FERC staff on Friday directed PJM’s transmission owners to provide evidence to back up their claims that their ability to raise capital is being threatened because they are being forced to absorb the risks of the increasing transmission without earning any return on the assets (ER21-2282).

The TOs asked FERC on June 30 to allow them the option to fund network upgrades and add them to their rate bases. Under PJM’s “participant funding” model approved in 2004, generators provide the capital for network upgrades, and the additional infrastructure is added to rate bases at zero cost, allowing TOs to recover only their operations and maintenance expenses from network transmission customers.

As the number of network upgrades has grown to support new renewable generation, the risk of owning and operating those facilities has also increased, leaving the existing funding model “unsustainable,” the TOs said.

Environmental groups, state regulators, generators, industrial customers and the RTO’s Independent Market Monitor filed comments opposing the proposal in July, contending there is no evidence that the TOs are having trouble attracting capital. (See PJM Stakeholders Blast TOs’ Petition to Rate-base Network Upgrades.)

In a deficiency notice Friday, FERC staff also appeared skeptical, asking the TOs to provide evidence that their current return on equity rates “do not currently account for the risks of owning and operating the transmission system with the network upgrade additions” and whether the TOs’ ROE would decrease if they obtained the ability to put the upgrades in ratebase.

Staff also asked the TOs to provide a comparison of their gross plant for all transmission assets to the gross plant for participant-funded network upgrades and “any available evidence that investors have informed the PJM TOs that they hold concerns over future investments in the PJM TOs given the projected increase in network upgrades, including whether any PJM TO has been unable to raise capital for a transmission project as a result of risks associated with network upgrades.”

The TOs also were asked to describe the criteria they will use in deciding whether to initially fund individual upgrades and the disclosures they would make about their decisions.

The TOs’ response is due 30 days from the filing.

As of October 2020, PJM’s interconnection queue listed about 1,600 requests totaling 147,000 MW in new generation. Only 23% of projects and 15% of requested capacity megawatts in the queue are ultimately developed and interconnected, according to PJM’s 2020 Regional Transmission Expansion Plan report.

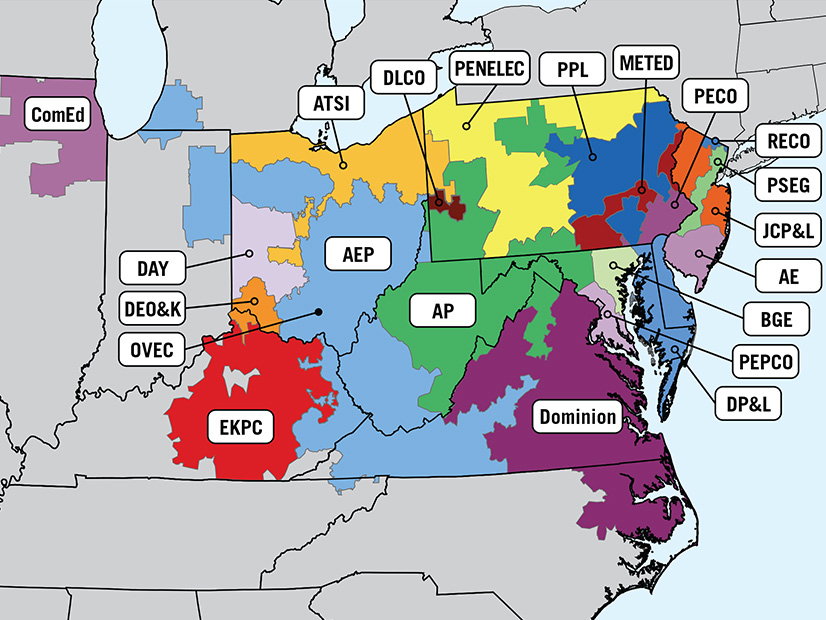

PJM’s TOs include Exelon (NASDAQ:EXC), American Electric Power (NASDAQ:AEP), Duke Energy (NYSE:DUK), Dominion Energy (NYSE:D), PPL (NYSE:D) and Public Service Enterprise Group (NYSE:PEG).