Staff for PJM and the New Jersey Board of Public Utilities on Tuesday gave stakeholders the nitty gritty details on the terms of the transmission projects the state is seeking to develop to facilitate offshore wind projects.

The special session of the RTO’s Planning Committee came ahead of the close Friday of the competitive solicitation window for the transmission projects under the “state agreement approach” (SAA) of FERC Order 1000. Under this process, the New Jersey BPU asked PJM to conduct the solicitation, and the RTO will recommend a proposal, though the board will ultimately select the winning project.

The approach allows states to seek transmission solutions in response to public policy goals: in this case — the first ever, New Jersey’s goal of deploying 7,500 MW of offshore wind by 2035. (See NJ Asks PJM to Seek Bids for OSW Tx.)

As projects are still being submitted, PJM staff did not go over the details of any candidate. Rather, the purpose of the meeting was to inform stakeholders how the winning proposal would link to the new offshore wind projects New Jersey is soliciting.

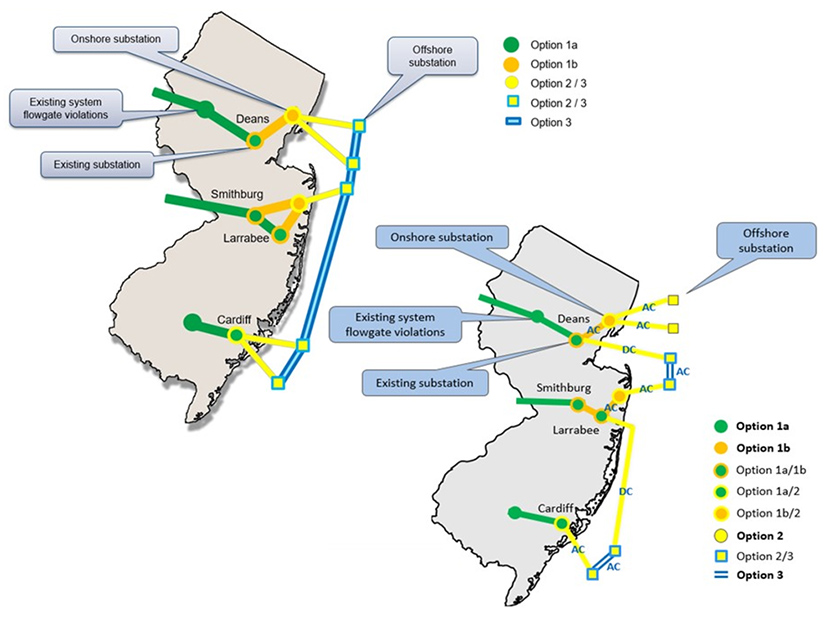

The BPU has already selected 1,100-MW and 2,658-MW offshore wind projects with their own transmission that won’t be subject to SAA cost allocation. The state is planning three more solicitations about every two years, beginning in the third quarter next year: two 1,200-MW projects and one 1,342-MW.

Suzanne Glatz, director of strategic initiatives and interregional planning at PJM, explained that the RTO would use all transmission capability created by the winning transmission project, under the term “SAA capability,” as an input for performing its feasibility and/or system impact studies for the three new wind facilities.

The BPU would be required to assign the new capability to the new offshore wind projects. But in the event that a selected wind project withdraws from the PJM interconnection queue, the board would be able to reassign the capability to a different offshore wind project, or even a different public policy resource, within two years of the withdrawal. Any unassigned SAA capability would be treated as open access.

Glatz emphasized that though the offshore wind projects would get the first bite of the transmission, they would still need to enter the RTO’s interconnection queue, the same as any other generator.

Gregory Carmean, executive director of the Organization of PJM States Inc., asked if the RTO is assuming that all the transmission upgrades needed to interconnect the new offshore wind would be located in New Jersey.

“I don’t think we have solutions yet, but I think we’ve identified at least one violation that’s outside of New Jersey,” Glatz answered. A New Jersey BPU staff member clarified, however, that any upgrades driven by the state’s public policy needs, even those outside the state, would still be subject to the SAA’s cost allocation.