Stakeholders Approve 1st Storm-related Protocol Changes

ERCOT stakeholders last week endorsed the first of several Nodal Protocol revision requests (NPRRs) addressing system changes stemming from February’s severe winter weather that almost shut down the Texas grid.

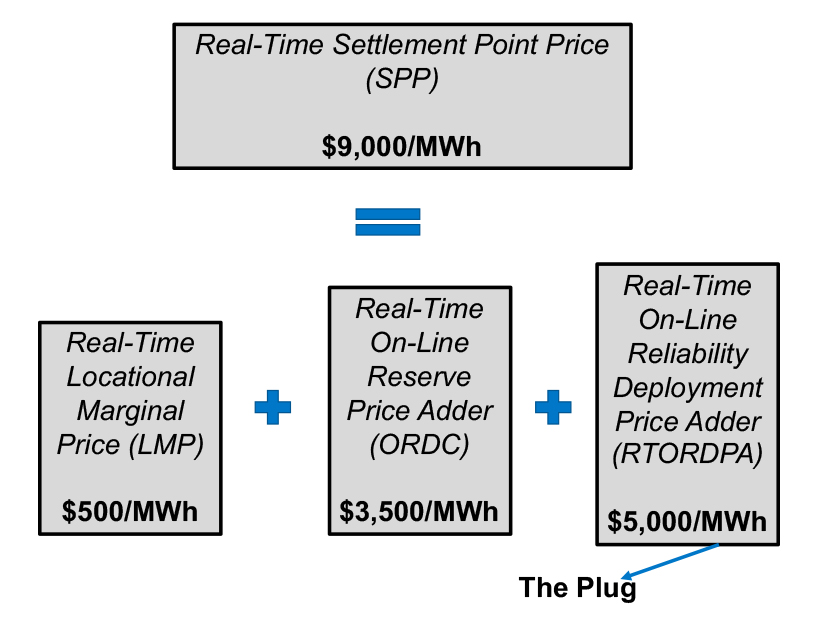

One revision (NPRR1080) limits the ancillary service market’s clearing prices to the systemwide offer cap of $9,000/MWh. A second (NPRR1081) requires that ERCOT’s real-time online reliability deployment price adder (RTORDPA) be adjusted to take firm load shed into account.

Both measures, sponsored by ERCOT and its Independent Market Monitor, unanimously cleared the Technical Advisory Committee during its meeting Wednesday in separate votes. A handful of members abstained from each vote.

The Board of Directors approved both NPRRs and an accompanying other binding document request (OBDRR030) during a brief teleconference Monday morning.

Texas Public Utility Commission Chairman Peter Lake, presiding over the board meeting, recognized the “accelerated” approval process as being outside the normal stakeholder process.

“This will ensure that as we go through the summer, we have the best functioning market we can have,” Lake said. “This is by no means the end. This is a part of the beginning in making our system better.”

In approving NPRR1081, the TAC first rejected a proposed amendment by Lower Colorado River Authority (LCRA) to remove the RTORDPA from ancillary service (AS) imbalance settlement calculations.

Referring to the adder as a “plug,” Randa Stephenson, LCRA’s senior vice president of wholesale markets and supply, said the public utility lost “tens of millions of dollars” when its services were deployed during the February winter storm, only to have the adder clawed back. She said the RTORDPA will increase real-time energy prices during periods of firm load shed before being clawed back from providers as part of the AS imbalance settlement.

“Our load paid $15 million for this uplift charge after they had done all the right things. This costs load money after they’ve hedged themselves,” Stephenson said. “There really needs to be an understanding of what this does to generators when they’re making decisions.”

LCRA found general support for its proposal. Attorney Katie Coleman, who represents ERCOT industrial consumers. said the measure will create risk for responsive service providers and deter their participation in the day-ahead market and bilateral transactions.

“This will ultimately raise costs to customers, beyond the little benefit they get when a resource makes this imbalance payment,” Coleman said. “Instead of adjusting for the actual megawatts of firm load shed, the [RTORDPA] adjustment is being used to backfill up to the cap. It’s making that imbalance exposure exponentially larger than it otherwise should be. We have concerns about this approach of not adjusting for the actual megawatts of load shed, but backfilling up to the cap.”

Kenan Ögelman, ERCOT vice president for commercial operations, said Stephenson and Coleman were not “necessarily incorrect” and agreed there is a need to look at the going-forward incentives NPRR1081 creates. However, he pointed out, staff worked with the Monitor in filing the revision request to address “urgent recommendations” in its recent market report. (See ERCOT Moves Quickly to Address Monitor’s Recommendations.)

“We don’t want to preclude the discussion or efforts to solve [LCRA’s issue],” he said. “We understand it might not be inherently clear around the new incentives being created here.”

LCRA’s amendment failed to pass, falling two votes shy of the 67% approval threshold, 14-9. Seven members abstained. The TAC then approved NPRR1081 26-0, with four abstentions.

NPRR1080 cleared the committee by a similar margin, 27-0, with three abstentions, despite some concerns that the change doesn’t appropriately value AS.

The measure is a direct response to the winter storm, when AS prices exceeded $25,000/MWh. They will now be capped at the systemwide offer cap of $9,000/MWh. That cap has been reduced by rule to $2,000/MWh for the rest of the calendar year because the peaker net margin topped a threshold of three times the cost of entry for new generation plants on Feb. 16.

Ögelman said the NPRR’s proposed changes “are consistent with economic market design principles.” Because AS is procured to reduce the probability of losing load, those principles dictate that reserves’ value should not exceed the value of lost load, which is equal to the offer cap.

The TAC also separately approved NPRR1078, which ensures only amounts owed to ERCOT by counterparties through the default uplift process can be collateralized. CPS Energy, with is involved in litigation with ERCOT and numerous natural gas suppliers, abstained from the vote.

More Reserves to be Procured

The committee will hold a special virtual meeting this Wednesday to consider ERCOT’s proposal to modify procedures for deploying non-spinning reserves sooner, an acknowledgement of the likely tight conditions for the rest of the summer months.

“Going forward, ERCOT is going to be bringing more reserves online and deploying earlier than we have previously,” said Jeff Billo, director of forecasting and ancillary services.

Billo said staff will be relying on their meteorologist’s weather forecasts to determine the load, wind and solar forecasts before making decisions on procuring additional reserves. The forecasts will likely be classified as low-, medium- or high-potential certainty.

“There are likely to be those days when the weather forecast is not as certain, and that affects the load and the wind and the solar,” he said. “On those days when we’re just not as confident in the weather forecast’s information, we may be procuring additional reserves.”

Members asked for data on how accurate ERCOT’s forecasts have been, noting deploying more reserves will affect prices.

“We’re going to be very much open to stakeholders’ comments and concerns,” Billo said.

Securitization Issues

Staff promised the TAC as many as two opportunities to discuss the grid operator’s plans for handling securitization legislation designed to address the market’s and market participants’ losses during the winter storm.

Members expressed a desire for a “full soup-to-nuts” workshop, but Ögelman cautioned that staff will be limited in what it can detail.

“We’re happy to share what our thinking is and an outline of what we’re working on,” he said. “What we would share would be our interpretations, which is not necessarily the final version of the application of those laws … potentially laying out options and talking about what we can do within our systems.

“I think everyone is going to have to weigh in on their preferences at the” PUC, Ögelman said.

“It sounds like the filing may be more high level, and we’ll be doing the designing of the process at the commission,” Reliant Energy Retail Services’ Bill Barnes said.

ERCOT is working on a tight timeline, as it must file its proposals with the PUC within 30 days.

Lawmakers passed several securitization measures that use customer-financed bonds to help market participants pay back the massive bills many incurred during the February storm. ERCOT’s market was short $2.991 billion as of June 4, while several participants have filed for bankruptcy. (See Texas Legislators Finish Work on Electricity Market — for Now.)

Combo Ballot Includes 7 Changes

The TAC unanimously approved a combination ballot that included three additional NPRRs, two revisions to the resource registration glossary (RRGRR), and single changes to the nodal operating (NOGRR) and planning guides (PGRR):

-

- NPRR995: sets the term “settlement-only energy storage system” (SOESS) and further defines it as transmission-connected or distribution-connected; relocates the settlement-only generator (SOG) term from under resource to stand alone as its own unrelated term; and incorporates the relevant SOESS terms into the market information system (MIS) reporting created for SOGs.

- NPRR1005: redefines point of interconnection (POI) to refer to any physical location where a generation entity’s facilities connect to a transmission service provider’s facilities, and removes references to load interconnections; introduces the term “point of interconnection bus” (POIB) for the bus in the substation closest to the resource’s POI or any electrically equivalent bus in the substation; and changes POI to POIB throughout the protocols, among other revisions.

- NPRR1063: requires ERCOT to post dynamic rating approval information to the MIS secure area.

- NOGRR210: clarifies language in the revised POI term and NPRR1005’s POIB.

- PGRR089: revises the list of data sets posted to the MIS by removing the planning horizon transmission capability methodology and adding long-term system assessment postings, geomagnetic disturbance vulnerability assessments and the monthly generator interconnection status.

- RRGRR025: clarifies language for NPRR1005’s defined POIB term by modifying the existing POI term to conform to the generation agreement’s conception of the POI as the point of ownership change. The revision also removes the generation agreement’s reference in that definition.

- RRGRR028: adds transformer manufacturer test reports to the data collection requirements and clarifies the required transformer information.