Staff File for $2.9B in Debt Recovery from Winter Storm

ERCOT has filed two applications for debt-obligation orders with the Texas Public Utility Commission to finance $2.9 billion in market debt stemming from high prices during February’s devastating winter storm.

The first application proposes a $2.1 billion market uplift to cover short pays during the storm’s Feb. 12-20 emergency period (52322). The second proposes financing the $800 million owed to ERCOT by market participants (52321).

As of Friday, the ERCOT market was still short $2.97 billion from transactions during the storm. Brazos Electric Power Cooperative ($1.88 billion), which declared bankruptcy shortly after the storm, and Rayburn Country Electric Cooperative (nearly $640 million) account for the bulk of the short pays.

Both proposals are a result of legislation passed earlier this year during the 87th Texas Legislature, allowing the securitization of various debts incurred during the storm. (See Securitization Offers Texas a Way Forward.)

The $2.1 billion debt obligation would cover “extraordinary” uplift charges assessed to the market’s load-serving entities for energy consumption during the emergency period, including reliability deployment price adder charges and ancillary service costs above the commission’s systemwide offer cap.

The grid operator has asked to recover the amount financed by imposing monthly uplift charges to qualified scheduling entities, based on the load ratio share of their eligible LSEs. ERCOT said it doesn’t have the financial relationships between LSE and QSEs and can’t determine the eligible costs without quantifying the LSEs’ actual exposure. It asked the PUC to open a parallel proceeding to allow LSEs and the commission to determine the final uplift balance.

The $800 million debt obligation would apply to amounts owed to ERCOT by market participants during the emergency period and subject to market uplift; the revenue auction receipts staff used to temporarily reduce short-pay amounts; and reasonable costs incurred by a state agency or ERCOT to implement the debt-obligation order.

It would impose a non-bypassable default charge on all wholesale market participants, except those exempted by statute from payment of default charges, and use the proceeds to pay debt obligations. It would not affect Lubbock Power & Light, which joined the ERCOT system on May 29, and those market participants subject to a default charge by acting as a central counterparty clearinghouse in market transactions.

The default charges would be charged on a monthly basis and allocated among market participants using the same allocated pro rata methodology under which the charges would otherwise be uplifted.

PUC staff have set procedural schedules in both dockets, with prehearing conferences scheduled for Wednesday. Hearings could be held in September. The commission faces an Oct. 14 deadline to issue final orders.

The commission on Wednesday asked market participants to help the PUC develop the debt-financing mechanism for the $2.1 billion debt obligation, with briefs to be filed by Aug. 4 (52322).

In its filing, the PUC asked whether the phrase “exposed to the costs included in the uplift” suggests offsetting payments above the systemwide offer cap with amounts received above the cap. The commission also asked market participants for the appropriate definition of entities affiliated with the entity that made such payments.

As of Friday, six parties have intervened in the dockets.

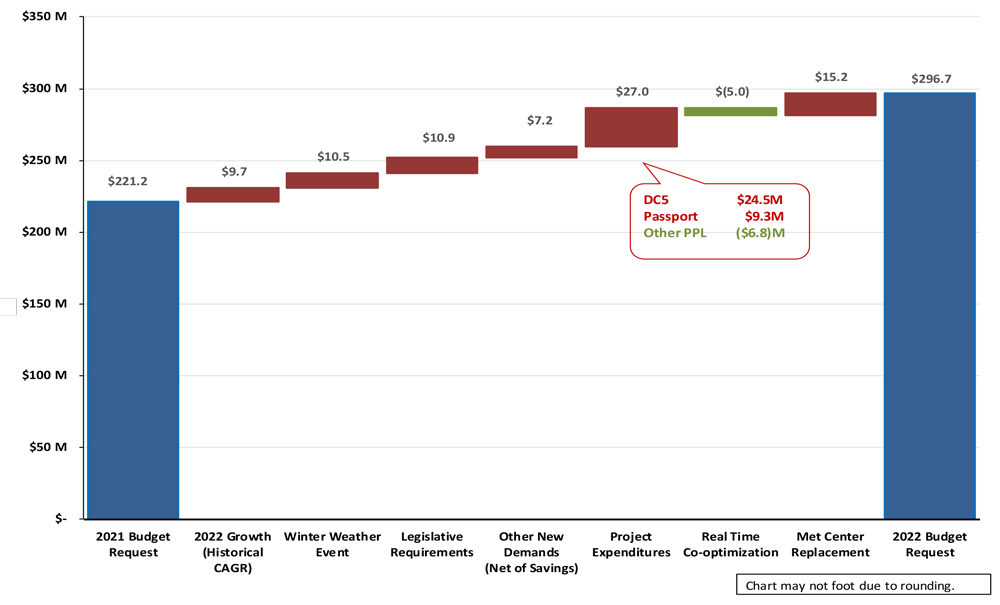

‘Strong Upward Pressure’ on Budget

During a special Board of Directors meeting Friday, ERCOT staff told the directors that the grid operator faces “strong upward pressure” on its budget and the administrative fee as it continues to recover from the winter storm and COVID-19’s effects.

Together with the added costs to incorporate new legislative mandates from Texas lawmakers, ERCOT’s budget could reach $296 million in 2022, up from this year’s $221 million.

“We think we can manage that in the next few years,” interim CEO Brad Jones said.

ERCOT currently faces $10.5 million in unexpected annual insurance and legal costs following the storm. Staff expect to ultimately take on an estimated $10.6 million in annual costs for weatherization inspections and cybersecurity responsibilities.

The grid operator’s administrative fee of 55.5 cents/MWh, which funds 95% of its operations, has been held flat since 2016. Staff are recommending the fee stay at that level when the 2022-2023 budget comes up for board approval Aug. 10.

The city of Dallas’ Nick Fehrenbach, representing the commercial consumer segment, spoke for board members opposed to keeping the fee flat. He said he is concerned over the market’s uncertain future design and deficit spending in the interim.

“The new board could be put in a position where a fee increase is almost necessary,” Fehrenbach said. “I think we should bite this bullet now. We can cut elsewhere.”

The board meeting was held to review ERCOT’s annual financial audit, which was delayed by the winter storm. Public accounting firm Baker Tilly expects to issue a clean report following receipt of legal documents from the grid operator. The Finance and Audit Committee and the board were both unanimous in accepting the report.

The directors also agreed to let Demand Control 2’s Shannon McClendon, the retail electric provider segment’s representative, begin drafting governing documents for a transition committee between the current board and the new one, which must be selected by Sept. 1.

Texas Senate Bill 2 replaces the current setup of five independent directors and eight market segment representatives with eight Texas residents with executive-level experience in finance, business, engineering, trading, risk management, law or electric market design. No more than two board members from institutions of higher learning will be allowed.

SB2 also sets up a three-person selection committee, with one member each appointed by the governor, lieutenant governor and the speaker of the House of Representatives. The committee will also choose the board’s chair and vice chair, retaining an outside consulting firm to help with the process.

Lt. Gov. Dan Patrick on July 20 selected G. Brint Ryan, owner of a Dallas-based global tax consulting firm and chair of the Texas Association of Business, as his appointee to the committee.

Lake, Jones Hold Joint Presser

Jones and PUC Chair Peter Lake joined for a press conference Thursday to update Texans on the operational changes they have made to improve grid reliability in advance of potential record demand this week.

The Weather Channel forecasts temperatures above 100 degrees Fahrenheit in the Dallas-Fort Worth metroplex for much of the week, thanks to a massive heat dome settling over the central part of the U.S. With projected heat indexes above the century mark in the rest of the state, Jones said the grid operator expects record demand as high as 76 GW.

“We want to make sure you are each aware that summer has arrived,” Jones said, addressing his in-person and virtual audience. “As it stands today, looking at our conditions and what we expect next week, we expect a sufficient amount of generation to serve all Texans.”

That is standard operating language when ERCOT discusses long-term resource adequacy. However, Jones bolstered his argument by explaining how the grid operator is increasing its supply of operating reserves to strengthen grid reliability. (See ERCOT Stakeholders Sign Off on More Ancillary Services.)

“We need a cushion of reserves going into the deepest summer months,” Lake said. “It’s going to be tight for the rest of the summer. We all know the heat is coming, but we’re ready for it.”

Lake said the PUC, working with ERCOT and its stakeholders, are redesigning the Texas market “from scratch.” Whereas the emphasis used to be on affordability over reliability, with generators earning greater revenues for producing when supplies are scarce, he said, the market will now prize reliability over cheap power.

“Our goal is to reallocate the payments currently being made to the most reliable source of power,” Lake said. “We don’t want to raise costs. We’re just shifting payments to the generators that provide the most reliable energy.”

Jones urged consumers not to panic over ERCOT calls for conservation, as it issued in April when a perfect storm of low wind production, thermal outages and unexpected demand almost required a return to energy emergency alerts.

“It’s a tool we need to keep in our toolbox. It’s something that is used across the country, across the world,” he said, pointing to similar conservation alerts during April in Chicago and on both coasts.