PJM transmission owners responded to FERC’s deficiency notice on their proposal to add network upgrades to rate base, arguing that the RTO’s tariff provides TOs with the “express authority” to make changes to any of the sections relating to transmission revenue requirements, cost allocation or cost recovery (ER21-2282).

In August, the commission directed the TOs to provide evidence backing up claims that their ability to raise capital is being threatened because they must absorb the risks of increasing transmission upgrades without earning returns on the assets. (See FERC Seeks Evidence in PJM TOs’ Bid to Rate-base Network Upgrades.)

The TOs asked FERC on June 30 to allow them the option to fund network upgrades and add them to their rate bases. Under PJM’s “participant funding” model approved in 2004, generators provide the capital for network upgrades, while the additional infrastructure is added to rate bases at zero cost, allowing TOs to recover only their operations and maintenance expenses from network transmission customers.

In their filing Monday, the TOs did not respond directly to the commission’s request for “evidence that investors have informed the PJM TOs that they hold concerns over future investments in the PJM TOs given the projected increase in network upgrades.”

Instead, the TOs noted that they filed their proposal under Section 205 of the Federal Power Act. “Thus, they do not need to demonstrate that the existing methodology absent the transmission owner’s option to fund network upgrades is unjust and unreasonable,” they wrote. “Instead, they need only show that the proposed revisions are just and reasonable.”

The TOs said when PJM was created as an independent system operator in 1997, the D.C. Circuit Court of Appeals “made very clear that absent a voluntary waiver,” the TOs retained all their rights under the FPA to make Section 205 filings “relating to rate design changes with respect to services provided by their own assets.” The TOs said the court “explicitly held” that the commission exceeded its jurisdiction when it attempted to “deprive utilities of their rights ‘to initiate rate design changes with respect to services provided by their own assets.’”

“The PJM transmission owners need not prove they retained the rights to file the proposed revisions; those rights are granted by statute,” the TOs said in their response. “To successfully challenge the PJM transmission owners’ rights to file the proposed revisions, protesters or the commission would have to show that the PJM transmission owners expressly waived those rights. There is, however, no evidence supporting such a showing.”

Several environmental groups, state regulators, generators, industrial customers and PJM’s Independent Market Monitor filed comments in July opposing the TOs’ proposal, alleging there’s no evidence the TOs are having trouble attracting capital. (See PJM Stakeholders Blast TOs’ Petition to Rate-base Network Upgrades.)

FERC staff asked the TOs to provide evidence that their return on equity (ROE) rates “do not currently account for the risks of owning and operating the transmission system with the network upgrade additions.”

The TOs said there is a “simple and straight-forward” reason the approved ROE rates do not account for the risks of owning and operating network upgrades, saying existing commission-approved ROE for transmission facilities “does not currently account for the risks of owning and operating network upgrades.”

“The commission-approved ROE for transmission rates is applied to the PJM transmission owner’s rate base, and that rate base does not currently include network upgrades,” the TOs said in their response. “Thus, the PJM transmissions owners do not earn a return or receive any compensation for owning and operating network upgrades.”

FERC asked whether the TOs’ ROE would decrease if they obtained the ability to put the upgrades in rate base.

The TOs said if the commission approves the proposed revisions, there would be “no reason or justification to reduce the commission-approved ROEs.” They said allowing for earnings on network upgrades would be compensation for owning and operating them and to “account for the risks of those facilities, which are separate from the risks addressed by the commission-approved ROE that the PJM transmission owners earn for their other transmission facilities on their system.”

The TOs said they have been forced to own and operate network upgrades “on a nonprofit basis.”

“In a market economy, no private business would voluntarily choose to pursue such a business model,” the TOs said. “While the PJM transmission owners are regulated entities, they are for profit entities, and therefore must be compensated for the service that they provide.”

The TOs said that gross plant for transmission assets has increased more than five-fold from $14.96 billion in 2004 to $77.72 billion in 2020. Over the same period, gross plant for network upgrades increased from $35 million to $1.31 billion, rising from 0.2% of the total gross plant to 1.7%.

FERC asked the TOs to describe the criteria they will use to determine whether to initially fund individual upgrades and the disclosures they would make about their decisions.

The TOs said they intend to fund network upgrades “if they have the capital budget and business flexibility to do so.” They said they have not yet developed “specific criteria” for the determination on whether to “exercise the transmission owner funding option.”

“Following the commission’s approval of their proposal, they will be in a better position to consider developing criteria to guide their decision-making process and to publicize those criteria,” the TOs said in their filing. “The criteria may include, for example, a minimum dollar threshold that would exclude network upgrades below a certain dollar amount; other potential criteria are still being considered.”

The TOs requested that FERC accept the proposed revisions “without hearing, modification or condition” and have an effective date of Aug. 30.

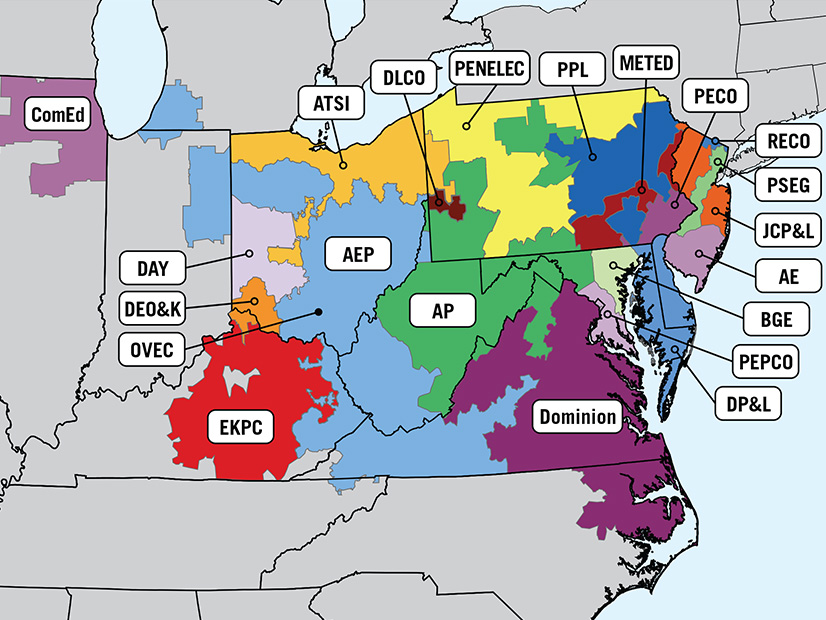

PJM’s TOs include American Electric Power (NASDAQ:AEP), Dominion Energy (NYSE:D), Duke Energy (NYSE:DUK), Exelon (NASDAQ:EXC), PPL (NYSE:PPL) and Public Service Enterprise Group (NYSE:PEG).