CEO Morgan: Vistra’s Thermal Resources Still Valuable

While continuing to rebound from February’s winter storm and a disastrous first quarter, Texas power producer Vistra (NYSE:VST) said Thursday there is still a home in ERCOT for its fleet of dispatchable resources.

Vistra CEO Curt Morgan said the company has been hardening its assets and participating in the state’s legislative and regulatory processes to redesign the ERCOT market after its near collapse in February.

“It is difficult at this time to speculate on what form these reforms might take,” Morgan told financial analysts during the company’s second-quarter earnings call, “though very clearly ERCOT and the [Texas Public Utility Commission] are focused on ensuring that Texans have reliable electricity going forward, reinforcing the importance of dispatchable resources like Vistra’s.”

Morgan said the most likely changes will be to ERCOT’s operating reserve demand curve and its price adders, as well as additional ancillary services to incent new investment and maintain existing dispatchable generation.

In the meantime, Vistra is also investing nearly $50 million this year and another $30 million next year to further harden and weatherize its generating facilities for colder temperatures and even more extreme weather. The company is also contracting for a “meaningful amount” of additional gas storage and installing dual-fuel capabilities at its gas steam units.

Morgan said the actions are necessary “to address the risk we were exposed to during Winter Storm Uri,” referring to The Weather Channel’s name for the February storm. Vistra’s share price lost almost a quarter of its value in February when the company said it expected to take up to a $1.3 billion financial loss because of its market losses during the massive ERCOT power outage. (See Vistra Stock Plunges After Market Losses.)

“There is no question the temperatures have been on the rise in 2021, as have the extremes in weather conditions,” Morgan said. “These weather extremes, coupled with the greater percentage of renewable resources backing up the supply stack in various markets, have resulted in a heightened sensitivity to scarcity conditions by the system operators, reinforcing the importance of thermal resources.”

Vistra has also completed a review of its renewable and battery business, which Morgan said is “one of the best.”

“We’ve got a great pipeline,” he said, noting the company’s use of sites with access to transmission. Capital costs will likely force Vistra to find a partner, Morgan said, as management takes “a real hard look at how we can accelerate the growth in that business.”

Vistra reported second-quarter ongoing operations adjusted EBITDA of $909 million, which excluded the effects of the storm but was in line with management’s expectations. Including the storm’s effects, the company’s ongoing operations adjusted EBITDA was $825 million.

A year ago, Vistra’s ongoing operations adjusted EBITDA was $929 million. The company uses adjusted EBITDA as a measure of performance because it says that analysis of its business is improved by visibility to both that metric and net income prepared in accordance with GAAP.

The Irving, Texas-based company’s stock price dropped 5%, from $18.89 to $17.94, after it announced earnings, but it recovered somewhat to finish the week at $18.56.

OGE to Retire 850 MW of Gas Generation

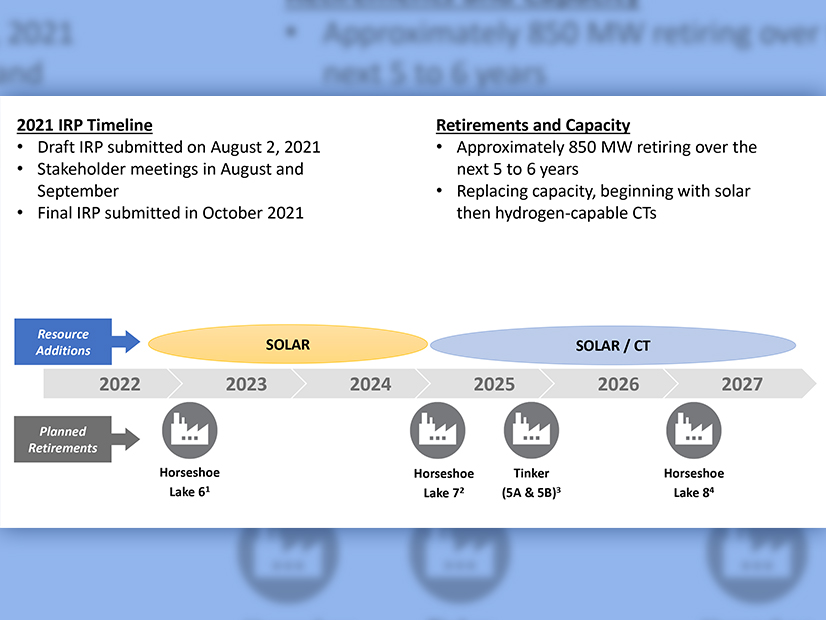

OGE Energy (NYSE:OGE) said during its second-quarter earnings call Thursday that it expects to retire about 850 MW of “aging, less efficient, less reliable gas plants” built more than 50 years ago.

CEO Sean Trauschke said the company has filed draft integrated resource plans in Oklahoma and Arkansas that call for replacing the gas units with solar- and hydrogen-capable combustion turbines and successful energy efficiency and demand-side management programs.

“This plan is a significant step forward to meet our objectives of fuel diversity and provide our customers with cleaner energy solutions while maintaining our affordable rates,” Trauschke said. He said OGE’s transition plan is to add 100 to 150 MW each year, beginning with solar, “to really smooth out the customer impacts.”

OGE also plans to recovery 85% of its total costs from the February winter storm through a securitization filing with the Oklahoma Corporation Commission. A hearing is expected in the fall.

The Oklahoma City-based company released earnings of $200 million ($0.56/share), compared to the year prior of $200 million ($0.43/share). That beat analysts’ expectations by 4 cents.

OGE’s share price opened at $34.18 on Thursday and twice came within 12 cents of its 52-week high Friday when it hit $35.34 on Friday. It closed the week down at $35.04.

CenterPoint Hits ‘Stride’ Under Lesar

CenterPoint Energy (NYSE:CNP) CEO David Lesar celebrated his one-year anniversary with the utility, saying the company is “now hitting the fast-paced organizational stride I want us to have.”

The Houston company reported second-quarter earnings Thursday of $221 million ($0.37/diluted share). That compared favorably with CenterPoint’s second quarter the year before, when earnings were $59 million ($0.11/diluted share).

Lesar said CenterPoint has invested about $1.5 billion in the first half of the year and is on track to spend about $3.4 billion for the entire year. He said new Texas legislation for transmission and distribution utilities to improve the grid’s resilience “helps minimize the risk of prolonged outages and allows us to put all of this into rate base.”

The company has also requested that the Texas Railroad Commission approve borrowing $1.1 billion in bonds to help pay for gas costs incurred during the February winter storm. If approved, CenterPoint said customer bills could go up as much as $5/month; if not, it would levy a fee as high as $40/month to pay for the costs.

Lesar replaced interim CEO John Somerhalder in July last year. Somerhalder replaced Scott Prochazka, who resigned after seven years at the helm in February 2020. (See Prochazka Steps down as CenterPoint CEO.)

CenterPoint’s share price set a new 52-week high of $26.92 on Friday and closed at $26.48. It opened Thursday at $25.90.