Utilities that hoped to cash in on the Biden administration’s infrastructure plan and clean energy goals are now fighting a rearguard action to defeat FERC’s proposal to eliminate the transmission rate adder for remaining in RTOs.

Decarbonization of transportation and buildings is expected to greatly increase electric demand and integrating renewables will require much more transmission — potential boons to utilities that have seen little load growth for more than a decade.

But FERC’s proposal now has transmission owners seeking allies in Congress and state legislatures, along with threatening to litigate and withdraw from RTOs.

Reversal

FERC’s April 15 vote approving a supplemental Notice of Proposed Rulemaking that would limit the 50-basis-point rate for participating in RTOs to the first three years was a sharp turnabout from March 2020, when the commission advanced a proposal to double the adder to 100 basis points (RM20-10).

The potential loss of the adder was the subject of discussion at several utilities’ first-quarter earnings calls, with American Electric Power CEO Nick Akins threatening litigation.

Last week, the Edison Electric Institute (EEI), transmission interest group WIRES and the International Brotherhood of Electrical Workers (IBEW) sent the chair and ranking members on the House and Senate energy committees a letter “to raise concerns” about the NOPR, which the groups said, “run counter to the nation’s interest in a robust energy grid.”

That followed a letter Ohio Rep. Thomas Patton sent FERC on May 12 extolling the value of PJM and urging the commission to “consider any long-term impacts which may be incurred if decisions could lead to transmission operators ‘going it alone’ due to short-term financial motivations.”

WIRES Executive Director Larry Gasteiger called the supplemental NOPR “profoundly disappointing” and said it is causing TOs to re-evaluate their participation in RTOs.

While the benefits of RTOs to customers “are unquestionable and … significant,” it’s “much more of a mixed assessment” for TOs, he told RTO Insider in a recent interview.

“I am hearing increasing concerns from companies in a number of RTOs about the difficulties and the challenges associated with participating in an RTO for various reasons,” he said. “I think it’s, first of all, turning over control of your assets to an RTO, so you lose control over what happens with respect to those assets. I think it includes participating in stakeholder processes that can be lengthy, protracted and sometimes litigious. So, there are costs associated with those. And then in addition … there are additional compliance requirements and other activities that FERC imposes through participation in RTOs like Order 2222, like processes associated with various aspects of Order 1000. All of those wind up … requiring more resources from the companies to participate in them.”

Gasteiger said stable regulatory policy is essential for encouraging transmission investment. “Unfortunately, we’re not seeing that from FERC in recent years,” he said. “Their policies have not been stable and consistent with respect to base ROEs, much less things like incentives.”

Financial Impact

At an April 22 earnings call, AEP’s (NASDAQ: AEP) Akins told stock analysts the loss of the adder could cost the company “$55 million to $70 million pre-tax.” The company reported $435.5 million in earnings in 2020, up from $153.5 million in 2019. (See AEP’s Akins Lambasts FERC’s RTO Adder Proposal in Earnings Call.)

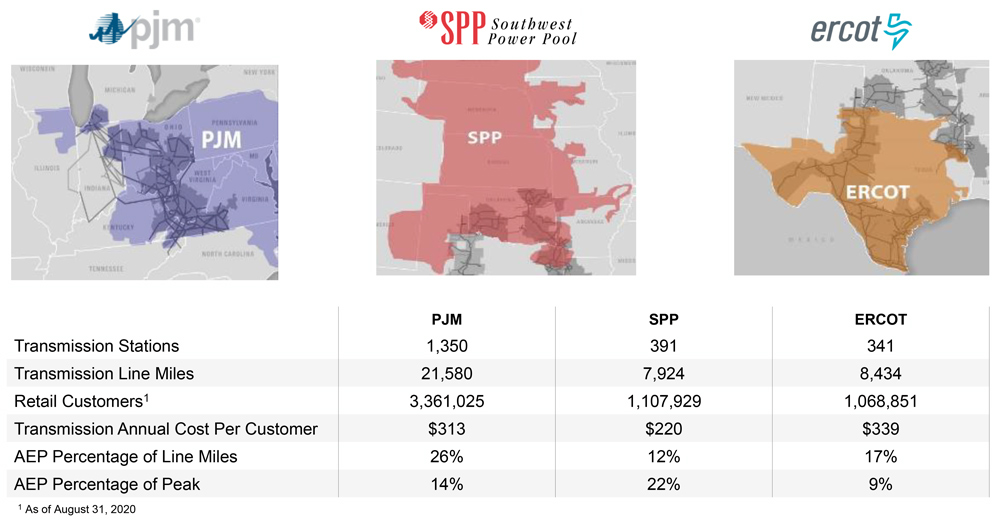

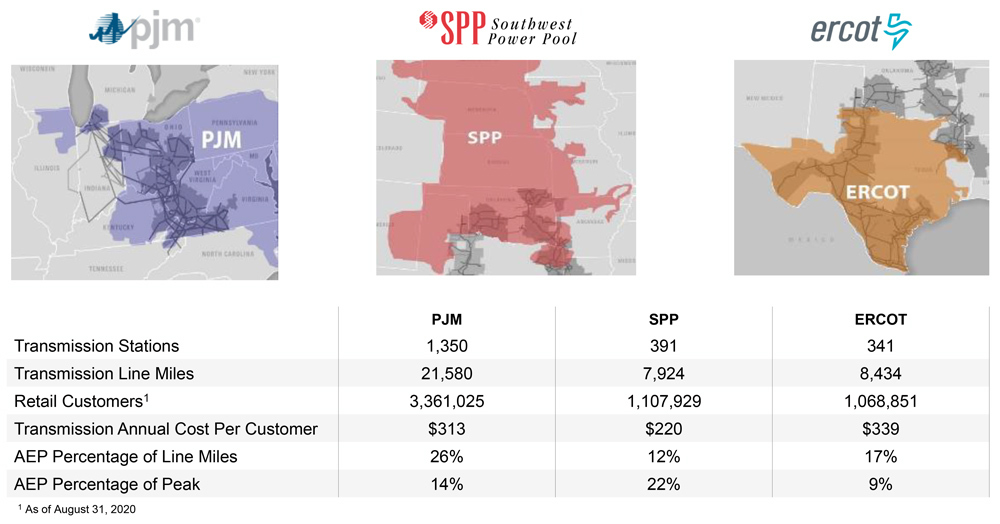

In 2019, FERC set return on equity (ROE) rates of 10.35% for AEP’s PJM transmission subsidiaries and 10.5% for those in SPP, including the 0.5% RTO adder. Last year, the commission set an ROE of 10.52% for AEP’s transmission assets in MISO. The company also has transmission in ERCOT, which is not regulated by FERC.

Congress directed FERC to offer incentives to promote capital investment and participation in RTOs in the 2005 Energy Policy Act, which amended the Federal Power Act: “The commission shall, to the extent within its jurisdiction, provide for incentives to each transmitting utility or electric utility that joins a transmission organization.”

Under Republican Chair Neil Chatterjee, the commission in March 2020 proposed doubling the RTO adder to 100 basis points, with Democrat Richard Glick dissenting in part. In the April 2021 vote on the supplemental NOPR, Glick, now chairman, was joined by Democrat Allison Clements and Republican Mark Christie. Chatterjee and Republican James Danly dissented.

Akins said, “FERC’s abrupt about face on incentives will certainly lead to litigation as is consistent with its previously well established and correct approach that incentives should not expire until the utility leaves the RTO.”

He added, “If you disrupt that net cost benefit opportunity, you will have people making different decisions about RTO participation.”

At FirstEnergy’s (NYSE: FE) earnings call, company officials said the loss of the adder would reduce earnings between $0.04 and $0.05 per share. CEO Steve Strah said the potential loss “is a concern obviously … but it’s not enough to throw our company off track.” FE reported 2020 GAAP earnings of $1.1 billion ($1.99/share) on revenue of $10.8 billion.

“We have a very large footprint of diverse transmission and distribution assets in which we can invest in multiple opportunities, should this development become a little bit more impactful to us,” Strah added.

“The bigger the markets are the lower the costs are, the higher the reliability and the more renewable energy that we can integrate into the system,” Fortis CEO David Hutchens (NYSE: FTS) said of the NOPR in a call with analysts. “So, we really think that that was the wrong direction to send.” (See Despite FERC NOPR, Fortis Optimistic About Transmission.)

Avangrid CEO Dennis Arriola (NYSE: AGR) told analysts that the loss of the adder could hinder some transmission projects but that the impact on earnings would not be material. “I think that there were definitely transmission lines for new projects where that adder makes a difference, because it’s difficult to get these done, and because the length of period that it takes to get the approvals adds risk,” he said.

A Bluff?

Whether utilities are bluffing or would actually leave could depend on state regulators. CAISO is unlikely to be affected because California’s three investor-owned utilities are required by state law to participate in the ISO — one reason that the California Public Utilities Commission has continuously advocated against the adders. (See CPUC Calls FERC Tx Incentive Plan ‘Atrocious.’)

The CPUC, the Maryland Public Service Commission and the Union of Concerned Scientists were among the intervenors to oppose the increase in the RTO adder in filings on the initial NOPR in July 2020. (See Tx Incentive NOPR Leaves Many with Sticker Shock.)

UCS noted that most RTOs and ISOs already had most of their current members in 2005. “Simply rewarding continued membership seems to provide additional revenue to member utilities without commensurate increase in benefits to consumers,” it said.

In a statement at the April open commission meeting, Glick said the proposed change was consistent with Congress’ direction.

“An incentive must incentivize something. If it does not do that, then it is a handout, not an incentive,” Glick said. Providing what is essentially a permanent payment for RTO membership is bad policy and inconsistent with the Federal Power Act.”

FERC last month extended the deadline to submit initial comments on the supplemental NOPR by 30 days to June 25, with the reply comment deadline extended to July 26.

Tom Kleckner, Robert Mullin, Jason York and Michael Kuser contributed to this article.