Regulation Mileage Ratio Calculation Endorsed

Stakeholders endorsed PJM’s proposal to change the undefined regulation mileage ratio calculation after several months of debate over what number to use in the calculation.

PJM’s proposal, which called for setting the RegA dispatch mileage floor at 0.1 instead of zero, was endorsed with 152 votes in favor (64%) at last week’s Market Implementation Committee meeting. In a vote asking if stakeholders supported the PJM proposal over the status quo, the plan was endorsed with 147 votes in favor (67%).

Members had originally delayed adopting the RegA dispatch after a unanimous vote to amend PJM’s issue charge at the July MIC meeting, requesting to remove the suggested “quick fix” process from the proposal and instead handle discussions under an abbreviated consensus-based issues resolution process. (See “Regulation Mileage Ratio Delayed,” PJM MIC Briefs: July 14, 2021.)

PJM originally sought to work the issue through the quick-fix process in Manual 34 and take final votes at the July Operating Committee, Markets and Reliability Committee and Members Committee meetings. But several stakeholders challenged the proposed solution of updating values in the regulation mileage ratio, saying it was too complicated to address through the quick-fix process. (See “Regulation Mileage Ratio First Read,” PJM MRC/MC Briefs: June 23, 2021.)

Michael Olaleye, senior engineer with PJM’s real-time market operations, reviewed the RTO’s proposed solution. Olaleye said PJM had not received any additional feedback from stakeholders since the issue was discussed at the August MIC meeting, and no changes had been made to the proposal.

Regulation mileage is the measurement of the amount of movement requested by the regulation control signal that a resource is following; it is calculated for the duration of the operating hour for each regulation control signal. PJM’s performance-based regulation market splits the dispatch signal in two: RegA for slower-moving, longer-running units; and RegD for faster-responding units that operate for shorter periods, including batteries. If a signal is “pegged” high or low for an entire operating hour, the corresponding mileage would be zero for that hour.

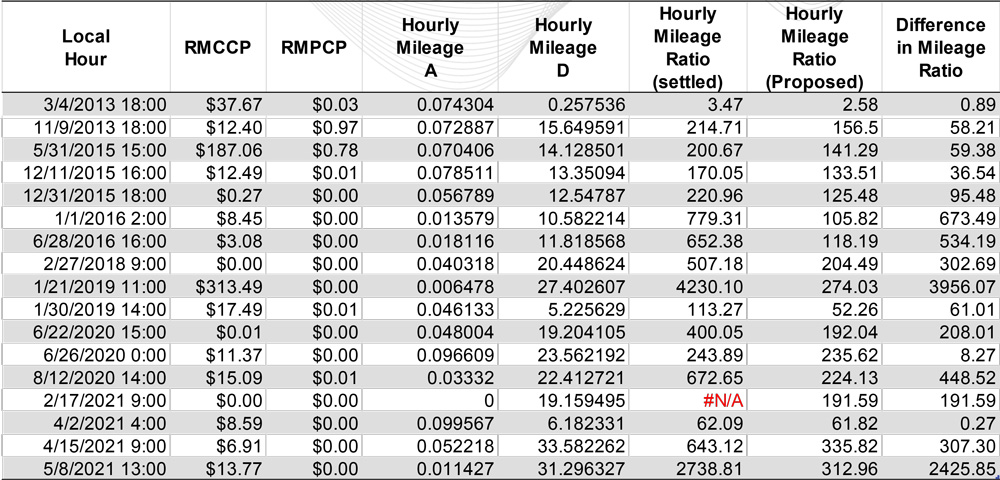

Olaleye said PJM has seen an increased frequency of RegA signal pegging and times the RegA signal is pegged for extended periods, highlighting a potential problem in the regulation mileage ratio calculation. The RegA mileage can be set at zero for a given hour and create a divide-by-zero error in the calculation of the mileage ratio.

PJM proposed setting the RegA mileage floor at 0.1 instead of zero, Olaleye said, which would allow for a “valid solution” for the ratio and still maintain market design objectives. He said the change would have no impact on the regulation signal design, operations or regulation market clearing.

Independent Market Monitor Joe Bowring presented a counterproposal, questioning PJM’s use of the 0.1 value. The IMM proposed a cap of 5.5 on the realized mileage ratio in all hours, indicating the cap would eliminate the current undefined mileage ratio result that PJM is attempting to address.

Bowring said the 5.5 cap would reduce but not eliminate the market distortion resulting from the use of mileage ratios when they incorrectly represent regulation output and that the change would affect less than 50% of impacted hours based on data collected by the IMM over the last 15 months.

Stakeholders ultimately rejected the IMM proposal, with 129 members voting against adoption (56%).

Gary Greiner, director of market policy for Public Service Enterprise Group, said the IMM’s proposal was “a lot more comprehensive,” and the solution suggested that there’s a problem with the way that the mileage ratio works. Greiner said it seemed the quick fix path was “not the right path to go down” if the problems are as comprehensive as the IMM’s proposal indicates.

Greiner said the divide-by-zero error could be solved “pretty easily without a lot of impact” by adopting PJM’s 0.1 proposal and come back with a more extensive stakeholder process in the future to address the milage ratio issues brought up by the IMM.

RPM Capacity Transfer Rights Rejected

A proposal by Buckeye Power to address the allocation of capacity transfer rights (CTRs) failed to win stakeholder approval.

Members rejected the proposal worked on for the last six months in the MIC, with only 55 voting in support (28%). Stakeholders originally endorsed Buckeye’s issue charge at the March MIC meeting with 79% support. (See “RPM Issue Charge Endorsed,” PJM MIC Briefs: March 10, 2021.)

Kevin Zemanek, director of system operations for Buckeye Power, reviewed Buckeye’s proposal regarding the allocation of CTRs, saying under the Reliability Pricing Model (RPM), CTRs return to load-serving entities (LSEs) capacity market congestion revenues that occur when there’s a difference between the prices paid by load and market revenue received by cleared resources. CTRs permit LSEs with load inside a constrained locational delivery area (LDA) to receive a credit for the import of capacity from a lower-priced region. (See “RPM Capacity Transfer Rights,” PJM MIC Briefs: Aug. 11, 2021.)

PJM does not have a way to allocate CTRs directly to an LSE with network resources outside a constrained LDA but whose resources have been designed as deliverable on the LSE’s network integration transmission service agreement. Instead, Zemanek said, PJM allocates CTRs pro rata to each LSE serving load in the LDA or zone based on the LSE’s share of the zonal unforced capacity obligation.

Buckeye’s proposal called for first allocating zonal CTRs to LSEs with historic generation resources identified as network resources in a network integration transmission service agreement (NITSA). The allocated CTRs will be “sufficient to meet the LSE’s daily unforced capacity (UCAP) load obligation but shall not exceed the total amount of the LSE’s generation capacity as identified on the LSE’s NITSA.”

Buckeye said the impact of the current rules vary from year to year; it said the rules cost it $10 million in the 2015/16 delivery year and $2.5 million in 2016/17.

The proposal would have recognized generation resources and transmission rights that existed prior to the implementation of RPM but would also terminate upon the retirement of a resource or a change in the designated resource status in the NITSA.

“These are not evergreen and would not last forever,” Zemanek said. “Based on the historical situations, we think this is minimal impact.”

Bowring said the IMM believes it’s inconsistent to use prior contracts to calculate network congestion. The current CTR process “certainly needs to be revisited” in the review of the PJM capacity market, he said, but it wasn’t appropriate to reevaluate it on a “one-off basis” with Buckeye.

“To the extent Buckeye is paid more, others will be paid less,” Bowring said. “And we don’t agree that there’s been any detailed analysis of what the ultimate impact will be.”

Peak Shaving Plan

Ed Rich, senior analyst with PJM’s capacity market operations, provided a first read of the problem statement, issue charge and solution addressing the peak shaving adjustment shortfall calculation in attachment D of Manual 19 through the “quick fix” process.

Rich said the peak shaving performance rating is used to correct the impact of approved peak shaving programs in the load forecast to be consistent with how the programs have performed when required to reduce load.

The current documented calculation for the megawatt shortfall in Manual 19 says, “For each hour of a required peak shaving event, a shortfall value is calculated as the aggregated metered load of all participants minus their aggregated customer baseline (CBL).” Rich said PJM has determined that the calculation is “erroneous” since “taking the difference of the metered load and the customer baseline will only calculate a shortfall value when a resource does not reduce but has a greater metered load than the customer baseline.”

Rich said PJM is proposing to change the shortfall value calculation as the “resource’s total participating megawatt minus the difference of their customer baseline (CBL) minus their metered load adjusted for line losses, capped at zero.”

Rich said the issue found by PJM has caused no incorrect shortfalls to be calculated because no peak shaving plans have been submitted and cleared in a capacity auction since the program was created.

“Instead of taking the average shortfall per event, using the total calculations for the year would be a more accurate representation of their total performance rating,” Rich said.

Bowring said he was a “little surprised” PJM was putting the issue through the quick fix process given that the key work activities and scope include providing background education on the issue. He said the issue could use more stakeholder discussion to grasp the concepts being changed.

“I certainly don’t totally understand what’s happening here,” Bowring said. “I don’t know if everybody else does.”

Manual 15 Revisions Endorsed

Stakeholders unanimously endorsed manual changes regarding the incremental and no-load energy offers.

Tom Hauske of PJM’s performance compliance department reviewed the Manual 15: Cost Development Guidelines revisions regarding the incremental and no-load energy offer developed in the Cost Development Subcommittee (CDS). Hauske first introduced the revisions at the August MIC meeting. (See “Manual 15 Revisions,” PJM MIC Briefs: Aug. 11, 2021.)

“There are a lot of wholesale changes in Manual 15,” Hauske said.

The most significant manual changes came in section 2.3 for the definition of incremental energy cost, Hauske said, which states, “The incremental energy cost is the cost in dollars per MWh of providing an additional MWh from a synchronized unit.” The changes also include methods for market sellers to submit sloped, stepped or block loaded incremental offers into PJM’s Markets Gateway System.

The manual changes will go to the MRC for endorsement.

Energy Scheduling Practices Revisions Endorsed

Members unanimously endorsed revisions to the Regional Transmission and Energy Scheduling Practices document.

Chris Pacella, senior lead analyst in PJM’s transmission service department, provided an overview of the revisions. Pacella said the revisions consisted of three main drivers, including minor clarifications related to process improvements in the 2019 OASIS Refresh project, minor updates as part of a general review, and updates related to the North American Energy Standards Board’s Wholesale Electric Quadrant v3.2 Business Practice Standards that take effect Oct. 27.

The updates now go to the MRC for endorsement.