Hydrogen offers big opportunities for utilities, but it will require a cultural change for them to take advantage, says Nick Irvin, Southern Co.’s (NYSE:SO) director of research and development for strategy, advanced nuclear, and crosscutting technology.

“We are an industry that likes our stable, risk-adjusted returns,” he told the Smart Electric Power Alliance (SEPA) and Electric Power Research Institute (EPRI) H2Power conference last week.

Irvin said he’s looking at how hydrogen infrastructure can serve multiple functions and classes of customers.

“Once I’ve made the molecule, I can divert it … either into transportation fuel, back into grid support services, or for use on-site for backup generation or for resiliency. That stacked value chain, where everyone is sharing in both the investment and the value proposition … is the Venn diagram that says hey, we as a utility, should be able to move into that space,” he said. “If we can get the prices right and the economics right in deployment, I think is a great tool for us to move out into this lower carbon future.”

In the near term, Irvin said it will be difficult to make hydrogen cheap enough to compete with natural gas at bulk scale. “So what we’re trying to do is look for opportunities for hydrogen to play in markets where it can be competitive in the near term … and look at those systems as opportunities to learn the lessons you need to know — as pilots for how you scale to things like gas turbine operations.”

Katherine Ayers, vice president of research and development for Nel Hydrogen U.S., said hydrogen is still in the demonstration phase for utilities. “What we’re seeing is utilities starting to do projects at the megawatt scale, but they’re first of a kind. … A lot of them are subsidized by different governments.”

Daryl Wilson, executive director of the Hydrogen Council, said his group is tracking more than 300 megawatt-scale projects around the world. “80% of those are in Asia, China, and Australia,” he said. “And in those areas, absolutely, the utility sector is very involved. So companies like Uniper (OTCMKTS:UNPRF) … and RWE (FRA:RWE) in Germany — so many players now looking to hydrogen from the utility sector in Europe.”

Does Efficiency Matter?

Irvin said the use of zero marginal cost renewable energy sources to produce hydrogen is counterintuitive to his training as an engineer, where he was schooled to focus on efficiency.

“I think you have to ask yourself the question of: How much does efficiency matter in that future? … How do you optimize the capital deployment?” he asked. “I think customer choice and backward compatibility to enable the customer to be as … useful and flexible and independent and autonomous as they want to be in everything that they do on a daily basis has really got to be the ultimate goal.”

Ayers said hydrogen’s value in transportation is less about efficiency than about how well it meets customers’ needs.

“Where [hydrogen fuel cells were initially] more passenger vehicle focused, there’s been a realization that heavy-duty vehicles are maybe in an easier, earlier business case and an area where the battery doesn’t compete quite as well. So from that perspective, they’re looking at durability.

“It’s how far can your [vehicle] go?” she added. “Efficiency is not the only variable to look at.”

Distributed Hydrogen Production

John Lochner, vice president of innovation for the New York State Energy Research and Development Authority (NYSERDA), said hydrogen could continue utilities’ current business model as a “plug and play” opportunity while also serving as an “enabler” of distributed micro grids.

“We continue to plan and assess and fund … research and development and demonstrations,” he said. “What might be the opportunity to deploy hydrogen in the current infrastructure? What might it look like to have a distributed hydrogen infrastructure without the pipes? What are the costs? What are the timelines? How does it help us meet our decarbonization goals? I’m not sure we have good answers yet.”

Local hydrogen production could produce economic development benefits, he said.

“I consider hydrogen as having the potential to be a Swiss Army knife with decarbonization. It could be used in transport heavy industry [and] HVAC for large buildings, particularly down here in New York City. We have lots of [large] buildings … where electrification is more costly and more complicated. … There are many possibilities that are enabled by a lot of the research being done by the Department of Energy (DOE) and by NYSERDA.”

DOE Looking for Inefficiencies in Electric Market

Jigar Shah, director of DOE’s Loan Programs Office, also sees decentralized production of hydrogen in the future.

He said DOE is seeking ways to use hydrogen to address inefficiencies in the electricity market, such as renewable energy curtailments and negative power prices.

He said electrolyzers will initially be large facilities because of the need to incorporate liquefaction to move hydrogen around the country.

“But I think over time as the costs come down, you’ll start to see a very decentralized hydrogen production grid with electrolyzer technologies, and a lot of the electrolyzers will act as reverse peaker plants. Today, peaker plants with natural gas are turned on when electricity prices go above [about] four cents a kilowatt hour [$40/MWh]. In the future, these hydrogen electrolyzers will be turned on every time electricity prices fall below $15 a megawatt hour — 1.5 cents a kilowatt hour. They can use up all the extra electricity capacity in the grid, and thereby dramatically reducing the cost of transmission and distribution.”

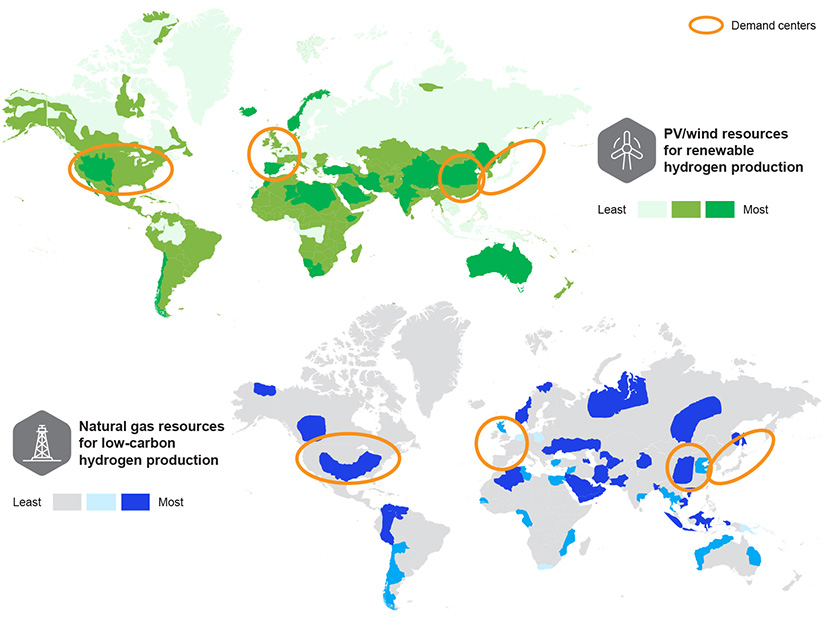

Hydrogen also could change the siting of energy-intensive industrial plants, he said. “Part of the reason why we make aluminum in the places that we make it is because that’s where the cheap hydropower is. When you think about where cheap wind and solar exists today, that is where we’re going to be making chemicals in the future.”