FERC on Tuesday approved Exelon’s (NASDAQ:EXC) proposal to split its regulated transmission and distribution business and merchant power generation into two separate publicly traded companies, determining that the transaction is “consistent with the public interest” (EC21-57).

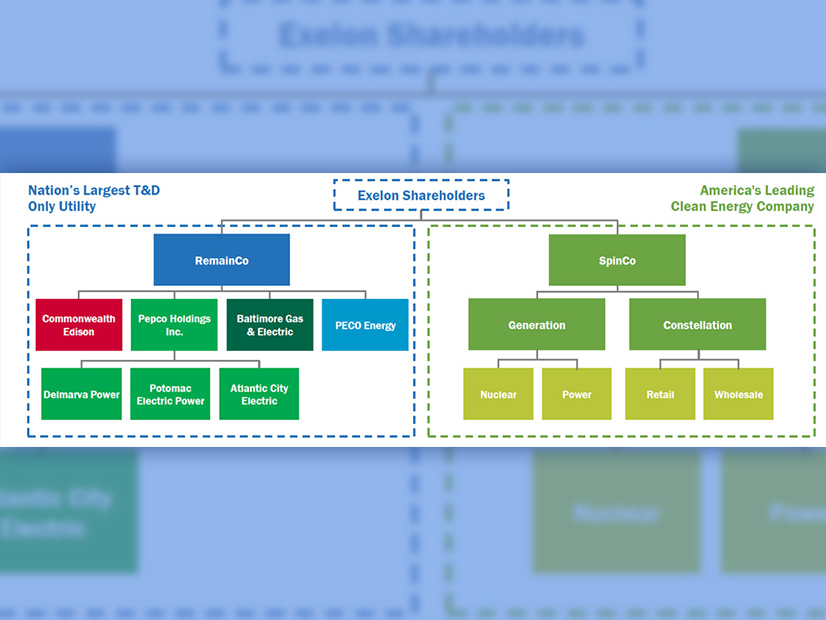

Exelon Utilities would comprise six regulated electric and natural gas utilities in five states and D.C. The spinoff, Exelon Generation, would supply energy via its nearly 31,000 MW of capacity from nuclear, wind, solar, natural gas and hydro assets.

Consumer advocates from several PJM states — Delaware, Maryland, New Jersey and Pennsylvania, and D.C. — argued that the split will result in “significant reordering of market participants” and concentrate horizontal market power in the RTO, leading to “potential economic withholding.” Exelon Generation would be the largest generation owner in PJM.

FERC said there would not be an adverse effect on horizontal competition, however, because Exelon will not become “newly affiliated with any jurisdictional generation assets, and market concentration will not increase.”

The advocates also raised vertical market power concerns that they said require further investigation. They argued that Exelon’s application does not provide enough information to ensure that control of generation and transmission facilities will be disassociated.

The commission countered that even if Exelon’s generation and transmission facilities were not wholly disassociated, there would be no adverse effect on vertical competition because common ownership and control of those facilities would remain the same after the final split of the companies.

FERC also determined that there will not be a negative effect on rates. Accordingly, wholesale energy sales will continue at market-based rates, and Mystic Units 8 and 9 will make sales at cost-based rates through May 2024 and not pass any transaction-related costs through those rates without first obtaining the commission’s approval.

The consumer advocates also claimed that Exelon’s application lacks the necessary detail to determine whether the company “will have an undue influence” in PJM stakeholder proceedings. Exelon holds one vote in the sector-weighted voting process in PJM’s stakeholder committees. The advocates said that if Exelon is divided into two separate entities, each will vote in the stakeholder process, likely in different sectors.

The commission disagreed with those arguments and said that the new companies would be independent, “with separate and independent financial interests that will no longer be in complete alignment.” They would also have separate management teams and boards of directors. FERC said this negates “doubling” of certain stakeholder voting rights.

Exelon hopes to complete the transition, which will require additional approvals by the Nuclear Regulatory Commission and the New York Public Service Commission, by the first quarter of 2022.