Low hydroelectric output, a summer heat wave and high prices during evening ramps helped boost CAISO’s load-serving costs by 3% last year despite “substantially lower” natural gas prices, the ISO’s Department of Market Monitoring (DMM) found.

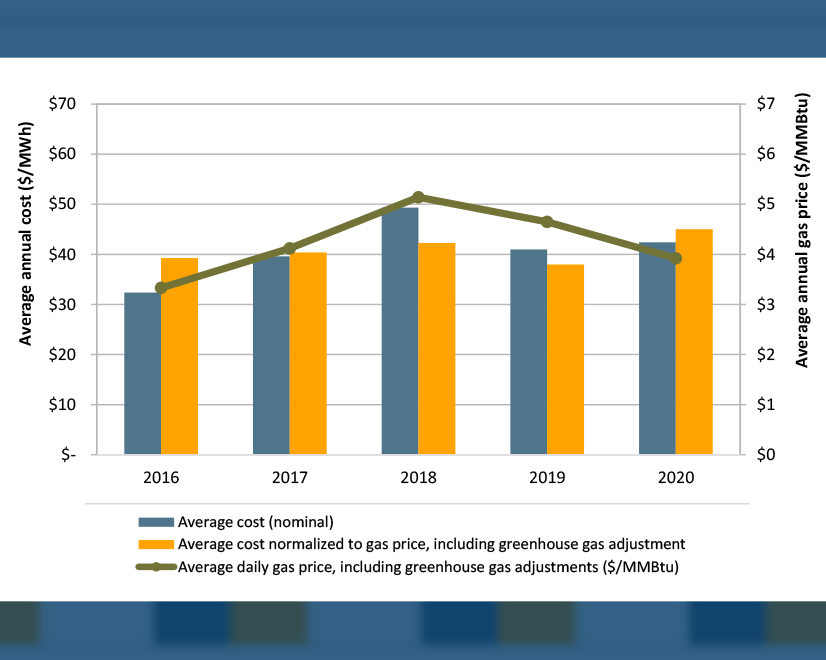

CAISO’s total wholesale energy costs hit $8.9 billion in 2020, translating into $42/MWh, up from $41/MWh a year earlier, the DMM said in its 2020 Annual Report on Market Issues & Performance.

When adjusted for the decline in natural gas prices and changes in greenhouse gas costs, the ISO’s wholesale costs increased by 19% per MWh last year, Amelia Blanke, DMM manager of monitoring and reporting said Thursday during a call to discuss the report.

“Within the ISO, the cost for gas, which includes greenhouse gas costs, fell by about 15.7% on a weighted basis,” Blanke said. Gas-fired resources tend sit on the margins of the CAISO market, setting the price for energy.

Hydroelectric generation accounted for about 8% of the ISO’s total supply last year, compared with 14% in 2019, 10% in 2018 and 15% in 2017. Average hydro output this year has been lower than last year in every month but March, Blanke said.

“This has a major impact on prices in our market as our hydro generation tends to be towards the bottom of the bid stack,” she said.

Wholesale power prices were lower in the first and second quarters of last year than in 2019 as COVID-19 restrictions began to take shape. Prices in the day-ahead, 15-minute and five-minute markets were all about 45% lower year-over-year in the first quarter, dipping to their lowest levels in the second quarter (typical for the ISO), and then ramping up in the third quarter due, in part, to an August heat wave. And while prices in all three markets converged closely during the first two quarters, they diverged in the second half, with day-ahead and 15-minute prices exceeding real-time by about 20% on average.

The reduced output from hydro plants and “extreme” summer loads also caused CAISO’s market to become structurally uncompetitive for more hours than in any of the past five years. “Despite this, prices were consistent with competitive baseline levels,” the DMM said.

The DMM also found that “the market for capacity to meet local resource adequacy capacity continues to be structurally uncompetitive in most local areas.”

The report pointed to other factors contributing to last year’s rising costs:

- Transmission congestion costs increased, particularly related to limits on lines linking Northern and Southern California.

- Ancillary service costs jumped to $199 million from $148 million in 2019 and $177 million in 2018, driven by higher regulation and operating reserve requirements and increased third- and fourth-quarter prices.

- Real-time imbalance offset costs increased to $177 million from $105 million a year earlier. Congestion offset costs accounted for $117 million of that amount. “As in 2018, congestion offset costs were caused largely by significant reductions in constraint limits made by grid operators in the 15-minute market relative to higher limits in the day-ahead,” the report said.

- Bid cost recovery — or make-whole — payments rose by $3 million to $126 million, representing 1.4% of total energy costs.

CRR Losses Continue to Mount

The DMM estimated that CAISO last year paid out $70 million more in congestion revenue rights (CRRs) than it took in from its CRR auctions, continuing a pattern that has been in place since the ISO began holding the auctions. A staunch critic of the CRR auction program, the DMM says it has saddled California ratepayers with $800 million in costs since 2012 without providing them any benefit. The Monitor contends that ratepayers are unwitting participants in a process that mostly enriches sophisticated “financial entities” that own no physical generation.

CRR losses had fallen sharply to $26 million in 2019 after the ISO implemented rule changes intended to reduce revenue deficiencies from the auctions. (See FERC OKs CAISO Plan to Deal with CRR Shortfalls.) The DMM attributed last year’s increase to a small number of load-serving entities selling their allocated rights to third parties, making them subject to payouts.

During Thursday’s call, Blanke reiterated the DMM’s call for the ISO to altogether disband the auctions, prompting a testy exchange with Seth Cochran, director of market affairs for CRR trader DC Energy.

Cochran urged the DMM to consider the findings of a recent London Economics International report that concluded that PJM’s financial transmission rights market is providing certain exogenous benefits to the broader wholesale market that the DMM is not capturing in its assessment of CAISO’s CRR market.

“This is a calculation fairly direct calculation of the ratepayer losses. We’re not attempting in this to capture any kind of exogenous benefits from hedging,” Blanke responded.

“Can the [DMM] slides be annotated to reflect that? That would be an important [acknowledgement] to that slide,” Cochran said.

“If the benefits of hedging are so great, then I think we’ve recommended the ISO should just run a market between willing buyers and sellers for hedging. You know, eliminate CRRs and just replace it with a straightforward hedging market,” DMM Executive Director Eric Hildebrandt said.

“If you read the report, you’d understand the liquidity needed to get those benefits comes from having hedges sold in the network configuration. So, to separate the two is not quite the way that that would work or play out in the real world,” Cochran responded.

Looking Ahead — and Back

Speaking about longer-term trends, Blanke said that day-ahead energy costs are steadily declining as a share of wholesale market costs in CAISO, falling from 95% in 2016 to 91% last year.

“More of that is coming from an increase in real-time energy costs, which include costs for the flexible ramping product,” Blanke said.

Blanke also noted that community choice aggregators account for 30% of CAISO load, up from 2% in 2015.

“With that shift, we’ve seen an increase in the amount of long-term power purchase agreements … which really provided a basis for a lot of the competitive bidding that we’ve seen in our market,” she said.

Blanke also pointed to the continuing growth of renewable resources participating in the market in response to state mandates and carbon emissions reduction targets.

“We’re also seeing the impact in terms of the kind of weather extremes, which are becoming more common in the market footprint, especially across the wider Energy Imbalance Market footprint,” she said.

Blanke said the DMM’s findings regarding last August’s rolling blackouts in CAISO — the first for California in 20 years — match those from a joint, root cause analysis issued by the ISO, the California Public Utilities Commission and the state’s Energy Commission. (See CAISO Issues Final Report on August Blackouts.) Causes included extreme temperatures and energy demand across the West, insufficient resource adequacy requirements, faulty accounting rules that overestimated RA capacity, a derate on an intertie from the Pacific Northwest, and unexpected loss of key gas-fired resources.