Existing climate pledges won’t be sufficient to keep global temperature rise under the 2100 target in the Paris Agreement, increasing the likelihood that governments will resort to more stringent actions that risk “severe” economic impacts, according to a new report from Oxford Economics.

The report outlines the effects of a “disorderly” scenario in which current national climate pledges fail to deliver near-term results needed to achieve net-zero emissions by 2050. As a result, Oxford Economics’ model assumes governments would be forced to implement an “aggressive” global carbon tax under conditions in which too few non-emitting resources would be in service to mitigate the effects of such a tax.

“If decisive climate change mitigation is delayed until 2030, a disorderly transition will likely unfold and require stronger policy action to reach net-zero emissions by 2050,” the report’s author, Oxford Economics senior economist Daniel Moseley, said. “Our latest modelling suggests that an aggressive carbon tax policy and frictions in shifting to renewables would result in substantial economic damage.”

In the scenario envisioned by the Oxford report, global participants don’t accelerate efforts to cap warming at “well under” 2 degrees Celsius until 2030, requiring sharper carbon emissions cuts in following years in order to meet 2050 goals. The report bases that assumption on the most recent Climate Action Tracker assessment, which contends that global temperatures are likely to rise by 2.6 degrees even when factoring in current pledges and targets.

Climate Action Tracker’s more “optimistic” scenario still falls short of the Paris goals.

“Assuming full implementation of the net-zero targets by the U.S., China and other countries that have announced or are considering such targets, but have not yet submitted them to the [United Nations Framework Convention on Climate Change], global warming by 2100 could be as low as 2.0°C,” according to the group, a collaborative effort of three nonprofit climate research organizations.

Climate Action Tracker’s latest assessment notes that 131 countries responsible for 73% of global greenhouse gas emissions have adopted or are considering net-zero targets, up by four since the last assessment in December.

“While all of these developments are welcome, warming based on the targets and pledges, even under the most optimistic assumptions, is still well above the Paris Agreement’s 1.5 ̊C temperature limit,” the group said.

GDP Down, Consumer Prices Up

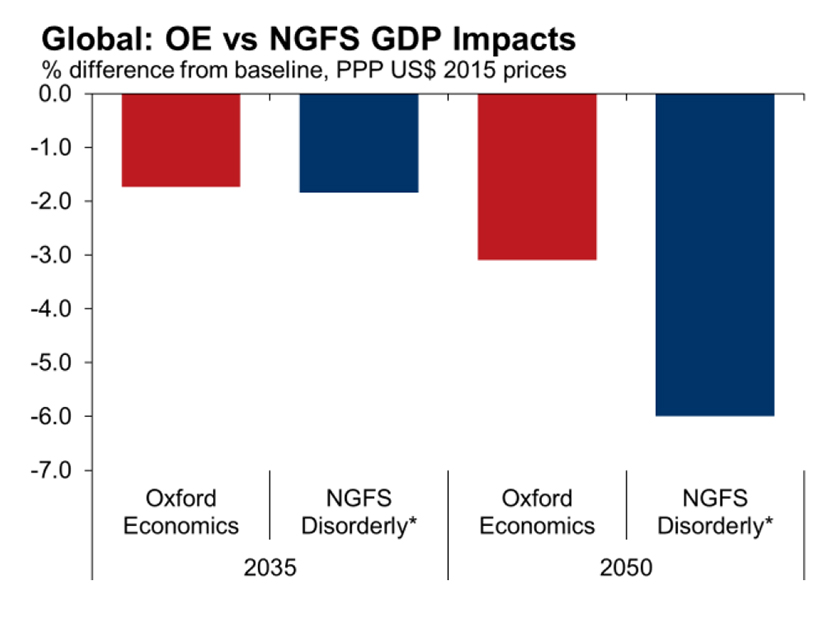

In Oxford’s analysis, aggressive carbon taxation would cause global GDP to fall 1.7% below the firm’s baseline GDP estimate for 2035 — which assumes countries reduce carbon emissions based on their current nationally determined contributions under the Paris Agreement — and 3% below the baseline for 2050. Consumer prices would also begin to rise sharply later this decade, peaking at a 4.2% annual inflation rate in 2031.

The report relies on Oxford’s Global Economic Model (GEM) and guidance from the Network for Greening the Financial System (NGFS). NGFS has estimated that a disorderly transition to net zero would leave 2050 GDP nearly 6% below the baseline, although its analysis does not account for the reduction of physical risks based on partially achieving the Paris targets.

“We improve the underlying NGFS assumptions by modelling physical risks using the GEM’s new damage function and by accounting for the latest emissions data,” the Oxford report said. The company’s model assumes that some risks would be mitigated by the benefits of limiting global warming to 1.6 degrees Celsius.

“The slower rise in global temperatures helps limit physical risks, particularly for relatively warmer nations. Using the GEM’s new climate damage function, we find that up to 2050, some of the disorderly scenario’s transition risks are outweighed by reduced physical risks,” the report says.

But Oxford said NGFS’s disorderly scenario illustrates that delayed mitigation measures will result in a strong macroeconomic impact.

“In this scenario, countries fail to raise their ambition beyond their current insufficient climate pledges until 2030, at which point policy action must be more drastic to reach the Paris Agreement targets,” the report says.

Oxford’s model modifies the NGFS scenario to increase global CO2 prices to $170/ton in 2035 and to about $700/ton in 2050. The model also assumes that carbon tax revenues would be fully recycled back into the economy through “social transfers” such as electricity bill rebates, “which help mitigate the transition risk and support disposable household incomes.”

But a rising carbon tax would spark inflation and create financial risks as consumer prices “rise markedly,” Oxford said. “This weighs heavily on demand and results in significant economic losses.”

The model assumes that carbon capture technology is “limited but necessary” over the next 30 years, reducing CO2 by 13 gigatons by 2050. Still, that would leave businesses and consumers to rely on energy efficiency measures to reduce most of their exposure to the carbon tax.

The report also contends that increased fossil fuel prices will reduce primary energy demand by 40% compared with the Oxford baseline, reducing the pre-tax price of fossil fuels, but not enough to offset the impact of the tax.

“Over time, the share of renewables used to produce electricity rises towards 100% by 2050 as carbon pricing makes the power sector more economically viable,” with electricity increasing to a 60% share of the global energy mix by that year, the report said.

“A slower rate of global warming provides some relief [from the economic impact], but the most material environmental benefits won’t materialize until the second half of the century,” Moseley said.