By Tom Kleckner

The costs of maintaining DC ties to allow SPP’s merger with the Mountain West Transmission Group should be allocated based on benefits, Texas Public Utility Commission Chair DeAnn Walker said last week.

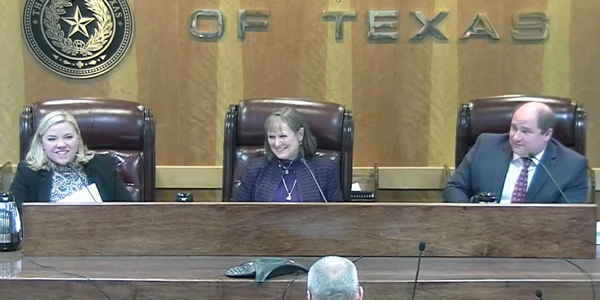

In brief comments during the PUC’s Dec. 14 open meeting, Walker, who serves on SPP’s Regional State Committee, updated Commissioners Brandy Marty Marquez and Arthur D’Andrea on the “very interesting debate” taking place as Mountain West pursues SPP membership. (See SPP, Mountain West Integration Work Goes Public.)

The benefits touted by the two entities come in part from using the four DC interties that separate them to schedule power as a part of the SPP market. The four ties have a combined transfer capability of 720 MW.

“I [told SPP] yesterday that Texas believes that whatever [maintenance] costs are related to those DC ties or future ones … be done on a cost-benefit ratio,” Walker said.

Mountain West has proposed those and any future costs be allocated on a load-ratio share, as part of its recommendation for a Westside Transmission Owners Committee.

Hartburg-Sabine Delay

Walker also briefed the commissioners on the MISO Board of Directors’ recent decision to postpone approval of the $130 million Hartburg-Sabine 500-kV market efficiency project in eastern Texas for two months because of a late cost-allocation change. (See “Texas Project Delay,” MISO Board Approves $2.6B Transmission Spending Package.)

The Texas regulators last month asked MISO to create separate zones for it and Louisiana to allow more granular cost allocation. The Louisiana Public Service Commission filed a similar request with the RTO. (See “PUC to Ask MISO to Create Texas Local Resource Zone,” PUCT Open Meeting Briefs: Nov. 17, 2017.)

“We have assurances [MISO] will come back after FERC rules on the cost issues,” Walker said. “They’ve made statements they fully support the project.”

With the delay, Walker will hand off her MISO liaison duties to D’Andrea. She had temporarily inherited the responsibilities when Ken Anderson stepped down from the commission in November.

Fending off FERC

Walker said she is continuing to work with the Texas governor’s office and ERCOT on a “potential solution” addressing her concerns that transmission projects along the U.S. border with Mexico may threaten the ISO’s electrical separation from the rest of the country and the PUC’s exclusive jurisdiction over the Texas grid operator. (See Regulators Fear Cross-Border Tx Risks ERCOT’s FERC Exemption.)

“I don’t want to talk publicly at this point, because it is a litigation strategy,” she said.

Walker did say ERCOT staff has told her they could develop protocol language that makes it clear the ISO has authority to deny an e-Tag “or go so far as disconnect [its] system” from HVDC connections. The protocol change could be ready in time for ERCOT’s February Board of Directors meeting.

“Hopefully it’s a protocol that won’t have to be used,” Walker said.

ERCOT has several synchronous (AC) and asynchronous (DC) ties with the Mexican grid. Texas regulators are concerned comingled electricity flows from border projects in California and Arizona could lead FERC to claim jurisdiction through the U.S. Constitution’s Commerce Clause.

“These are drastic measures we’re talking about,” Marquez told Walker. “These are huge market disruptors, but they are a last line of defense, so I think it’s important we do it. We’ll continue to seek other solutions as well.”