MISO last week said that without major, long-range transmission projects, reliability issues will explode in the Midwestern portion of its footprint.

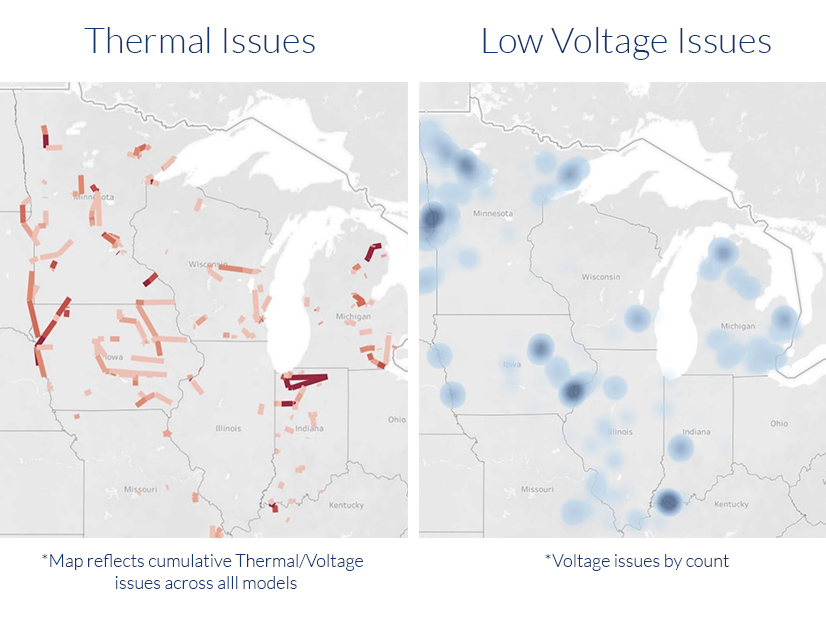

The grid operator used the most conservative scenario of its three planning futures — Future I — to look 10 years into the future. It said days containing high renewable generation and shoulder seasons could yield thousands of thermal and voltage stability issues. MISO has yet to perform future reliability analyses using Futures II and III, which predict more renewable penetration and electrification growth.

The reliability analysis is the latest in MISO’s attempt to bolster its case for long-range transmission projects. (See MISO Leadership Says Tx Expansion, Market Redefinition ‘not Optional’.)

Future low-voltage and thermal issues are most ubiquitous in the West planning region, which includes Minnesota, Iowa, parts of the Dakotas and western Wisconsin. On winter days, MISO said reliability violations could number more than 4,400 in the West.

MISO also said high renewable generation paired with light-load days is the biggest cause of concern into the 2030s for its Midwest region. The grid operator said more frequent thermal problems are caused by localized transmission issues and shifting regional flow patterns. The voltage violations are a product of high renewable output and load-serving needs.

Speaking during a special workshop Friday, MISO Senior Economic Planning Engineer Ranjit Amgai said Local Resource Zone 3 in Iowa sees the most reliability violations during shoulder months, nights with light load and winter days. He said the region sees strong southern flows from Minnesota, Wisconsin and the Dakotas (Zone 1), and west-to-east flows across eastern Iowa will probably overload the zone’s 161- and 345-kV lines.

Stakeholders asked MISO to also study how its indicative map of projects could assist with the identified reliability issues. (See MISO Reveals Contentious Long-range Tx Project Map.) MISO planners said they have not yet looked at how the draft line routes could solve the looming reliability troubles, but they noted the RTO’s first round of reliability results are only the beginning.

“Identifying violations are the main focus right now before we can propose any projects,” Amgai said. “We’re on step 1-A of about 10 steps.”

“Analysis is going to get more intense as we go along and have more models. This is going to be a multiyear effort,” MISO Senior Manager of Transmission Planning Coordination Jarred Miland told stakeholders. He said MISO will complete some 20-year reliability models next month, and he added that a transfer analysis is forthcoming.

Other stakeholders asked why MISO South was so far absent from the reliability analysis.

“Our focus right now is really on the East, West and Central,” Executive Director of System Planning Aubrey Johnson said. He said a MISO South focus in reliability analyses — including the exploration of projects that could open the RTO’s Midwest-to-South transfer capability — won’t arrive until late 2021 or early 2022.

MISO also has yet to investigate future thermal and low-voltage issues on its seams with PJM and SPP. WEC Energy Group’s Chris Plante said it’s imperative MISO provide reliability results into tie lines on neighboring systems.

“We have to respect those constraints on our neighbors’ system,” Plante said.

Miland said MISO still may put forward a “limited number” of initial long-term projects for board approval by year-end with the 2021 Transmission Expansion Plan (MTEP 21). Without long-term projects, MTEP 21 is shaping up to bring the lowest investment to the footprint in three years. (See MISO Annual Tx Investment Falls in 2021.)

‘Generation Pays’ Deliberations

Meanwhile, MISO’s stakeholder-led Regional Expansion Criteria and Benefits Working Group (RECBWG) on Thursday debated whether generators should bear some cost-sharing for long-range projects.

Some stakeholders at the teleconference said that if an interconnecting generation project is found to be dependent on a long-range project, it should be assigned a portion of the costs, similar to MISO’s current shared network upgrade process in its interconnection queue procedures.

“Generators aren’t the only ‘free-riders’ in cost allocation. New load can be free riders. Cost allocation is based on a snapshot, and that changes the next day. There are going to be free riders all over this,” Sustainable FERC Project counsel Lauren Azar said.

MidAmerican Energy’s Neil Hammer said the discussion was too focused on the benefits that generators stand to obtain when the larger picture is the long-range plan is necessary for MISO’s future system overall. He said the transmission projects will enable multidirectional flows, reliable resource retirements and members’ renewable goals.

“Really, this is benefiting the pool and load,” Hammer said.