Sponsors of the Southeast Energy Exchange Market (SEEM) pledged Monday to provide FERC confidential market data and to apply the “just and reasonable” standard to increase transparency and allay market power concerns.

The sponsors made the pledges Monday in their response to a May 4 deficiency letter from FERC staff that asked 12 detailed questions about how the proposal to automate matching buyers and sellers in bilateral trading would operate (ER21-1111, et al.).

SEEM’s sponsors say their proposal would eliminate transmission rate pancaking and allow 15-minute energy transactions.

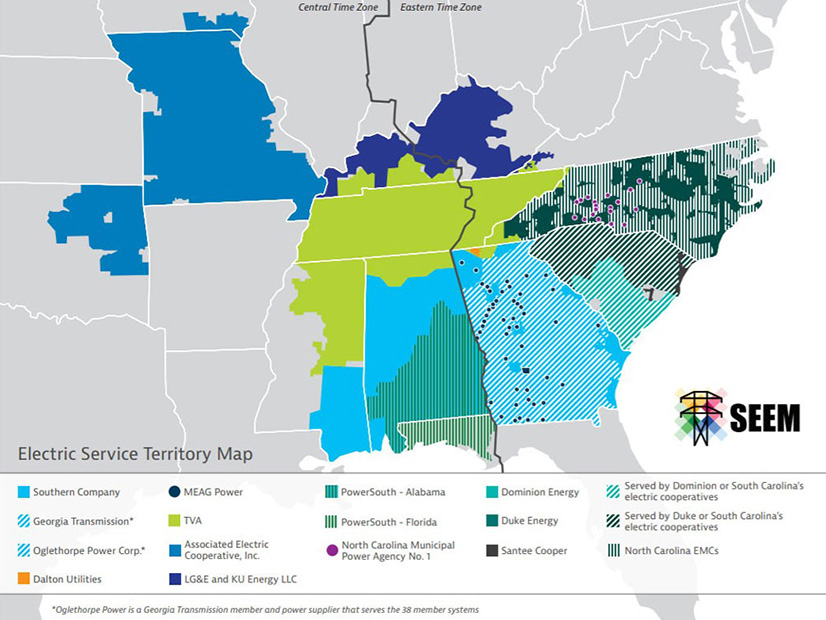

“The Southeast EEM members continue to believe that the Southeast EEM proposal will materially benefit customers throughout the southeastern United States by enhancing opportunities for competition in the bilateral market and increasing access to lower-cost energy from across the large footprint of the Southeast EEM,” said the group, comprising more than a dozen utilities and cooperatives including the Tennessee Valley Authority, Southern Co. (NYSE:SO) and Duke Energy (NYSE:DUK).

They said the changes to the proposed SEEM agreement would “increase transparency and provide the commission, participants and other stakeholders with the same confidence as the Southeast EEM members that the Southeast EEM will operate to the benefit of all concerned.”

They asked the commission to approve their proposal by Aug. 6.

“It is apparent from many of the deficiency letter’s questions that commission staff is interested in issues related to market power, market manipulation and market oversight,” the sponsors wrote. “The Southeast EEM provides no new opportunities to exercise market power.”

The members proposed the following changes:

- confidential weekly submissions of market data to FERC and the Market Auditor, “comparable” to the data provided by RTOs under Order 760, including participants, bid/offer prices, quantities and locations.

- disclosure of regulators’ questions and answers, as well as Market Auditor reports, to participants, subject to restrictions on access to confidential information by marketing function employees. The Market Auditor will be required to respond to the state regulatory commissions in Alabama, South Carolina, Mississippi, Virginia, Tennessee, Georgia, North Carolina, and portions of Kentucky, Oklahoma and Florida, as well as FERC, NERC and the TVA inspector general.

- a clarification that available transfer capability calculated by participating transmission providers must be provided to the SEEM administrator and must be used in the algorithm for each leg of any contract path to ensure transmission will not exceed available capacity.

- making the “just and reasonable standard” the default for most SEEM rules rather than the lower Mobile-Sierra public interest standard.

“While the Southeast EEM members do not believe these changes are needed here to ensure that the proposed market enhancements are just, reasonable and not unduly discriminatory or preferential, the changes are offered to respect and heed the message suggested by the staff questions and the intervenor concerns some of those questions echo,” the members said.

They reiterated that their proposal could only lower power costs for customers because SEEM transactions will only occur when a seller has lower-cost energy available to meet 15-minute non-firm increments than the buyer has available from its owned or controlled firm generation. “Therefore, there is no potential for the Southeast EEM to be used as a tool to increase prices through the exercise of market power,” they said.

SEEM said it was unable to answer FERC’s question about the supply of 15-minute residual energy expected to be offered.

“Before market launch, forward-looking estimates of the level of supply and demand in this voluntary residual market are difficult to make with any precision or certainty,” it said, adding that its consultant, Susan Pope of FTI Consulting, “expects that the market will attract robust participation by buyers and sellers in the Southeast.”

They also emphasized that SEEM will not function as an imbalance market and that balancing services will continue to be provided by the 10 balancing authorities in the SEEM footprint, unlike the Western Energy Imbalance Market (EIM) run by CAISO.

“The ‘EEM,’ unlike the ‘EIM’, will have no market clearing imbalance price that could be driven up through an exercise of market power to favor a related position; each Southeast EEM ‘exchange’ will be individually priced, just like the other bilateral transactions for which existing market power mitigation measures are already sufficient.”

Critics: SEEM Not a True Market

Clean energy groups have asked FERC to reject SEEM’s proposal, saying it doesn’t go far enough to encourage competition. In March, SEEM filed a response rejecting the critics’ objections as flawed or irrelevant. (See Southeast Utilities Defend SEEM Proposal.)

In a blog post Monday, Maggie Shober, director of utility reform for the Southern Alliance for Clean Energy, said FERC should require SEEM to be an imbalance market.

“SEEM as proposed is unlikely to deliver on its own promise: small incremental cost savings and marginally reduced renewable energy curtailments. Instead, ratepayers in the Southeast need actual competition, under a neutral administration, with broad participation, market transparency and accountable governance,” Shober wrote. “SEEM does not even attempt to promise these market essentials.”

She said SEEM should have an independent market monitor, eliminate the “split the difference” price settlement to one similar to locational marginal pricing and add a day-ahead hourly market with a resource-sharing construct.

“Right now there are countless utilities across the region that have proposed new gas plants in their queues, far more than regions of the country where markets are in place. One key reason for this is that each utility is doing resource planning largely as an island,” Shober wrote. “We’ve shown before that Southeast utilities do not tend to peak at the same time, and a platform for sharing resources across these utilities (i.e. a market) would reduce the need for all that new gas and would make it more economically efficient for complementary clean energy resources to flow across the region.”