By Amanda Durish Cook

CARMEL, Ind. — MISO is proposing to once again revise the equation behind its yearly resource adequacy survey issued in partnership with the Organization of MISO States.

The new adjustment for the 2018 OMS-MISO survey adds a “likelihood” weighting to account for the in-service dates of potential new capacity still in the queue, said MISO Resource Adequacy Coordinator Ryan Westphal.

Including queue resources “is a pretty new process, so there’s no history of a success rate yet,” Westphal said during a Nov. 8 Resource Adequacy Subcommittee meeting.

Last year marked the first time the survey began including in its weighted resource adequacy averages a 35% capacity share of projects in the definitive planning phase of the interconnection queue. But MISO at the time didn’t contemplate adding likely in-service dates into the equation. The RTO is now proposing to weight projects represented within that 35% share based on the likelihood they’ll complete the queue by a certain year.

Under the proposal, next year’s survey will weight according to status — 10% for projects not yet started and in the first phase of the queue, 25% for projects in the second phase and 50% for those in the third phase. All projects with signed generation interconnection agreements will count fully toward offsetting resource adequacy requirements. MISO will also credit new wind and solar resources at 16% and 50%, respectively, of nominal capacity.

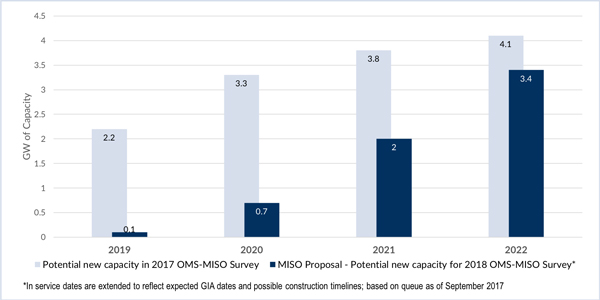

The new approach to weighting will result in a far lower forecast of potential resources. In last year’s survey, MISO predicted that 2.2 GW of potential resources in the definitive planning phase would come online in 2019. By applying the new weighting to the 2018 survey, MISO expects only 0.1 GW of potential resources will come online in 2019. By 2020, MISO sees 0.7 GW in operation instead of an earlier prediction of 3.3 GW. The in-service forecast climbs to 2 GW in 2021, but that represents just more than half the 3.8 GW predicted last year.

Before this year, MISO stakeholders had criticized the survey as being too alarmist for not including any potential new resources without signed interconnection agreements. Inclusion of a portion of those resources in this year’s survey showed MISO will have 2.7 to 4.8 GW of excess resources from 2018 to 2022, a departure from the shortfalls predicted in previous years. (See Capacity Survey Shows MISO in the Black.)

Saying the new survey style could “dramatically” impact some zones, Exelon’s David Bloom asked for a zone-by-zone comparison showing how predictions for potential new generation will change from this year to the next.

“By changing the assumptions from year to year, I think what MISO is doing is changing results,” said Kevin Murray, representing the Coalition of Midwest Transmission Customers. “You’re going to go from reporting a surplus in 2019, to reporting a deficit simply by arbitrarily shifting assumptions.”

Westphal asked stakeholders to keep in mind that the change deals only with potential resources still in the queue, which the survey only began including last year. He said all generation with signed interconnection agreements will continue to be counted.

“Did the queue get worse in the last year? Did a bunch of resources drop out? What happened to lose about 2.1 GW in 2019?” asked Indianapolis Power and Light’s Ted Leffler.

Laura Rauch, MISO manager of resource adequacy coordination, said the 35% of new generation used in last year’s survey was not adjusted for the more realistic in-service dates.

“Last year, we took the in-service dates that owners provided with their queue application. Some of those generators hadn’t been studied yet,” Rauch said. She said updated in-service dates for potential wind resources have the biggest effect on MISO’s numbers.

Madison Gas and Electric’s Megan Wisersky said she was concerned change would spark public concern about capacity shortfalls.

“You look at how the survey gets used and abused out in the public,” Wisersky said. “Two things happen when the survey is released to people who don’t deal with these kinds of things every day. One: I know what happens when you show these types of deficits — things get dicey. Two: [People ask if] the queue process is leading to resource inadequacy. And that’s what I’m worried about when people without knowledge of these get ahold of them.”

Westphal said MISO has time to collect stakeholder advice and refine the survey over the next several months.