PJM stakeholders urged FERC on Wednesday to reject a proposal that would allow transmission owners to fund network upgrades and add them to their rate bases.

Environmental groups, state regulators, generators, industrial customers and the RTO’s Independent Market Monitor all filed comments opposing the proposal (ER21-2282). WIRES and the Edison Electric Institute, two groups whose members include the PJM TOs, were the only ones filing comments in support.

In their June 30 proposal, the TOs’ contended their ability to raise capital is being threatened because they are being forced to absorb the risks of the increasing transmission needed to support new renewable generation without earning any return on the assets.

Under PJM’s “participant funding” model, generators provide the capital for network upgrades, and the additional infrastructure is added to rate bases at zero cost, allowing TOs to recover only their operations and maintenance expenses from network transmission customers.

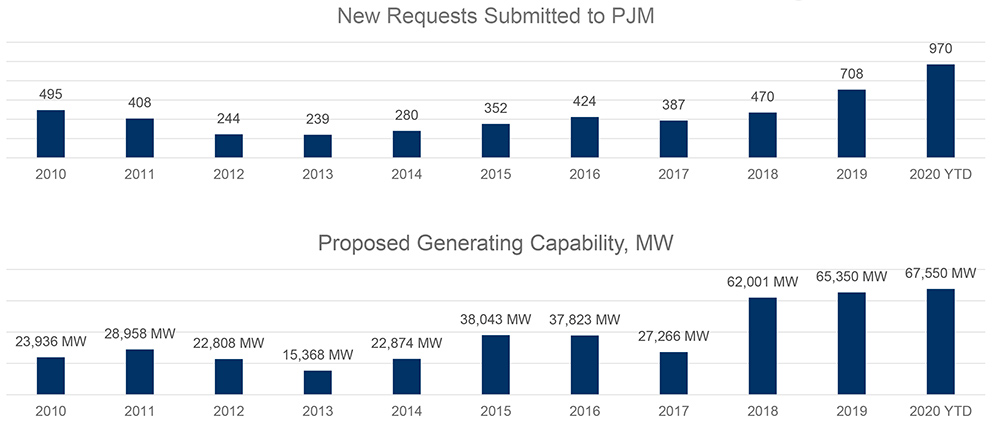

When FERC approved the funding model in 2004, the TOs said, PJM’s Regional Transmission Expansion Plan (RTEP) envisioned the addition of 10,700 MW of new generation and the RTO was processing only 55 interconnection requests. As of October 2020, PJM’s interconnection queue listed about 1,600 requests totaling 147,000 MW in new generation. (Only 23% of projects and 15% of requested capacity megawatts in the queue are ultimately developed and interconnected, according to PJM’s 2020 RTEP report.)

“When the commission approved the existing funding model in PJM, the impact on the PJM transmission owners from the failure of that model to provide a return or profit on network upgrades was minimal due to the limited number of network upgrades on the transmission system and generation interconnection requests in the PJM interconnection queue at the time,” the TOs said. “As the number of network upgrades has grown, the corresponding risk of owning and operating those facilities has also increased. The anticipated increase in network upgrades over the next several years makes the continuation of the existing funding model unsustainable.”

The filing included an affidavit in which David Weaver, vice president of transmission strategy at Exelon (NASDAQ:EXC), cataloged the risks he said TOs face from the expanded grid: litigation and regulatory penalties resulting from transformer fires and accidents; NERC compliance risks; environmental risks from the discharge of contaminants; damage to transmission lines from severe weather; and liability over outage coordination.

To address the issue, the TOs proposed giving themselves the option to provide the initial funding for upgrades and the ability to earn a return on the facilities. They said the proposal was modeled on one FERC approved in MISO last year following the D.C. Circuit Court of Appeals’ 2018 Ameren ruling, in which the court said the commission failed to consider complaints from TOs who claimed RTO policy forced them to accept “risk-bearing additions to their network with zero return” and essentially act as “nonprofit managers” of network “appendages.” (See MISO Gauging Aftershocks of TO Self-fund Order.)

‘Convoluted Procedure’

In filings Wednesday, opponents of the proposal questioned the TOs’ claimed risks and contended there is no evidence that they are having trouble attracting capital. They also said it would raise generators’ interconnection costs and allow vertically integrated utilities to favor their own generation affiliates.

Because PJM did not join the TOs’ June 30 filing, Invenergy said they must prove their proposal is “consistent with or superior to” the commission’s reimbursement policy.

FERC Order 2003 required interconnection customers to initially fund network upgrades, with the TOs reimbursing the costs and adding the infrastructure to its rate base after generation projects achieve commercial operation. But PJM and its TOs won FERC approval for an alternative model in which interconnection customers receive tradable transmission rights instead of reimbursement.

“Instead of reverting to the commission’s existing Order No. 2003 reimbursement policy, which would address these concerns and permit the PJM TOs to earn a reasonable return on network upgrades, they propose something entirely different: a convoluted procedure that will burden customers with additional costs, create opportunities for undue discrimination and for which the PJM TOs attempt to provide the thinnest of evidentiary support,” Invenergy said.

“The filing elides the fundamental truth that PJM, with the unanimous support of the PJM TOs, voluntarily sought the variation and impact that is the subject of the filing,” said the American Clean Power Association, Advanced Energy Economy, Natural Resources Defense Council, the Sustainable FERC Project and the Sierra Club, filing as “joint protesters.”

‘Risks’ Questioned

“The PJM TOs describe a number of risks that businesses in the utility space face, but like the New York transmission owners who earlier this year sought a similar additional profit opportunity, they present no evidence that they are the least unable to attract capital or that the current network upgrade funding rules have any material impact on their ability to do so,” Invenergy said. “Indeed, given that most network upgrades are improvements to the existing system (e.g., to replace old equipment with new equipment), these improvements most likely reduce the risks inherent in owning and operating a transmission system.”

The Organization of PJM States Inc. (OPSI) said the TOs offered only anecdotes in support of their claims of increased risk “but do not attempt to quantify these risks in any way. For example, the TOs entitle one type of risk ‘Operational and Safety Risks’ and provide an affidavit that describes those risks as ‘the inherent safety hazards involved in both the installation and day-to-day operations of high-voltage transmission equipment.’ If there is one type of risk the TOs should be able to quantify, it is this type. … The Weaver affidavit spends over 1,200 words describing this type of risk, yet at no time sets forth even an approximate cost of this type of risk for an average network upgrade.

“Many of the risks complained of by the TOs could potentially — but not certainly — result in increased expenses for a TO. In the event of increased expenses, and so long as the expenses are the type meriting commission approval for ratemaking, the TO will pass its increased expenses onto transmission ratepayers through its transmission tariff,” OPSI added.

“PJM TOs’ argument that they are unable to attract capital under the existing funding approach is undercut by the many indicators of financial wellbeing … including attracting billions of dollars in capital in recent years, receiving authorization from the commission to issue over $19.9 billion of new securities and maintaining strong credit ratings,” the joint protesters said. “That risk is not reflected in PJM TOs’ [Securities and Exchange Commission] filings, and many of the TOs cited investments associated with attaining these clean energy targets as revenue opportunities. This marked inconsistency may explain why complainants offer no evidence that rating agencies have downgraded ratings (or might downgrade them in the future) because of an increase of generation in the queue that would result in increased amounts of network upgrades.”

The PJM Industrial Customer Coalition (ICC) said the commission should hold an evidentiary hearing to determine the extent of the risks faced by TOs under the current rules.

‘Explicit Attempt to Eliminate Competition’

OPSI also called the proposal “anticompetitive and discriminatory.”

“Because generation-owning TOs will be able to unilaterally increase the interconnection cost of a competitor’s generation, benefiting the TO’s own or affiliate generation, the proposal provides an economic incentive for discrimination,” OPSI said. “Even if the proposal did not allow the TOs to pick and choose who faces increased costs, adding additional costs for new-entry generation to interconnect still puts that new generation at a competitive disadvantage to incumbent generation; of course, TO-affiliated generation is incumbent generation.”

PJM’s Monitor said the TOs’ proposal should be rejected because they are not authorized to propose changes to the RTO’s market design. “The rules that TOs propose to change were filed by PJM pursuant to its exclusive authority under Section 205 [of the Federal Power Act], and they remain subject to such authority,” it said.

The Monitor said “the proposed changes are an explicit attempt to eliminate competition” by increasing the cost to interconnect new generation. “Rather than eliminating competition to fund interconnections, the rules should extend competition to the financing of all transmission projects, including reliability projects in the RTEP.”

For its part, PJM agreed that the proposal “raises the potential for undue discrimination.” It said the TOs’ pledge to include notices of their decisions to elect to fund a network upgrade in the interconnection customer’s facilities study report was an insufficient protection.

Instead, PJM said TOs should be required to list the criteria they will apply in determining whether or not to fund upgrades. “Posting criteria may assist an interconnection customer in understanding which network upgrades a transmission owner may elect to fund at a time when the customer is making its initial siting choices,” PJM said. “The commission should seek additional clarity with respect to any circumstances under which the transmission owners would elect or decline to fund network upgrades before accepting the proposal.”

Increased Costs

Invenergy said its experience in MISO shows that “the capital cost typically charged when initial funding is elected can be higher than the cost of capital that is available to the interconnection customer. And this does not even account for the incentive PJM TOs will have in studying future requests to exaggerate the network upgrades required for an interconnection and the costs of those upgrades in order to maximize rate base.”

It also said the proposal would raise generators’ costs because it would require them to pay for TOs’ income taxes and provide a letter of credit as financial security for as long as 20 years. “Under the current participant funding model, security is posted only prior to the completion of the upgrades and is reduced dollar for dollar as the customer pays for the upgrades.”

In addition it could deny interconnection customers capacity interconnection rights and incremental auction revenue rights created by the upgrades, Invenergy said.

PJM acknowledged that TO funding of network upgrades could benefit an interconnection customer if its cost of capital is less than the customer’s. “However, any advantages associated with the lower cost of capital may be lost if the interconnection customer is required to maintain a letter of credit for the full cost of the project post construction,” PJM said. Requiring 20 years of financial security “may adversely impact the continued development of the competitive market in the PJM region.”

Cost Shifting

Several commenters raised concerns that the plan would result in cost shifts.

“The PJM TOs provide no good reason why, given the commission’s general finding that network upgrades benefit all grid users, any return on those facilities must be borne solely by the interconnection customer,” Invenergy said.

OPSI said it would shift the risk of default from individual generators to transmission customers. “Having no incentive to ensure receipt of effective security when issuing loans for building network upgrades, TOs will be more susceptible to accepting ineffective forms of security, thus unjustly increasing the general ratepayers’ exposure to charges for unrecovered portions of loans in default,” it said.

The ICC also said FERC should ensure that any changes do not increase costs for transmission customers. “The commission must remain steadfast to ensure that other transmission customers do not subsidize service to interconnection customers,” it said.

PJM said the proposal would impose costs on its members by making the RTO responsible for administering the pro forma network upgrade funding agreement, billing and collecting payments, and holding the security required.

The Long Island Power Authority and Neptune Regional Transmission System filed joint comments seeking assurances that interconnection customers will remain solely responsible for the capital costs of network upgrades and that those costs will not be incorporated into transmission rates for PJM network integration transmission service or firm point-to-point transmission service to the border of PJM.

Ameren Order

Opponents also contended the TOs offered a misleading interpretation of the Ameren order, saying that although the court vacated the commission’s orders, it did not reach the merits of the MISO TOs’ arguments.

“The commission did not reverse its prior determination that the MISO initial funding option is impermissible, nor did it find that the MISO funding option is just and reasonable or that the flaws previously identified with were incorrect,” Invenergy said. “The commission simply abandoned any effort to develop a record under FPA Section 206 to support a determination one way or the other.”

“In fact, the court was explicitly permitting the commission to conclude what the TOs now say the commission cannot conclude, so long as the commission justifies its reasoning,” OPSI said.

Other Protests

Shell Energy North America (NYSE:RDS.A) said the proposal “raises significant issues with respect to the integration of new resources, including offshore wind projects.” The company said it should be set for hearing, “subject to the outcome of settlement procedures, which include technical conferences” and subject to the Advance Notice of Proposed Rulemaking that FERC issued on July 15 (RM21-17). (See FERC Goes Back to the Drawing Board on Tx Planning, Cost Allocation.)

Consumer advocates for D.C., Maryland, Delaware and Illinois said the TOs’ proposal, “submitted without the consent of any other PJM Member, would raise costs and risks for consumers, undermines competition, could negatively impact the development of certain generation resources, and is contrary to the ongoing efforts by FERC and PJM to craft more robust interconnection and cost allocation policies. While the [joint consumer advocates] do not dispute that additional interconnection and cost allocation reforms may be needed to better promote competition and to protect both ratepayers and transmission utilities from the impacts of interconnecting additional generators on PJM’s system, the Transmission Owners’ request is premature and unsupported [and] provides no analysis of its impacts on costs, competition, or other consumer interests.”

Others filing comments opposing the proposal included solar developer Savion, the Solar Energy Industries Association, J-POWER USA and Public Citizen.

Defending the TOs

WIRES defended the proposal, saying it “aligns with the Biden administration’s climate change goals.”

“The PJM transmission owners are poised to play a pivotal role in the prompt and reliable interconnection of network resources in order to make the necessary accommodations to support this exciting clean energy transition,” WIRES continued. “While these efforts will be made, they cannot continue to be made on a nonprofit basis or achieved if significant enterprise risks are left uncompensated.”

“As increasing amounts of generator-funded assets are turned over to be owned, operated and maintained by the PJM TOs, larger amounts of the TOs’ business would operate as a ‘nonprofit,’” EEI said.