Planning Committee

2021 IRM Results

PJM is recommending an installed reserve margin (IRM) of 14.6%, slightly up from 14.4% required in 2020.

During the Aug. 31 Planning Committee meeting, Patricio Rocha Garrido of PJM’s resource adequacy department reviewed the 2021 reserve requirement study (RRS) results, which determine the RTO’s IRM and forecast pool requirement (FPR) for 2022/23 through 2024/25 and establish the initial IRM and FPR for 2025/26. The results are based on the 2021 capacity model, load model and capacity benefit of ties (CBOT).

Rocha Garrido said the recommended FPR for 2021 slightly increased to 1.0887, from 1.0865 for 2020. He said the FPR is the most important parameter of the study because it is used in the reliability requirement calculation for Reliability Pricing Model (RPM) auctions.

The 2021 capacity model is driving the increase in both the FPR and the IRM, Rocha Garrido said, with the average effective equivalent demand forced outage rate (EEFORd) of 5.8%, compared to 5.78% in the 2020 RRS. Rocha Garrido said the higher average EEFORd was caused by the increase in the average unit size, going to 175 MW in the 2021 RRS compared to 159 MW in 2020.

“We’re spreading the risk across a smaller quantity of units, which in general tends to be bad for reliability,” Rocha Garrido said.

The CBOT — the help PJM can expect from imports during peak loads — is also estimated to increase pressure on the FPR and IRM. Rocha Garrido said imports from neighboring grid operators have decreased from 1.54% in 2020 to 1.47% in 2021.

Rocha Garrido said the 2021 load model is putting downward pressure on both the FPR and the IRM because PJM is “seeing a slight reduction in the standard deviation of the summer peak week” compared to 2020. The 2021 PJM Load Forecast Report, which was used in the study, was released by the RTO in January.

Rocha Garrido said the study results will also be used in the 2022/23, 2023/24 and 2024/25 Base Residual Auctions (BRAs). He said delays in the 2019 BRA for 2022/23 necessitated the use of data from the 2020 study.

The PJM and world load models used are based on the 2001-2013 period and were approved at the Aug. 10 PC meeting. (See Stakeholders Endorse but Question PJM’s Load Model.) The 2021 RRS assumptions endorsed at the June PC meeting were also used. (See “2021 RRS Assumptions Endorsed,” PJM PC/TEAC Briefs: June 8, 2021.)

The PC will vote on the study results at its next meeting, with final votes at the Markets and Reliability Committee and Members Committee meetings in November.

Paul Sotkiewicz of E-Cubed Policy Associates asked what was driving the average unit size increase.

Rocha Garrido said it mainly from the fact that PJM is not modeling effective load-carrying capability (ELCC) resources in the RRS anymore. He said units like landfills, dispatchable hydro, wind and solar have been left out.

Sotkiewicz said “we’re entering pretty uncharted territory,” as the previous RRS results included ELCC resources. He asked if those resources are being taken out of the capacity model and being treated as if they “have no contribution whatsoever.”

“I’m trying to figure out where the ELCC piece fits into this,” Sotkiewicz said.

Rocha Garrido said dealing with ELCC is a “tricky topic” because past modeling of unit size was “imperfect” when they were included. But he said having the model with or without ELCC resources should not impact the FPR.

Manual 14G Updates Endorsed

Stakeholders unanimously endorsed updates to Manual 14G regarding the behind-the-meter generation (BTMG) business rules on status changes.

Terri Esterly, senior lead engineer for PJM’s markets automation and quality assurance department, reviewed the revisions to Manual 14G: Generation Interconnection Requests. The revisions were first presented at the Aug. 10 PC meeting, and no language changes were made between the meetings. (See “Manual 14G First Read,” PJM PC/TEAC Briefs: Aug. 10, 2021.)

The manual updates resulted from work conducted at special sessions of the Market Implementation Committee, Esterly said, where stakeholders reviewed existing BTMG business rules and identified gaps in the rules. Related changes to Manual 14D were presented at the August Operating Committee meeting and are set to be voted on at the committee’s meeting Friday. (See “Manual 14D Updates,” PJM Operating Committee Briefs: Aug. 12, 2021.)

Esterly said the updates included language on megawatts changing from BTMG status, where they can net against the load, to the PJM market resource status. Esterly said the updates were designed to address conflicts with the RPM must-offer requirement and removal from generation capacity resource status business rules, as well as clarifying and “adequately” documenting all the processes related to status changes.

Most of the Manual 14G updates were in section 1.6.1, Esterly said, clarifying information required in an interconnection request to designate capability as a generation capacity or energy resource and to “ensure consistency” with the BTMG definition already in the tariff. The updated language includes a list of information required in a new services request for a BTMG unit, a definition of behind-the-meter load and a clarification on how to determine the maximum host/process loads.

The manual updates will now go to the Sept. 29 MRC meeting for a first read and endorsement in October.

Preliminary 2022 Capital Budget

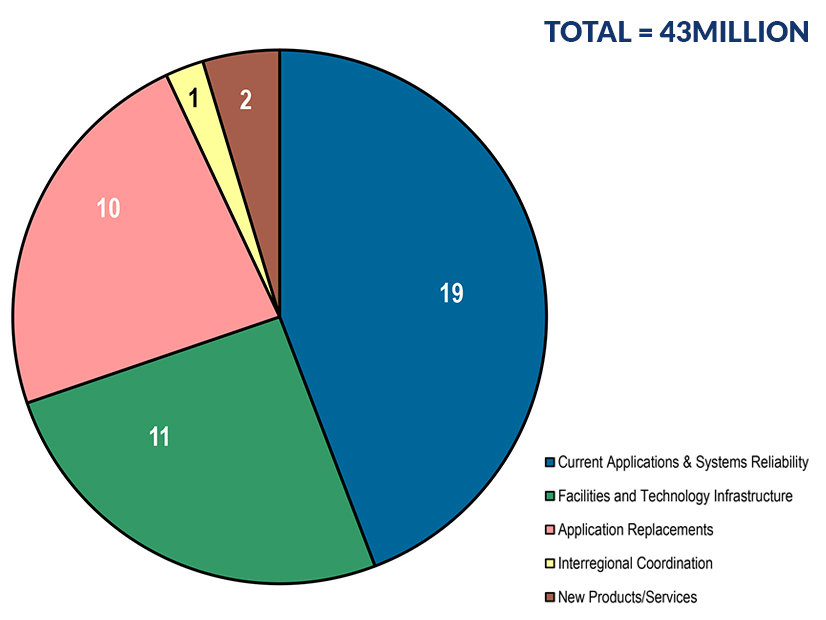

Jim Snow of PJM reviewed the RTO’s preliminary 2022 capital budget, which is set at $43 million, an increase of $3 million compared to the 2021 budget. Snow said PJM is anticipating spending $45 million per year over the next five years in the capital investments.

Snow said the $3 million increase from the previous budget is primarily being driven by cybersecurity and data analytic costs.

The largest piece is $19 million for current applications and systems reliability, a $4 million increase over 2021. Snow said the money will be used for enhancing the abilities of applications PJM currently uses, including cybersecurity tools, dispatch tools and system planning.

Facilities and technology infrastructure is the second biggest piece of the budget at $11 million. Snow said the budgeted money includes the purchase of network, server and storage infrastructure equipment; upgrades to physical and virtual equipment to allow essential operations on-site and working from home because of the COVID-19 pandemic; and equipment upgrades for cybersecurity monitoring.

Application replacements are budgeted at $10 million and include the Next Generation Markets Systems (nGEM), a multiyear partnership between PJM, MISO, ISO-NE and General Electric to transform the market systems architecture, technology and products.

The Finance Committee will develop a recommendation letter at its Sept. 13 meeting to send to the PJM Board of Managers, and the board will consider the budget at its meeting on Sept. 22.

Transmission Expansion Advisory Committee

Generation Deactivation Notification

Phil Yum of PJM provided an update on 14 recent generation deactivation notifications totaling nearly 8,000 MW at the Aug. 31 Transmission Expansion Advisory Committee meeting.

Houston-based GenOn Holdings requested the April 1, 2022, deactivation of the 627-MW coal-fired Avon Lake 9 Generating Station and 21-MW oil-fired Avon Lake 10 unit, both located in Ohio’s American Transmission Systems Inc. (ATSI) transmission zone, and the 568-MW coal-fired Cheswick Generating Station in the Duquesne transmission zone in Pennsylvania. GenOn originally requested a deactivation date of Sept. 15 for the three units.

GenOn also requested the May 31, 2022, deactivation of 1,233 MW from the coal-fired Morgantown Generating Station 1 and 2, located in the PEPCO transmission zone in Maryland.

Exelon requested that its two Byron nuclear units, both in the ComEd transmission zone in Illinois, be deactivated Sept. 14 and 16. The company originally announced in 2019 its intention to retire the units. The Illinois legislature is still working on an energy bill that would potentially provide $700 million to bail out Exelon’s three nuclear plants in the state. (See Massive Ill. Energy Bill with Funding for Exelon’s Nukes Still Stuck.)

NRG Energy has requested that the coal-fired Waukegan Generating Station Units 7 and 8 and the 510-MW coal-fired Will County Generating Station Unit 4, all located in the ComEd zone, be deactivated on May 31, 2022.

Yum said PJM completed reliability analyses for these requests and determined the units can retire as scheduled.

NRG also requested a May 31, 2022, deactivation of its coal-fired 412-MW Indian River 4 Generating Station, but the reliability analysis identified the need to keep the plant operating. Yum said PJM identified seven different thermal violations, estimated to cost $117.4 million. PJM and NRG are still working on solutions to allow for deactivation.

PJM also received generation deactivation notices for three additional units for May 31, 2022, including Talen Energy’s 115-MW gas- and oil-fired Pedricktown Power Plant in the Atlantic City Electric transmission zone and the 120-MW Newark Bay Power Plant in the Public Service Enterprise Group transmission zone, as well as Vistra’s 1,320-MW coal-fired William H. Zimmer Power Plant in the Duke Ohio/Kentucky transmission zone. Yum said a reliability analyses were completed for each unit, and they can retire as scheduled.

A total of 7,918 MW of generation is set to be deactivated between the 14 units.