PJM stakeholders voted overwhelmingly Wednesday in support of the RTO’s proposed replacement for the extended minimum offer price rule (MOPR-Ex), handing the recommendation to the Board of Managers.

The RTO’s proposal, which would apply the MOPR only to resources connected to the exercise of buyer-side market power or those receiving state subsidies conditioned on clearing the capacity auction, bested eight other plans in a special Members Committee meeting. It received an 87-18 vote for a sector-weighted score of 4.18/5 (83.6%).

Two other proposals also won majority support but fell short of the two-thirds sector-weighted threshold for a positive recommendation. American Municipal Power’s (AMP) proposal won a 68-30 majority (3.25/5), while the Delaware Division of the Public Advocate’s received a 54-37 vote (2.98/5). Most of the others received less than 20% support.

Dave Anders, PJM’s director of stakeholder affairs, emphasized, however, that the votes were advisory and that the board was not bound by them in proposing tariff changes to FERC under Section 205 of the Federal Power Act. “It does not require a positive, weighted vote,” he said.

“We expect the board will consider all of this in their decision-making,” he said after the vote.

The vote was conducted at a public MC meeting following a closed session with board members in which stakeholders debated the proposals. Proponents were permitted up to three minutes to lobby for their plan in the public session, and several of them used their time to rebut criticism they had heard at the earlier session.

The vote was conducted under the RTO’s critical issue fast path (CIFP) accelerated stakeholder process mechanism, initiated by the board in April. It was the latest development in an 18-month saga that has whipsawed PJM and caused the cancellation of the 2020 Base Residual Auction (BRA).

PJM adopted the extended MOPR in response to FERC’s 2-1 ruling in December 2019 saying MOPR should apply to all new state-subsidized resources to combat price suppression in the capacity market (EL16-49, EL18-178). Then-Chair Neil Chatterjee and fellow Republican Bernard McNamee formed the majority, with Democrat Richard Glick angrily dissenting, calling it an attack on state decarbonization efforts.

Glick asked PJM to undo the rule after he was named chairman by President Biden in January. (See PJM MOPR in the Crosshairs at FERC Tech Conference.)

Before Wednesday’s vote, board Chair Mark Takahashi thanked stakeholders for their efforts. While noting that members disagreed in their approaches and legal opinions, he said “everything was extremely professional and very helpful to the board.”

‘Maximize Transparency and Market Confidence’

PJM said its approach “will maximize transparency and market confidence while ensuring PJM and the Independent Market Monitor are able to mitigate the exercise of BSMP [buyer-side market power] when it is identified, while also better accommodating state public policies and self-supply business models.”

“Exercises of BSMP require both the ability and incentive to do so. It is the exercise of BSMP that shall be prohibited,” PJM said in a presentation.

Market participants will be asked to sign attestations declaring that they are not exercising market power or receiving state funds tied to clearing in the auction.

The RTO said it and the Monitor will conduct “fact-specific, case-by-case reviews” if it suspects market power. “Upon that review, should PJM or the IMM have concern that the market seller provided a misrepresentation or otherwise acted fraudulently, PJM or the IMM may make a referral to FERC for investigation,” it said.

With the new rules in place, PJM would eliminate both the expanded MOPR and the prior MOPR, which was limited to new natural gas resources. The board has pledged to have new rules in place for the December BRA for delivery year 2023/24, with a FERC filing expected by the end of July.

Different Approaches

The second-most popular proposal, from AMP, would have determined whether a load-serving entity can exercise market power by determining its ability to influence capacity prices based on its size relative to the rest of its constrained locational deliverability area. “PJM should not be put in a position of having to determine appropriate versus inappropriate intent,” AMP said.

PJM’s proposed procedure for determining whether a resource is receiving state subsidies conditioned on clearing the capacity auction | PJM

The Delaware Division of the Public Advocate said it combined parts of PJM’s plan and one from Exelon. It would provide an exemption for “emerging technologies,” citing the Bloom Energy fuel cell in Delaware and offshore wind.

The Monitor’s proposal also would exempt emerging technologies such as offshore wind and carbon capture and sequestration that would not otherwise be competitive. “It is not undue discrimination to distinguish between subsidies for uneconomic, emerging technologies and subsidies for mature technologies,” it said.

The IMM also would have PJM exempt self‐supply entities whose net long position did not exceed 15%. All resource types would be subject to review. “Intent is not relevant. Profitability is not relevant,” says the proposal says, rejected by stakeholders 20-81.

Monitor Joe Bowring said it would keep the MOPR in place with “de minimis” impact on auction results. “Contrary to the assertions of some this morning, our proposal is not anti-ZEC,” he said, referring to state zero-emission credits for nuclear plants.

Kicking the Can

Calpine won only 10 votes for its “Sunrise” proposal, which would suspend the MOPR rules through the BRAs in December and June 2022 (delivery year 2024/25) to allow stakeholders to conduct a broader review of capacity market rules.

“Calpine is against just changes in the MOPR,” David “Scarp” Scarpignato said in remarks before the vote. “We think PJM has to take a more holistic approach.”

Among other changes, Calpine wants to increase Capacity Performance penalties and require dispatchable resources to have 16 hours of guaranteed run time for three days through on-site fuel, backup fuel or contracted LNG.

If no agreement could be reached, the existing MOPR rules would become active again — the “sunrise” — for delivery year 2025/26.

Exelon (NASDAQ:EXC) said Calpine’s proposal would “‘kick the can down the road,’ holding MOPR reform hostage to other capacity modifications that will be controversial and are likely to be delayed.”

Instead, Exelon proposed use of an “objective” buyer-side market power test that was effective through 2018. It would use two “bright line” screens: one to address state policies targeted at modifying auction prices, and one to address buyer-side market power.

“Mitigation should only be applied to capacity market offers of new gas-fired units. New gas units are widely acknowledged to be the least expensive incremental capacity resource and therefore the most effective means of successfully exercising buyer-side market power,” Exelon said in its presentation. “Simply put, it makes little economic sense for a buyer to invest in any resource other than a new gas-fired unit if it were attempting to exercise buyer market power.”

Exelon said its proposal is targeted at the Supreme Court’s holding in Hughes v. Talen Energy Marketing, which outlawed state policies “tethered” to PJM’s federally regulated market.

“State policies that provide value for clean energy attributes that are not conditioned upon clearing in the PJM capacity market are legitimate exercises of state authority; not exercises of market power,” Exelon said. “PJM has every reason to accommodate and respect the state policy. Both the Supreme Court and lower federal courts have acknowledged that nearly every state policy can ‘affect’ PJM capacity market outcomes, without such policies constituting an impermissible intrusion into” federal jurisdiction.

Exelon said the current MOPR rules, which cover ZEC payments, resulted in the transfer of more than $35 million in capacity market revenue from its Illinois nuclear plants to emitting fossil resources in the 2022/23 auction in May. Exelon’s proposal failed 27-66.

Another nuclear operator, Public Service Enterprise Group (NYSE:PEG), also attempted to protect its New Jersey units receiving ZECs with what it called the “Carbon Adjusted Minimum Offer Price Rule.”

It said FERC’s December 2019 ruling on a complaint by Calpine and others “did not take account of the price-distorting impacts of a lack of a price for carbon in the PJM markets.”

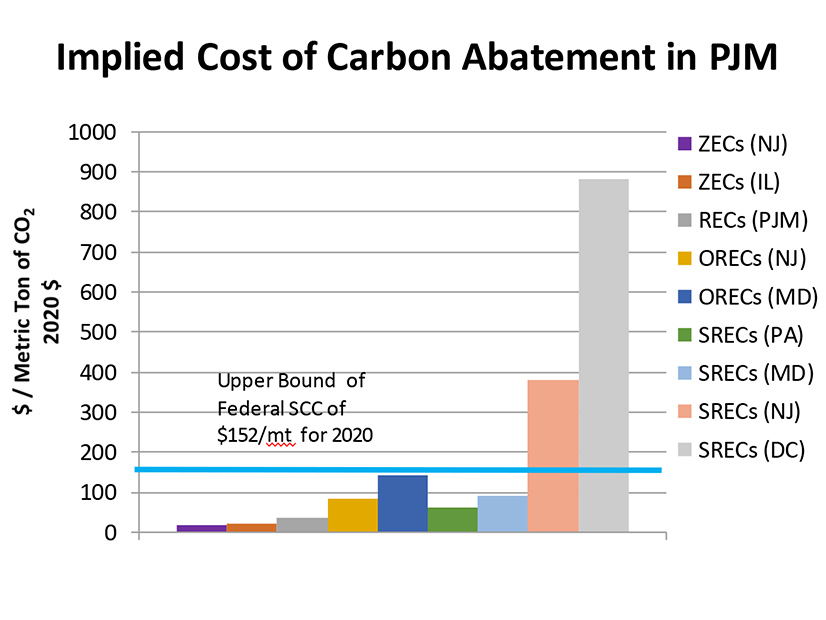

PSEG’s proposal would exempt all zero-carbon support programs created by states from the MOPR. PSEG says most zero-carbon programs within the PJM footprint have implied costs of carbon below the federal social cost of carbon and that the two programs with costs above that level — the New Jersey and D.C. solar renewable energy credit programs — are too small to have a material impact on capacity market prices.

It said it would improve the economic efficiency of the market, remove obstacles to states’ carbon-reduction efforts and “establish PJM’s leadership as a change agent in moving towards the establishment of a carbon-free energy economy.”

“Programs designed by states to promote other policies — for example, a state program to help keep coal plants in operation — would not pass this test” and would be subject to the MOPR, PSEG said. Its proposal failed 11-87.

E-Cubed Policy Associates, representing Elwood Energy, proposed testing all new-entry resources and certain existing resources receiving out-of-market revenues through non-bypassable charges. It said it would avoid “the messy and likely costly legal battles of what state policies should or should not be subject to MOPR.” It failed 16-73.

The least popular proposal was LS Power’s “repricing” plan, in which PJM would clear the auction with the MOPR to establish the total cost to load. Then it would have a second run including resources subject to the rule that did not clear and divide the total cost to load by the total megawatts. Resources could withdraw from consideration if prices were lower than it needed as expressed in its bid.

LS Power’s Tom Hoatson used his time to dispute “this notion that all we’re interested in is high capacity prices.

“What we’re interested in is a competitive outcome,” he said. The proposal failed 7-82.