Transmission owners told FERC on Friday that limiting the incentive for RTO participation would reduce grid investments and undermine efforts to address climate change, while consumer groups and state officials said the commission’s proposal was long overdue (RM20-10).

FERC proposed limiting the current 50-basis-point rate for participating in RTOs to the first three years in April (RM20-10). The commission’s 3-2 vote approving a supplementary Notice of Proposed Rulemaking was a sharp turnabout from March 2020, when FERC, under then-Chair Neil Chatterjee, advanced a proposal to double the adder to 100 basis points.

The reversal prompted utilities to threaten litigation and petition members of Congress to intervene. (See TOs Won’t Give up RTO Adder Without a Fight.)

Friday was the deadline for filing initial comments on the NOPR, and dozens of utilities, RTOs, regulators and ratepayer groups weighed in, clashing over the legality and impact of the proposed change.

What Does the Law Require?

Supporters of the NOPR generally agreed the three-year limit is, as the American Public Power Association (APPA) put it, a “reasonable balance” for promoting RTO participation and protecting consumers against excessive rates.

But TOs said the NOPR would be contrary to Congress’ intent in 2005, when it amended the Federal Power Act to direct FERC to “provide for incentives to each transmitting utility or electric utility that joins a transmission organization.”

“That is the only specific conduct in all of Section 219 for which Congress mandated an incentive,” ITC Holdings said. “The supplemental NOPR thus improperly attempts to rewrite the statute by replacing ‘that joins’ with ‘to join.’”

The Edison Electric Institute’s comments opposing the NOPR included an affidavit from former U.S. Rep. Joe Barton, who chaired the House-Senate conference committee that approved the 2005 legislation.

“Contrary to the interpretation proffered in the Federal Energy Regulatory Commission’s April 21, 2021, Notice of Proposed Rulemaking, Section 219c does not contain a ‘sunset’ clause, and at no point does it implicitly, or expressly, state that the incentive to a utility that joins a transmission organization should be limited in duration,” the Texas Republican said. “If the committee had intended that the incentive to a utility that joins a transmission organization was meant to be a one-time payment or one-time deal, I would have instructed conference committee staff to make that clear in the language of the statute.”

SPP and MISO filed joint comments criticizing the NOPR as an “abrupt and unsupported change of course” by FERC, adding that “the benefits of RTO membership largely flow to the end-use customers and not to a regulated utility that owns the assets.”

“The resilience of the RTO model is not infinite,” they continued. “As voluntary constructs created by the commission, the RTOs are highly sensitive to the ever-changing calculus of costs and incentives. … Growing and disparate regulatory costs and burdens imposed by the commission solely on RTOs present a serious challenge to the voluntary membership model. In such an environment, it is not surprising that not only have no new RTOs formed after the initial period of RTO development, but large parts of the country continue to have no access to the significant and quantifiable benefits provided by RTO markets,” the RTOs said.

PJM also filed comments opposing the change. As of Monday evening, no comments had been filed in the docket by ISO-NE, NYISO or CAISO.

Potomac Economics, which performs market monitoring for MISO, NYISO and ISO-NE, said the commission’s proposal “seems to be predicated entirely on a false distinction between the decision to ‘join’ an RTO and the decision to ‘remain’ in an RTO; unsupported assertions that all utilities benefit from being members of an RTO; and a disregard of the additional obligations and costs borne by members of an RTO.”

Case-by-case Review Required?

SPP transmission owners American Electric Power (NASDAQ:AEP), Evergy (NYSE:EVRG), Oklahoma Gas and Electric (NYSE:OGE) and Algonquin Power’s Empire District Electric (NYSE:AQN) said FERC would have to make individual findings on whether existing transmission rates including the adder are just and reasonable.

“How, for instance, would FERC support finding that one utility’s total ROE [return on equity] of 10% is unjust and unreasonable and needs to be reduced by 50 basis points, if another utility with comparable credit ratings has a just and reasonable base ROE of 10.25% even without the 50-basis-point adder?” they asked.

The New England States Committee on Electricity (NESCOE) said it supported most of the proposed NOPR but also called for individual determinations on any future RTO adders.

“The proposal to codify a 50-basis-point adder incentive would make it impossible for the commission to fulfill its statutory obligation to ensure that rates are just and reasonable,” NESCOE said. It asked FERC “to reaffirm the burden it placed on utilities in Order No. 679 to demonstrate, on a case-by case-basis, that the level of the transmission organization ROE adder incentive is appropriate.”

NESCOE quoted from the order, in which FERC declined to “make a generic finding on the duration of incentives that will be permitted for public utilities that join transmission organizations.”

The Electricity Consumers Resource Council (ELCON), which represents industrial consumers, said it supports limiting the incentive but said the commission should provide an empirical analysis to justify the size and duration of the adder. “The commission has not provided an analytical framework for judging whether (or why) that specific duration — and the associated ratepayer burden — is ‘just and reasonable and not unduly discriminatory or preferential,’ as required by Section 219d. The same critique applies to the level (or size) of the incentive.”

It also said FERC should calculate the cost of the adder, which the Transmission Access Policy Study Group (TAPS), an association of transmission-dependent utilities, has estimated at $400 million per year. “We happen to agree with TAPS’ estimate, but we are troubled that the commission does not provide its own estimate of the cost of its policy in rates under its jurisdiction,” ELCON said.

The Virginia Office of Consumer Counsel noted that its investor-owned electric utilities are required by a 2003 state law to participate in an RTO. “An incentive … is something ‘serving to encourage, rouse or move to action.’ The dangling carrot must actually bring the donkey to a trot.”

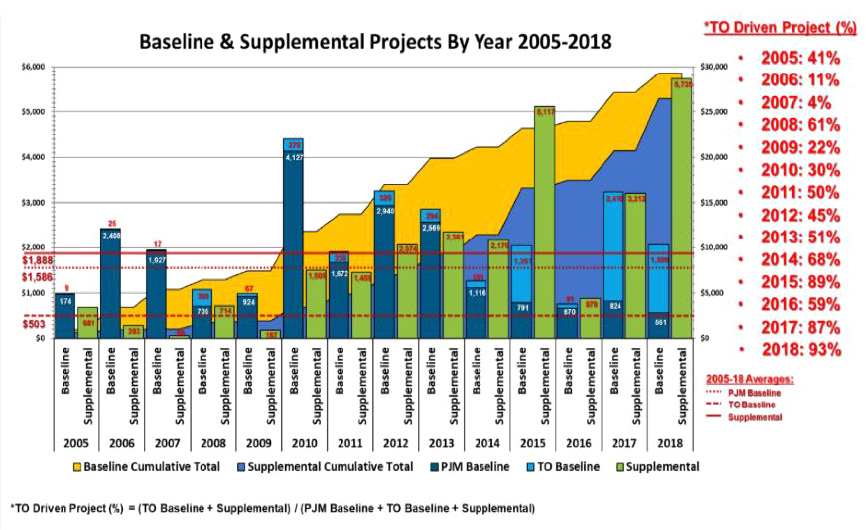

The Organization of PJM States Inc. (OPSI) said keeping “the incentive in perpetuity goes beyond the requirements of Section 219 and thereby imposes unnecessary and unjustified costs upon ratepayers.” OPSI also said the adder should not apply to supplementary transmission projects which do not result from the RTO transmission planning process.

MISO generation and transmission cooperatives Great River Energy, Hoosier Energy Rural Electric Cooperative, Southern Illinois Power Cooperative and Wabash Valley Power Alliance said there is no evidence that the adder has been an incentive for joining RTOs. “While the transmission organization incentive was created through Order 679 in 2006, many of the largest (in terms of rate base) transmission owners in MISO did not receive the transmission organization incentive until Jan. 5, 2015. Many, if not all, of these transmission owners were MISO members prior to receiving the transmission organization incentive, so clearly it was not needed to incentivize them to join MISO or remain members.”

Burdens, Benefits of RTO Participation

The two sides also clashed over the burdens and benefits of RTO participation.

PJM transmission owners, including Dominion (NYSE:D), Duke Energy (NYSE:DUK), East Kentucky Power Cooperative, Exelon (NASDAQ:EXC), FirstEnergy (NYSE:FE) and Public Service Enterprise Group (NYSE:PEG) complained that FERC’s existing ROE methodology does not capture the risks TOs face in joining RTOs.

“RTOs are governed by increasingly divergent and combative stakeholders and are deferring more to stakeholders who can be hostile to transmission owner interests and who can make changes to the RTO’s tariff and other governing documents difficult, if not impossible, for transmission owners,” the TOs said. “Thus, the RTO incentive is necessary to maintain a proper balance by compensating the transmission owner for the risks of RTO membership. Removing the RTO incentive … would destroy that balance.”

ITC said customer benefits from RTOs “far exceeds the costs of the incentive,” citing estimates of $3.1 billion to $3.9 billion in annual net benefits in MISO alone. The incentive “appropriately (although not equally) enables ITC to share in the benefits it creates for others through its ongoing participation in MISO, Southwest Power Pool and PJM Interconnection,” it said.

Will Eliminating Adder Affect Behavior?

Opponents of the NOPR painted a dark picture of the transmission system without the adder.

“The legal threshold for transmission owner withdrawal is not high and, given the ever-increasing costs and regulatory burdens imposed on the RTOs, limiting the existing incentive could make both joining and staying in an RTO less attractive,” MISO and SPP said. “The value of RTO membership is built, in part, on the value that each member, and each member’s facilities, brings into the footprint. One member leaving could have a disproportional impact on the value of continued RTO membership for the other members. Any subsequent withdrawals further diminish the overall value for the remaining members to stay in the RTO.”

ITC said eliminating the RTO adder “will only stunt transmission organization growth, potentially leaving these regions with only energy imbalance markets (EIMs). Worse yet, the policy could lead fully formed transmission organizations to devolve into EIMs.”

“If even a few utilities exit transmission organizations, the disruption to organized markets would be significant and would substantially erode the benefits currently enjoyed by market participants and customers,” ITC added.

The SPP TOs cited estimates that up to $600 billion in transmission investments will be needed by 2050 to integrate renewables and reduce carbon emissions. FERC’s proposal “is in direct conflict with the policy initiatives that are being pursued by the [Biden] administration and debated in the Congress,” they said.

PJM said the commission “should neither assume that elimination of the incentive would have zero effect on the potential for transmission owners to exit an RTO, nor assume that the consumer benefits would remain at their same level should the size of the RTO be reduced.”

If FERC does change the adder, PJM said, it “should avoid making a sweeping nationwide ruling that ignores region-specific issues such as the degree of vertical integration in a particular RTO; whether the RTO already has formal exit fees applicable to transmission owners; how particular transmission owners came to join the RTO; whether the region is dominated by restructured or traditional regulation states; and other aspects of transmission owners’ profiles that differ across the nation.”

“If it fails to do so, the commission may be making assumptions about affiliate relationships, the history of how particular transmission owners came to join RTOs as it relates to the ‘voluntariness’ issue, and other matters that do not necessarily fit for a large and mature multistate RTO such as PJM,” it said.

Others said TOs are bluffing in threatening to leave RTOs over the loss of the adder.

“A utility that would contemplate leaving an RTO/ISO arrangement or refusing to participate in one absent an adder could be called upon to justify why that decision is reasonable for either the company or its customers,” the Connecticut Public Utilities Regulatory Authority (PURA) said.

“As a practical matter, utilities that join transmission organizations are unlikely to leave because of the significant cost savings in the form of congestion cost relief or less expensive power due to access to economic dispatch of supply gained in joining a transmission organization, and they do not need an ROE adder incentive to remain,” NESCOE said.

NESCOE noted RTO members are generally exempt from having to purchase energy and capacity from qualifying facilities under the Public Utility Regulatory Policies Act (PURPA) and can charge market-based rates because the region over which their market power is measured is much larger.

The MISO G&T co-ops said the RTO’s exit fees will prevent TOs from leaving.

“The exit fees provide a significant barrier to exit for longstanding members, particularly those in MISO whose membership predates the 2011 approval of roughly $5.6 billion of Multi-Value Projects. For a utility that is considering exiting the transmission organization, the financial impact of the loss of the incentive is likely far outweighed by the financial impact of the exit fees,” they said. “Thus, from a practical standpoint, the incentive does not prevent any utility that is a member of a transmission organization from exiting the transmission organization.”

TAPS said limiting the incentive could increase RTO participation. “A state regulator that has authority to approve a utility’s application to join an RTO might be more willing to do so if the ratepayer impact of joining is lower due to the limited duration of the transmission organization incentive,” it said.

APPA said the decision to join or remain in an RTO “is not solely a decision of transmission owners; the decision is also influenced by other stakeholders — including state regulators.”

It provided an affidavit from consultant Marc Montalvo, who said limiting the adder is unlikely to discourage transmission development in RTO regions. “The base ROE is explicitly designed to allow utilities to attract capital for their projects, without the necessity of any adder,” Montalvo said. He included a scatterplot comparing RTO utilities’ 2020 ROE rates with their rate base growth between 2016 and 2020. He said the analysis “reveals no discernible relationship between ROE and rate base, presumably because many other factors come into play in investment decisions.”

Montalvo also presented data showing TOs’ rate bases grew from $106 billion in 2016 to almost $150 billion in 2020, an increase of 41.5%.

“Applying an additional ROE adder to this incremental rate base produces an additional, steadily increasing revenue stream that is essentially a windfall to the utility,” he said. “These additional revenues would plainly overcompensate utilities for any frictions management and shareholders may perceive to be associated with remaining in an RTO.”

ITC included a fallback position in its comments. If the commission does eliminate the RTO adder, it said, it should also require RTOs to eliminate their exit fees. “The commission cannot adopt a ‘Hotel California’: ‘You can check out any time you like, but you can never leave,’” ITC said.