By Amanda Durish Cook

FERC on Thursday rejected a rehearing of MISO’s subregional flow limits and accepted the RTO’s method for calculating the limits.

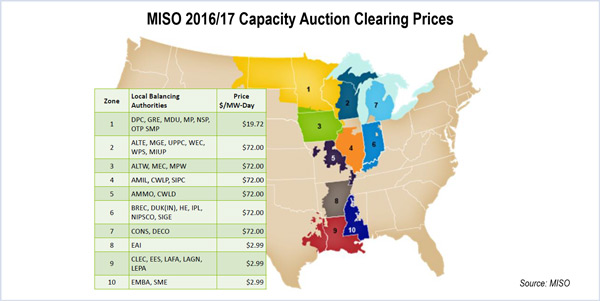

The commission declined to rehear its December 2016 dismissal of a complaint seeking to overturn the results of MISO’s 2016/17 planning year capacity auction. A coalition of transmission customers had argued that subregional transfer constraints where MISO flows must cross FERC Backs MISO on Transfer Limit, Seeks Details.)

MISO calculates the transfer limits between its Midwest and South regions by deducting firm reservations from 2,500 MW of available capacity flowing from South to Midwest and 3,000 MW estimated to be available in the opposite direction. The initial limits were set out in a settlement with SPP that became effective in early 2016.

Several MISO stakeholders and the Independent Market Monitor argued that the RTO’s subregional constraint calculation is flawed, with a group of transmission-dependent utilities in Wisconsin arguing that the subtraction of all firm transmission service reservations “incorrectly assumes that those holding the reservations will use them all the time, even when it would be counter to their economic interest.” The Monitor agreed that the calculation is too conservative.

In its Nov. 16 order, FERC pointed out that while it’s possible that not all firm transmission customers will use their service simultaneously, it’s also possible they could.

“All parties appear to agree that the regional directional transfer limits established in the settlement agreement are a reasonable starting point for the calculations,” FERC wrote. “We agree … MISO’s proposal requires it to make two reductions, when applicable, to the regional directional transfer limits: (1) a reduction, based on a feasibility analysis, for reliability purposes; and (2) a reduction by the amount of firm transmission service reservations in the prevailing direction.”

Multiple companies submitted alternative proposals for calculating subregional constraints, but FERC declined to examine their fairness.

“There may be more than one just and reasonable methodology that MISO can use to calculate subbegional constraints. We need not analyze whether the various alternative proposals are also just and reasonable,” the commission said.

FERC also clarified — at WPPI Energy’s request — that its finding regarding the 2016/17 auction should not be construed as “conclusive proof” that MISO’s approved methodology will be considered the best course for future capacity auctions.

Monitor Concerned with Cost of Midwest-South Constraint

The order comes as the Monitor is reiterating concerns about the cost of the SPP contract path with respect to make-whole payments.

“We’ve been coming at MISO with concerns about the RSG [revenue sufficiency guarantee] on the North-South constraint for some time now,” Monitor David Patton said.

Patton said the constraint contributed to $3 million in revenue sufficiency guarantee payments in April 2017 alone.

“It’s a vexing constraint because it’s not a physical constraint; it’s an agreement,” Patton said during an October Market Subcommittee meeting.

He said the constraint created about $9 million in RSG payments from September through mid-October, with $6 million of that paid to a single company. “These are wasteful costs,” he added.

Earlier this year, MISO conducted a study to evaluate the benefits of constructing transmission to link the Midwest and South areas. The RTO concluded that not one of 35 potential projects could pass the 1.25-to-1 benefit-cost criteria based on adjusted production cost benefits. (See “No Tx Coming for North-South Constraint,” MTEP 17 Proposal: 343 New Transmission Projects at $2.6B.)