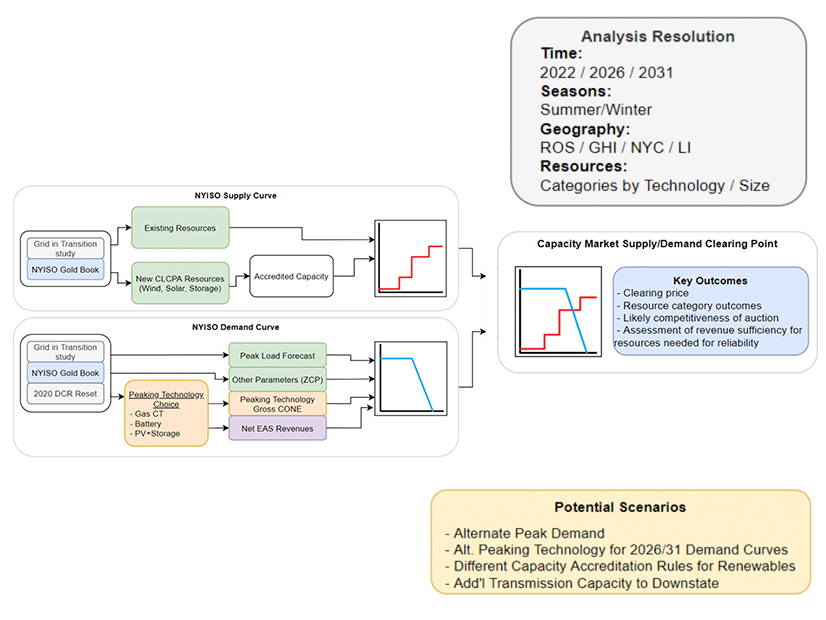

NYISO on Monday unveiled a draft study plan on ways to model 10-year capacity supply and demand curves and identify the resulting market outcomes in order to advance the ISO’s effort to revise its buyer-side mitigation (BSM) rules.

The ISO on Aug. 9 presented a proposal to exempt most new solar, wind, storage and demand response installed capacity (ICAP) resources from BSM evaluation. (See NYISO Proposes Sweeping BSM Exemptions.)

“We need to look at the proposed changes as an input and say ultimately, ‘How is that going to affect the competitiveness of the capacity market at a high level, and will there still be signals for efficient development of resources that are needed to maintain reliability?’” Paul Hibbard of Analysis Group, which developed the plan, told the ICAP Working Group Monday.

New York’s Climate Leadership and Community Protection Act (CLCPA) requires the state to procure large amounts of renewable energy resources to get to zero-emission electricity by 2040. The ISO aims to integrate the new resources into its capacity market while maintaining reliability and reasonable rates for all resources.

Limited Aims

The ISO wants to maintain the current mitigation regime, including the competitive entry exemption, the self-supply exemption and the supply-side mitigation construct, which with modifications can protect the market against the exercise of buyer-side market power.

Hibbard tried to dissuade stakeholders from looking for long-term conclusions in the current BSM study, which will rely on Analysis Group’s 2020 white paper on demand curve reset values, publicly available NYISO data and The Brattle Group’s Grid in Transition study from last year.

It would be a “fool’s errand” to try to imagine the shape of wholesale markets 15 years from now, Hibbard said, so the study will attempt to identify the potential impacts of BSM market rule changes that happen now and determine how to manage the capacity market in a sustainable way over the next decade.

That approach allows planners to anticipate which existing and emerging resources will be important to both fulfilling CLCPA requirements and maintaining reliability, he said.

NYISO staff will return to the ICAP Working Group Aug. 30 to discuss with stakeholders the related PJM minimum offer price rule (MOPR) filing, which proposed tariff changes to comply with FERC’s controversial 2019 order requiring expansion of the MOPR to new state-subsidized resources. Stakeholders said some of the arguments supporting the PJM filing sound as if mitigation of public policy resources is making the capacity market unsustainable over the long term regardless of what happens with capacity accreditation. They said that while BSM may not strongly affect prices, it still can cause customers to buy more capacity than they need, which indirectly affects prices.

Analysis Group will present its BSM study findings to NYISO stakeholders on Sept. 9 and issue a final report soon thereafter.

Accreditation Matters

NYISO also presented a straw proposal for capacity accreditation that features six elements on modeling, criteria, frequency, resources, locations and marginality — that is, whether resources should be valued at their marginal or average incremental reliability value.

NYISO believes that establishing the six elements in the broader BSM proposal will be important to demonstrating how reforming BSM will continue to result in just and reasonable ICAP market outcomes, said Zach Smith, the ISO’s manager of capacity market design.

The ISO thinks that a suitable capacity accreditation framework is important to justifying large changes to buyer-side mitigation and MOPR rules by “helping us demonstrate that the capacity market will remain a competitive marketplace and support the necessary resource mix required to help keep the lights on in New York,” said Michael DeSocio, NYISO director of market design.

NYISO may need to further evaluate an internal “laundry list” of items, Smith said. After the BSM proposal has been approved by stakeholders, the ISO will focus on developing further implementation details for completing a capacity accreditation study.

Determining the final values will take a while, because “to run these studies is not trivial,” DeSocio said. “What we’re focused on right here, and as part of the BSM work, is to get agreement on the framework.”

The ISO’s Market Monitor, Potomac Economics, presented a conceptual framework and design principles for capacity accreditation, noting that “current rules are inadequate for compensating new resource types and several old types in accordance with their actual reliability value.”

At the Aug. 30 ICAP meeting, consultancy E3 will provide examples and technical information on capacity accreditation. The ISO will review tariff changes related to both BSM and capacity accreditation at the Sept. 9 meeting.