RENSSELAER, N.Y. — NYISO year-to-date monthly energy prices averaged $34.89/MWh in October, a 4% increase from a year earlier, Senior Vice President for Market Structures Rana Mukerji told the ISO’s Business Issues Committee (BIC) on Wednesday.

Locational-based marginal prices (LBMPs) averaged $28.35/MWh for the month, down 4.1% from September and up 27% from October 2016. The ISO’s average daily sendout was 398 GWh/day, compared with 437 GWh/day in September and 391 GWh/day a year earlier.

New York natural gas prices rose nearly 4% in October, averaging $2.36/MMBtu at the Transco Z6 hub. Prices were double those of a year ago, although still “historically low,” Mukerji said.

Distillate prices rose 14.9% year on year, with Jet Kerosene Gulf Coast averaging $12.30/MMBtu, down from $13.40 in September. Ultra Low Sulfur No. 2 Diesel NY Harbor averaged $12.86/MMBtu, compared with $12.80 in September.

The ISO’s local reliability share was 14 cents/MWh, down 2 cents/MWh from the previous month, while the statewide share remained unchanged at -50 cents/MWh. Total uplift costs were lower than in September.

External Capacity and Imports

Reviewing the Broader Regional Markets report, Mukerji highlighted NYISO’s effort to clarify the minimum deliverability requirements for PJM resources seeking to export into the ISO’s installed capacity (ICAP) market. He noted that during an October ICAP Working Group meeting, the ISO provided an overview of the current approach to assessing the deliverability of external resources into the New York Control Area for purposes of qualifying eligible capacity within the market.

NYISO is also modifying the documentation requirements for capacity imports across the PJM AC ties, with a planned effective date of May 1, 2018. The process change will require submission of documentation on the day the ICAP Spot Market Auction results are posted to demonstrate that external resources with capacity awards relating to imports across the PJM AC ties have firm transmission service for the month.

The ISO also is considering whether an Atlantic Economics proposal, or an alternate formula-based model, may be viable for calculating locality exchange factors (LEFs). NYISO has engaged General Electric to investigate the viability of potential refinements to the current methodology for determining LEFs.

NRG’s Kelli Joseph Elected Vice Chair

The BIC last week elected Kelli Joseph, NRG Energy’s director of market and regulatory affairs, to serve as vice chair of the committee for the 2017/18 term.

Joseph advocates on behalf of NRG at NYISO and the New York Public Service Commission and worked at NYISO as a grid operations senior analyst prior to joining NRG in 2014. She attended Houghton College and earned a Ph.D. in political economy at the University of Virginia and an international MBA at the IE Business School in Spain.

BIC Approves Developing New LCR Methodology

The committee also voted for NYISO to continue developing a new methodology to determine locational capacity requirements (LCR), subject to updating the net cost of new entry curve to be used in the ISO’s baseline assumptions.

Zachary Stines, associate market design specialist for the ISO, told the BIC that the new optimization methodology results in increased stability as generation changes occur within the system. He said the ISO sought to develop capacity requirements that maintain reliability while minimizing the total cost of capacity at the level of excess condition, i.e., the applicable minimum installed capacity requirement, plus the capacity of the relevant peaking plant.

David Clarke of the Long Island Power Authority opposed the proposed methodology, saying it is based on an unrealistically low estimate of net CONE on Long Island.

Mark Younger of Hudson Energy Economics wanted the ISO to commit to refreshing the database with the current net CONE values so that the optimization uses the same CONE as that used in the energy market. Stines said the ISO would do so early in 2018.

Questions on Integrating Public Policy Task Force

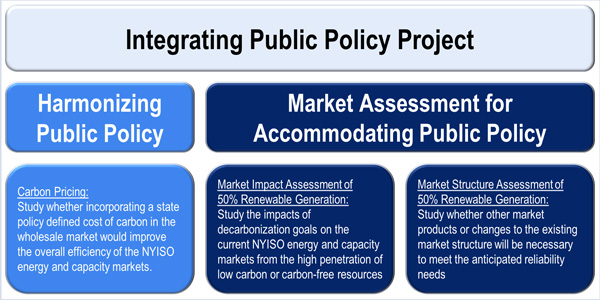

NYISO Senior Manager for Market Design Michael DeSocio’s progress report from the Integrating Public Policy Task Force (IPPTF) elicited a half-hour of stakeholder dissension over the ISO’s definitions of “harmonizing” versus “accommodating” public policy.

NYISO and the New York PSC jointly formed the task force in October to create a forum for stakeholders to discuss pricing carbon into the wholesale electricity market along the lines described in a previous Brattle Report. (See New York Stakeholders Question Carbon Pricing Process.)

Representing New York City, attorney Kevin Lang of Couch White, expressed concerned about the lack of transmission planning in the task force process, given the amount of offshore wind being sought by the state. Younger agreed, saying that new transmission will be required for the grid to absorb increased amounts of new renewable energy and that nobody should assume the issue has been settled.

“Even if you price carbon, it’s unlikely to be high enough to incent renewables development,” said NRG’s Joseph. “We need to be talking about design changes; that’s why we proposed a two-tier market. Not instead of carbon pricing, but while we are at it, look at capacity markets.”

In response to a question about whether the task force had a coherent mission, DeSocio said it is focused on fulfilling the goals of New York’s Clean Energy Standard.

The IPPTF’s next public hearing is scheduled for Nov. 20 in Albany.

— Michael Kuser