Eleven public interest and consumer groups asked congressional leaders Thursday to order an independent study of

FERC policies on wholesale markets, saying regulators need to understand the “relationship between market structure and the cost and reliability of electricity.”

The groups said there is no objective data on the impact of FERC’s policies, begun more than 20 years ago, to open wholesale markets to competition. “Many states also expanded competition at the retail level in search of consumer savings. This was a bold and unprecedented experiment in electricity regulation, but the impacts on customer bills appear to have been mixed,” the groups said, citing a 2015 working paper by the National Bureau of Economic Research (NBER).

The paper concluded that electricity restructuring improved generation efficiency, but that “electricity rate changes since restructuring have been driven more by exogenous factors — such as generation technology advances and natural gas price fluctuations — than by the effects of restructuring.”

The groups — including the R Street Institute, Electricity Consumers Resource Council (ELCON), Public Citizen, industrial customers in Pennsylvania and Louisiana, and conservative groups such as Heritage Action for America — said the study should be conducted by the Government Accountability Office (GAO) “or other independent oversight organization” and that Independent Market Monitors for each RTO and ISO should also be involved. The request came in a letter to the chairs and ranking members of the Senate Committee on Energy and Natural Resources and the House Committee on Energy and Commerce.

In 2008, GAO called on FERC to do more to analyze RTO benefits and performance, reporting that “there is no consensus about whether RTO markets provide benefits to consumers or how they have influenced consumer electricity prices.”

The groups said when they asked FERC for a meeting on the issue, “FERC staff replied that ‘the commission is not inclined at this time to commission that type of broader study.’” A FERC spokesperson declined to comment.

Although FERC has issued several reports on RTO performance metrics between 2010 and 2017 and NBER has reported that RTOs reduce production costs, “these lines of analysis are incomplete and do not address the central question of the impact of RTOs on customer bills,” the groups said.

“We need regulators who base their policy decisions on objective data and real-world impacts rather than assumptions by advocates,” they said. “The study we request should investigate the cost impacts of federal policy regarding market structure, namely the net benefits to retail consumers resulting from the formation of Regional Transmission Organizations (RTOs) and Independent System Operators. At minimum, it should examine how existing RTO market structures have impacted the cost of electricity to retail consumers. We also ask that the study explore the reliability impacts of wholesale market structure and, if resources allow, develop a set of best practices regarding RTO expansion.”

Potential RTO expansion in the West and Southeast and efforts to decarbonize the grid and electrify transportation “make it more important than ever that policymakers investigate the impacts of wholesale market policies on retail customers now,” they wrote.

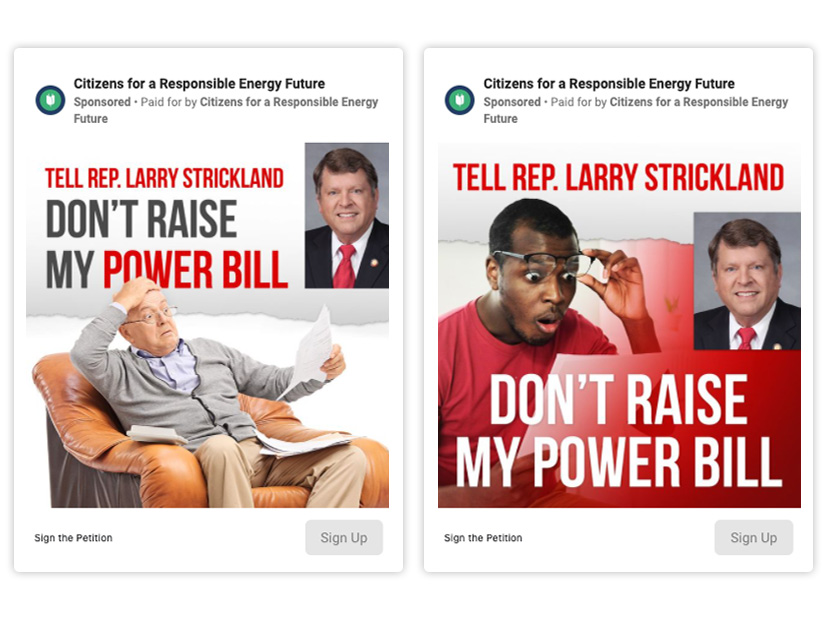

They cited Duke Energy’s financing of a public relations campaign opposing a Southeast RTO as a “Really Terrible Option” that would raise customer’s bills.

Duke (NYSE:DUK) is one of the utilities that asked FERC in February to approve the Southeast Energy Exchange Market (SEEM), an expansion of existing bilateral trading, as an alternative to an RTO. (See Clean Energy Groups Pan Southeast Utilities’ SEEM Proposal.)

“The assertions made by both sides can and should be examined objectively using real-world data,” the letter said. “If both sides are right about the economics — that is, if there are substantial production cost savings from RTOs at the wholesale level, yet retail customer bills in RTO regions continue to climb — then Congress, FERC and the states owe it to consumers to understand the disconnect and address it.”

PJM and MISO each have reported savings of $3 billion to $4 billion annually, while SPP has put its savings at more than $2 billion. CAISO has estimated more than $1 billion in savings through its Western Energy Imbalance Market since 2014.

“Government studies published more than a decade ago regarding wholesale markets claimed to lack the necessary data,” ELCON CEO Travis Fisher said in a statement. “The time is right to revisit these issues with fresh data so we can have an informed debate about the impacts of wholesale markets on consumers.”