By Peter Key

The RTO Insider Top 30 saw improved profits in the third quarter over 2016, but revenues fell, and more than half of the companies saw their top and bottom lines shrink.

| company filings

Net income grew $563.7 million (5.3%) to $11.1 billion as all 30 companies turned a profit, indicating that their problems weren’t strong enough to overcome the seasonal strength of the quarter that includes the year’s two hottest months. Still, 17 companies saw their income fall.

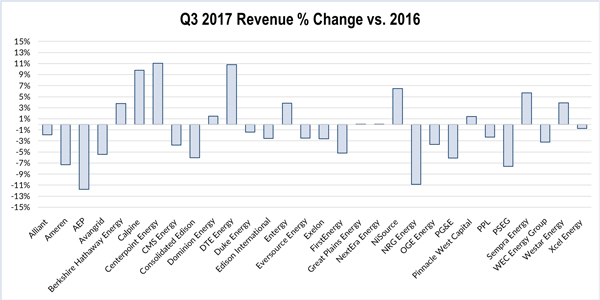

Revenue fell $1.36 billion (1.6%) to $85.4 billion, with 18 companies posting revenue declines, in some cases because of unfavorable weather.

| Company | Market Cap ($ billions) | Revenue Q3 2017 ($ billions) | % change vs. 2016 | Net Income Q3 2017 ($ millions) | % change vs. 2016 |

| AEP | $37.67 | $4.10 | -11.77% | $544.7 | -171.1% |

| Alliant | $10.22 | $0.91 | -1.91% | $168.8 | 31.5% |

| Ameren | $15.27 | $1.72 | -7.32% | $288.0 | -22.0% |

| Avangrid | $15.79 | $1.34 | -5.43% | $99.0 | -9.2% |

| Berkshire Hathaway Energy | NA | $5.28 | 3.75% | $1,068.0 | 3.1% |

| Calpine | $5.42 | $2.59 | 9.81% | $225.0 | -23.7% |

| CenterPoint Energy | $12.56 | $2.10 | 11.06% | $169.0 | -5.6% |

| CMS Energy | $13.93 | $1.53 | -3.78% | $172.0 | -7.5% |

| Consolidated Edison | $26.87 | $3.21 | -6.03% | $457.0 | -8.0% |

| Dominion Energy | $52.87 | $3.18 | 1.50% | $665.0 | -3.6% |

| DTE Energy | $20.20 | $3.25 | 10.83% | $270.0 | -20.1% |

| Duke Energy | $62.04 | $6.48 | -1.43% | $954.0 | -18.9% |

| Edison International | $26.11 | $3.67 | -2.52% | $470.0 | 11.6% |

| Entergy | $15.41 | $3.24 | 3.81% | $398.2 | 2.6% |

| Eversource Energy | $20.22 | $1.99 | -2.51% | $260.4 | -1.9% |

| Exelon | $40.13 | $8.77 | -2.59% | $824.0 | 68.2% |

| FirstEnergy | $15.23 | $3.71 | -5.18% | $396.0 | 4.2% |

| Great Plains Energy | $7.39 | $0.86 | 0.05% | $3.4 | -97.4% |

| NextEra Energy | $73.00 | $4.81 | 0.06% | $847.0 | 12.5% |

| NiSource | $9.11 | $0.92 | 6.47% | $14.0 | -48.5% |

| NRG Energy | $9.25 | $3.05 | -10.87% | $171.0 | -57.5% |

| OGE Energy | $6.97 | $0.72 | -3.64% | $183.4 | -0.1% |

| PG&E | $27.72 | $4.52 | -6.09% | $550.0 | 41.8% |

| Pinnacle West Capital | $9.98 | $1.18 | 1.41% | $276.1 | 5.0% |

| PPL | $24.83 | $1.85 | -2.33% | $355.0 | -24.9% |

| PSEG | $26.03 | $2.26 | -7.63% | $395.0 | 20.8% |

| Sempra Energy | $29.82 | $2.68 | 5.44% | $57.0 | -90.8% |

| WEC Energy Group | $21.54 | $1.66 | -3.21% | $215.4 | -0.7% |

| Westar Energy | $7.96 | $0.79 | 3.88% | $158.3 | 2.3% |

| Xcel Energy | $25.66 | $3.02 | -0.76% | $492.1 | 7.5% |

| Totals | $669.2 | $85.4 | -1.57% | $11,146.8 | 5.3% |

American Electric Power posted by far the largest increase in net income — $1.31 billion — but that was largely due to its 2016 performance, when it lost $765.8 million because of a $2.3 billion write-down on the value of its competitive wind farms, coal generators and coal-related properties. (See AEP Turns Away from Generation to Transmission, PPAs.) AEP earned $544.7 million in the just-ended quarter, but its adjusted earnings per share of $1.10 missed the Zacks consensus estimate of $1.19 and were down from $1.30/share — excluding the impairment — a year ago.

After releasing its earnings, AEP said it plans to invest $18.2 billion from 2018 through 2020, 72% of which will be focused on its transmission and distribution operations. That includes $1.8 billion in new renewable generation, but excludes the $4.5 billion Wind Catcher project in Oklahoma, which is dependent on regulatory approvals in 2018. (See AEP to Spend $4.5B on Largest Wind Farm in US.)

Exelon had the largest percentage increase in net income, 68.2% ($824 million), primarily due to increased profits at Commonwealth Edison ($152 million) and its generation unit ($69 million). Company executives also said its utilities were performing better than planned.

| company filings

Exelon’s bottom-line success hasn’t stopped it from pushing for subsidies for its nuclear generation fleet, which is the largest in the nation. In its third-quarter earnings call, CEO Chris Crane said the company was encouraged by Energy Secretary Rick Perry’s Notice of Proposed Rulemaking, which, if adopted by FERC, would give a financial boost to Exelon’s nuclear plants (RM18-1). (See CEOs See Dollar Signs in ZECs, PJM Price Formation.)

After Exelon released its earnings, its Texas merchant generation business, ExGen Texas Power, filed for bankruptcy protection to offload most of a $675 million loan due in September 2021. The company plans to relinquish four Texas natural gas plants to lenders and pay $60 million to keep a fifth plant in response to what the company called “historically low power prices” in Texas. (See Exelon Gives up 4 of 5 Plants to Lenders in Chapter 11 Filing.)

Sempra Energy had the largest decrease in net income, dropping $565 million to $57 million, because of a California Public Utilities Commission administrative law judge’s decision denying subsidiary San Diego Gas & Electric’s request to recoup losses stemming from wildfires a decade ago. (See SDG&E’s Wildfire Costs Undercut Sempra Profits.) Although the PUC hasn’t decided whether to accept its ALJ’s ruling, accounting rules require Sempra to reflect the decision in its results. The PUC is slated to decide on the matter at its Nov. 30 meeting. Sempra has said it will appeal the decision if it’s not allowed to recover the costs.

Great Plains Energy had the largest percentage decrease in net income, falling 97.4% to $3.4 million, because of the $162.9 million it spent in its attempted acquisition of Westar Energy. Great Plains recast the deal as a “merger of equals” in August after the Kansas Corporation Commission blocked an earlier version of the deal in April. (See Great Plains, Westar File Revised Merger Plan.) Shareholders for both companies approved the revised deal on Nov. 21.

DTE Energy had the largest revenue gain, jumping $317 million to $3.25 billion, largely because of a $392 million increase in operating revenue from the non-utility operations of its energy trading unit. In percentage terms, however, DTE’s 10.8% revenue increase, was second to the 11.1% increase by CenterPoint Energy, which saw its revenue grow to $2.1 billion because of a $257 million revenue increase at its energy services segment.

AEP posted the largest revenue decrease in dollars and percentage terms, falling $547 million (11.8%) to $4.1 billion, because of what it called the mildest weather conditions in 25 years.