A FERC technical conference on ancillary services Tuesday focused on the need for flexible ramping products to compensate for shortfalls in forecasted wind and solar output as the variable energy resources play a larger role in organized markets.

“There is broad industry consensus that RTOs and ISOs will need more operational flexibility from resources to reliably serve loads as the resource mix evolves to include more weather dependent variable energy resources, and loads change due to weather dependent distributed energy resources, electrification, and other factors,” FERC staff wrote in their whitepaper framing the panel discussions.

“Responding to these changing system needs involves several RTO/ISO market design considerations, including how to provide appropriate price signals that both reflect operational needs and incent resources to submit energy and ancillary services supply offers that increase the operational flexibility available on the system, and also encourage efficient investment and retirement decisions,” it said.

Organized markets are increasingly focused on serving “net load,” defined generally as load minus wind and solar generation, representing the demand that must be met with dispatchable resources. CAISO and SPP have run into problems meeting net load when demand is high but solar and wind ramp down, the whitepaper noted.

Until an adequate amount of storage is paired with variable resources, RTOs and ISOs will need other types of quick-start ramping products, including those that rely on gas generation, to compensate for unexpected shortfalls, it said. (See Calif. Needs far more Storage to Decarbonize, Panelists Say.)

SPP’s “Wind Burn”

SPP is a poster child for the issue. The grid operator has added 21 GW of wind capacity since its Day 2 market went live in 2014 and has almost 30 GW of capacity on hand. In May, wind energy accounted for 84% of SPP’s generation during one interval and, renewables make up 95% of its interconnection queue, SPP said in written comments.

Achieving “more certainty, and [being] able to respond quickly to the uncertainty and changes in wind output, is and will be a concern in SPP,” said Jodi Woods, manager of the RTO’s Market Monitoring Unit. “Specifically, actual wind generation can deviate significantly from what was forecasted or expected.”

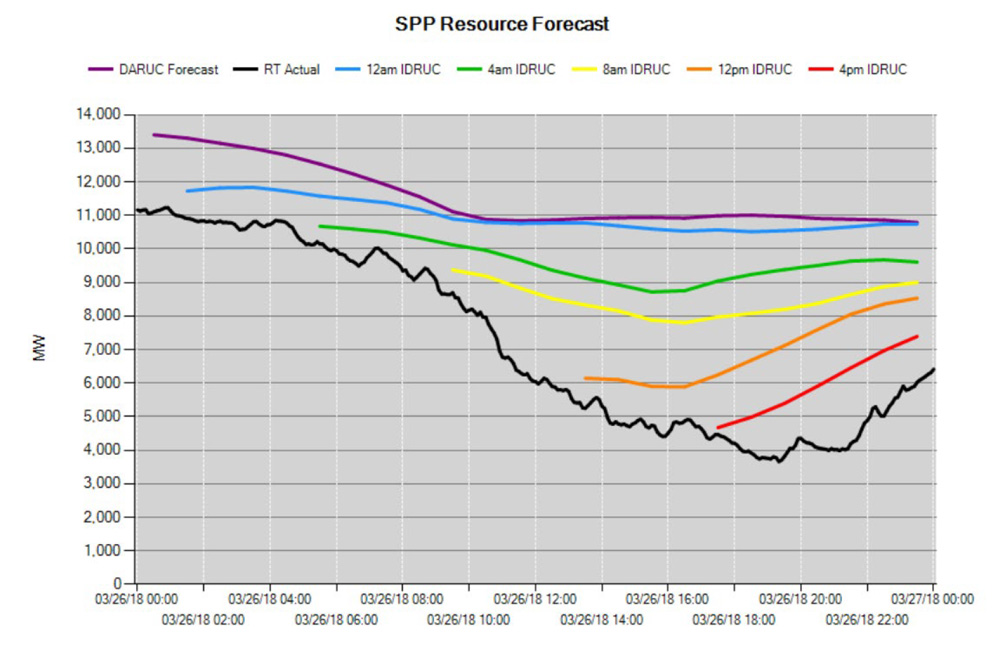

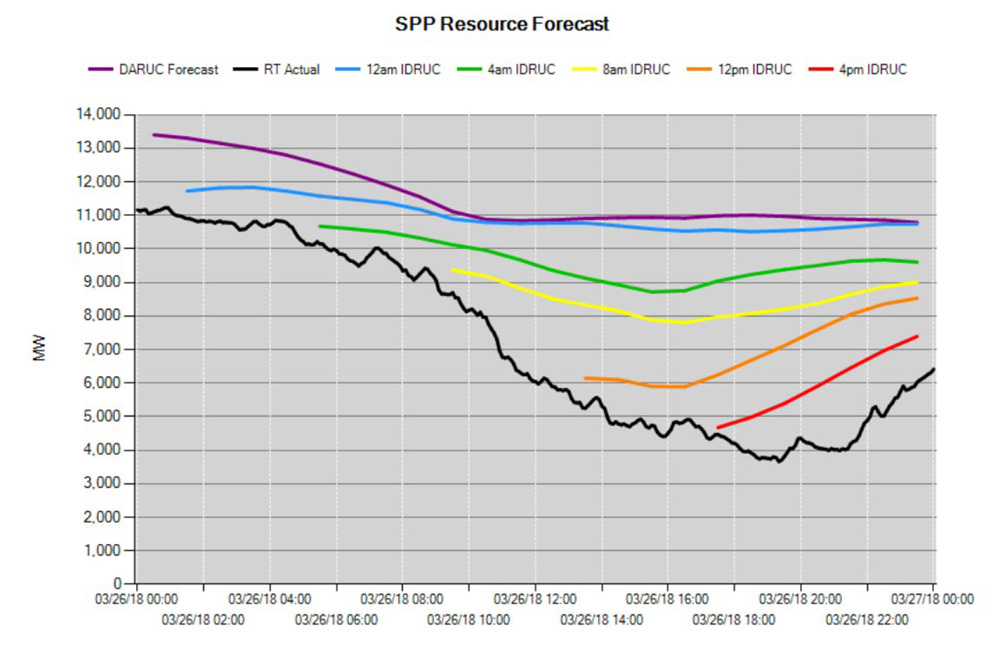

The RTO experienced what it called a “wind burn” event in March 2018, when the day-ahead forecast for wind output was 7,000 MW above the reliability unit commitment forecast.“During this event … SPP operators committed 54 units out-of-market to replace the unexpected decrease in wind generation and meet reliability needs,” FERC said. “SPP stated that the root cause of the forecast error was the poor performance of meteorological forecasts.”

Woods said that while SPP’s wind forecast errors were off by only about 4.5% last year, that still represents up to 950 MW — the grid operator’s second largest single-resource contingency and larger than its spinning reserve requirement for the last two years.

SPP is using workarounds in some instances but “manual interventions lead to lower prices in the market and do not send the right pricing signals to responding duration,” she said.“Products that compensate for flexibility and ramping are needed,” Woods said. “When the need for flexibility and ramping are not accounted for, the market may use the ramp for energy needs and not save it to meet the flexibility needs of the system,” Woods said.

Quick Ramp Products

SPP and other organized markets with sharp increases in renewables are looking to quick-response solutions.

Ancillary service products in CAISO, MISO and SPP provide short-term ramp capability “to manage the changing system needs … and reduce out-of-market actions by operators,” FERC said. “Although the three ramp products differ, they share several similar features. The ramp products are bi-directional in that they procure and price upward and downward ramp capability as separate products. The ramp products add a constraint (i.e., a ‘ramp constraint’) to the energy and ancillary services market clearing process that simultaneously procures and prices energy, traditional ancillary services, and the ramp products on a co-optimized basis.”

“In all three markets, the ramp product prices are based on the opportunity cost resources incur from providing ramp rather than energy and the other ancillary services,” it said. “In the event the system is economically or physically short of a ramp product, the ramp price is set by an administratively determined demand curve for the ramp product, with separate demand curves for upward or downward ramp capability.”

At NYISO, the “changes to the grid and operational risk require flexible energy security needs,” Director of Market Design Mike DeSocio said. “We will also need resources that can provide energy output for hours and days to allow grid risks such as renewable output falls, system restoration needs, and storm watches. When we think about the need for flexibility, resources that can respond in a few minutes and run for several hours or days at a time, will be invaluable to the grid of the future.”

Rahul Kalaskar, CAISO’s manager of market analysis, said that over the last decade, the ISO has seen increased variability and uncertainty between its day-ahead and real-time markets, driven by a significant increase in variable resources. That has resulted in more real-time imbalances in both directions.

“The day-ahead forecast cannot predict the net load that will materialize throughout the operating day, so any difference that occurs between what is predicted and what occurs results in imbalances,” Kalaskar said. “When there is a risk that imbalances may be too large to address through the real-time market, the ISO will rely on out-of-market actions to address these.”

He said CAISO is currently adding improvements to the existing real-time flexible ramping product and developing a new day-ahead ramping product called an imbalance reserve to make sure there’s sufficient real-time dispatch capability to meet net load imbalances. (See FERC OKs Ramping Product for CAISO, EIM.)

Up Ramp, Down Ramp

MISO expects an increased “future need for flexibility to address short-term market-wide reserve requirements as the mix of different types of resources … continues to evolve, including the replacement of coal-fired power plants with variable energy resources and natural gas power plants,” the FERC whitepaper said.

Wind generation in MISO increased from 1 GW in 2005 to 19 GW in 2019, and solar generation will reach 11 GW in 2032 if MISO’s resource fleet continues to change at its current pace, it said.

In 2014, FERC approved MISO’s proposal to introduce two ramp capability products — up-ramp capability and down-ramp capability, both intended to address short-term variations in net load. MISO’s ramp capability products procure ramp capability within a 10-minute timeframe. (See MISO Quick Capacity Reserves Wait Until 2021.)

“When MISO is unable to meet the system’s ramp requirements, a demand curve with a maximum price of $5/MWh sets the price for the ramp capability products,” FERC said. “However, MISO is currently considering revising the demand curve for the up-ramp capability product to better reflect net load uncertainty and continue to track with this uncertainty as it changes with the evolving resource mix.”

In PJM, uncertainty and the need for quick ramps to address shortfalls is a “major driver,” said Adam Keech, the RTO’s vice president of market design and economics.

“We tend to look at reserves in PJM as a product with many different uses,” Keech said. “When we look at uncertainty, we’re really trying to get that net load uncertainty to inform the reserve requirement because we deploy reserves for a number of different reasons. For us, the most important things coming out of the reserve markets are the ability to commit units quickly and get megawatts onto the system and ramp them up quickly as well.”