renewables, which operates nearly 7 GW of mostly wind power in 23 states.

State Regulatory Update

During the call, Torgerson addressed a recent move by Connecticut regulators to investigate Avangrid and Eversource Energy for potentially manipulating natural gas prices in the state between 2013 and 2016 (17-10-31). The state’s Public Utilities Regulatory Authority (PURA) is working off allegations set out in a report issued earlier this month by university researchers and the Environmental Defense Fund, who contended the companies unjustly reaped gains of about $3.6 billion over the period.

In Connecticut, “we have an obligation to supply gas, and we also have a very strict code of conduct for our employees,” Torgerson said. “We will be looking to make sure we’re following all the rules, which I believe we are, and we’ll cooperate with PURA in their review.”

In New York, Avangrid subsidiaries New York State Electric and Gas and Rochester Gas & Electric next year expect to implement a collaborative earnings adjustment mechanism designed to facilitate interconnection of distributed energy resources, which Torgerson said “provides incentives that would actually increase the [return on equity] if targets are achieved.” Regulatory discussions on the two utilities’ joint proposals for advanced metering infrastructure and a distributed system implementation plan have been deferred to late this year, with decisions expected by June 2018.

Federal Scene

Torgerson noted that FERC earlier this month rejected a bid by New England transmission owners — including Avangrid’s Central Maine Power — to increase their ROEs to the previous level of 11.14% after a federal appeals court earlier this year temporarily vacated a 2014 commission order that reduced the ROE to 10.57%. The commission said it would address the actual rate in a later remand order (ER15-414, EL11-66). (See FERC Rejects New England Tx Owners on ROE.)

“[FERC] really didn’t, in my mind, get to the merits of the ROE,” Torgerson said, contending the commission seemed more concerned about the “whiplash” of moving the rates back and forth.

Transmission Projects, Wind and PPAs

Three-year rate plans in Connecticut and New York, along with the FERC formula rate, are giving Avangrid better than 80% certainty, Torgerson said.

Avangrid looks to continue developing onshore renewables and transmission projects for long-term growth, “some of it through the Massachusetts Clean Energy [request for proposals] and the New York transmission renewables solicitations, but also with the offshore wind RFP that will be in Massachusetts,” he said.

For the Massachusetts solicitation, CMP in July partnered with Hydro-Québec to bid the New England Clean Energy Connect, a 145-mile, 320-kV HVDC line that would carry 1,200 MW of hydro and wind energy from Canada to Maine. The company also teamed with NextEra Energy on the Maine Clean Power Connection, a new 345-kV connection from western Maine to the New England grid with capacity options of 460 to 1,110 MW, allowing varying combinations of wind, solar and storage facilities in eastern Canada and western Maine. (See Tx Developers Pitch Mass. Clean Energy Bids.)

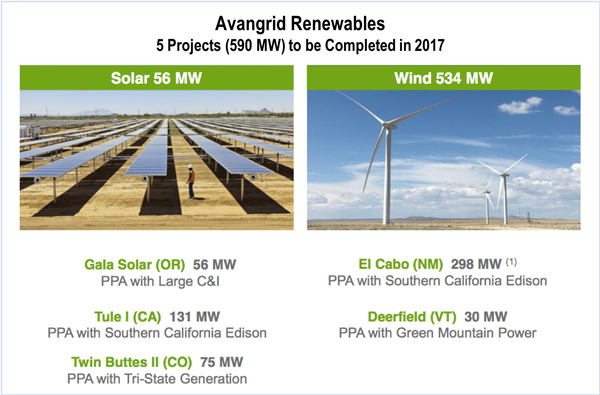

Avangrid continued to sign on new wholesale customers during the third quarter, executing a power purchase agreement for 86 MW, “adding to the 401 MW of PPAs previously secured and announced in 2017 — all with 100% production tax credits,” added Torgerson. “Construction on approximately 800 MW of wind and solar projects is well underway, of which 590 MW will be operational by year-end 2017.”

He added that the market for PPAs has become more competitive this year as customers look not only for renewable energy, but renewables at a low cost.