By Robert Mullin

FERC on Tuesday agreed to sharply reduce the penalty Barclays Bank must pay to settle claims that it manipulated Western electricity markets a decade ago.

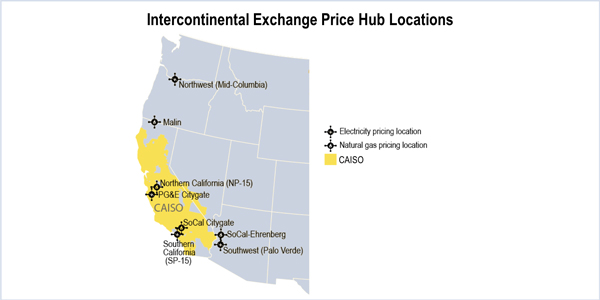

The commission approved a settlement agreement requiring the U.K.-based company to pay $105 million in penalties after company traders engaged in a two-year scheme to influence physical power prices at certain trading hubs in the West in order to benefit from their positions in financial swaps covering those same markets (IN08-8). The illegal trades occurred from November 2006 to December 2008, and involved the Mid-Columbia, NP-15, SP-15 and Palo Verde delivery points.

The agreement represents a significant comedown for FERC, which in July 2013 levied a record $470 million fine against Barclays, which included a requirement that the bank disgorge nearly $35 million in profits from the scheme. Those proceeds were to be paid into the low-income home energy assistance programs (LIHEAPs) of Arizona, California, Oregon and Washington. Former FERC Chairman Norman Bay was director of the commission’s Office of Enforcement at the time.

Barclays challenged the penalty in federal court, and Tuesday’s settlement indicates the bank largely prevailed in its nearly five-year legal battle with FERC. Under the terms of the agreement, the bank will pay just $70 million in civil penalties, though it must still relinquish its profits from the scheme, just over half of which will be directed to the LIHEAPs. The company and its traders did not admit nor deny committing any violations against the commission’s anti-manipulation rules.

“The commission concludes that the agreement is a fair and equitable resolution of the matters concerned and is in the public interest, as it reflects the nature and seriousness of the conduct and recognizes the specific considerations stated [in the order] and in the agreement,” FERC wrote in its decision to approve the order.

One critic of the settlement strongly disagreed with FERC’s take.

“FERC’s action is an outrage and sends a clear signal to market manipulators: Crime will now pay,” Tyson Slocum, director of Public Citizen’s energy program, said in a statement.

Slocum said the “egregious” settlement did not occur in isolation but instead points to a broader development in which FERC “may be getting soft on rule-breakers.” As evidence, he cited the recent appointment of General Counsel James Danly, who previously served on the legal team defending Dynegy in market manipulation case brought by Public Citizen (EL15-70). One of Danly’s former law partners has written articles “attacking” Bay’s enforcement actions and appointment as chair, Slocum pointed out.

“Consumers have benefited from FERC’s aggressive enforcement of wrongdoers,” Slocum said. “The evisceration of the Barclays settlement, when combined with key staffing decisions at FERC, may signal that the days of tough enforcement on banks, hedge funds and other energy traders may be coming to an end.”

Slocum called for Congress to hold an oversight hearing on FERC operations to ensure that consumers are protected from energy market manipulation.

David Applebaum, an attorney who previously served as director of investigations in the Office of Enforcement, told Bloomberg that FERC’s move was “inevitable” after a federal judge in September ruled the agency had waited too long to bring its case against Ryan Smith, one of the Barclays traders involved in the scheme. Smith, along with fellow traders Karen Levine and Daniel Brin, initially faced penalties of $1 million each, while their manager, Scott Connelly, was ordered to pay $15 million.

“I think once the Smith decision came out, it was inevitable that FERC would have to reduce its damages and civil penalties significantly,” Applebaum said.

Levine, Brin and Connelly were covered under Tuesday’s settlement.

FERC declined to comment for this story.