To decarbonize the fast-evolving U.S. grid by 2035, long-duration storage technologies that can provide 10 or more hours of power will have to be developed and deployed by 2030, according to Eric Hsieh, director of grid systems and components at the U.S. Department of Energy.

But hitting that deadline may not be possible because of the long and expensive process new technologies must go through to test and validate their performance, he said.

To allow enough time for manufacturing, permitting, interconnection and construction, “any new technologies would probably need to be ready by 2030” to be operational by 2035, Hsieh said during the DOE’s Long-Duration Storage Shot Summit on Thursday. “So, under any scenario of achieving this goal, there’s less time on the calendar, between now and deployment, than the time these technologies” would normally need for performance testing.

This “information gap” — and the use of artificial intelligence and machine learning to accelerate testing — is now the focus of a consortium of researchers at the DOE’s national laboratories. They have launched a Rapid Operational Validation Initiative (ROVI) to build the tools and datasets that could cut the performance testing process from years to weeks, said Eric Dufek, department manager for energy storage at the Idaho National Laboratory.

The national labs have already developed some AI and machine learning capabilities that might soon “do rapid, accurate and cost-effective performance characterization and provide the quantitative, reliable certainty to everybody that is developing and deploying different assets,” Dufek said during a panel on the initiative.

The need for speed is at the heart of the Long-Duration Storage Shot (LDSS), the second of the DOE’s Earthshots aimed at driving down the costs of certain key energy technologies that will need to be commercialized and deployed at scale to reach President Biden’s 2035 deadline for a 100% clean electric grid. Six to eight “shots” are planned for the initiative, beginning with the Hydrogen Shot, announced in June, which is aimed at cutting the cost of green hydrogen, produced with clean energy, from its current price of $5/kg to $1/kg within a decade.

Launched in July, the LDSS has set an even more ambitious target: cutting the levelized cost of long-duration storage 90% to 5 cents per kWh-cycle for 10 hours of duration or longer, Hsieh said.

That target is based on the 2020 capital costs and levelized cost of storage (LCOS) of lithium-based batteries, Hsieh said. At the same time, “the Storage Shot is technology-neutral and includes all technologies with a pathway to the specified cost and performance targets,” he said.

A wide spectrum of technologies is in the running to fill the long-duration space. Traditional pumped hydro currently accounts for more than 90% of grid-scale storage in the U.S., but other possibilities include liquid air, compressed air, hydrogen, flow batteries and gravity-driven technologies. For example, the California-Swiss startup Energy Vault uses tall towers to store and discharge energy by lifting and lowering 35-ton blocks of concrete.

The sheer number of “potential pathways here offer potential breakthrough avenues and obviously also challenges,” said Jason Burwen, interim CEO of the Energy Storage Association, who believes the DOE’s target is achievable.

“Each technology points you toward different cost problems to tackle,” Burwen said in a phone interview with RTO Insider. “Thermal storage technologies, for example, there’s a lot of promise there because you’re talking about materials and thermal mass, which can scale … probably fairly well at low cost, and then it becomes a matter of solving for the containment vessel associated with those.”

Speaking to RTO Insider on Monday, Yiyi Zhou, clean energy specialist at BloombergNEF, also saw a number of possible candidates for hitting the 5-cent target, including hydrogen, compressed air and aqueous, or liquid air, technologies.

“[The] levelized cost of hydrogen for renewable electricity has the potential to reach below U.S. $1,” Zhou said. “This is the equivalent to about 2.5 cents per kWh.”

But, she cautioned, an LCOS that low might only be applicable in certain markets.

Faster, More Granular, More Complex

Lithium-ion batteries are the dominant technology in residential and grid-scale storage today, allowing for durations of four to six hours and a range of flexible grid support services. But according to a range of policy makers and industry stakeholders at the LDSS summit, increasing levels of renewable energy on the grid will require longer-duration technologies.

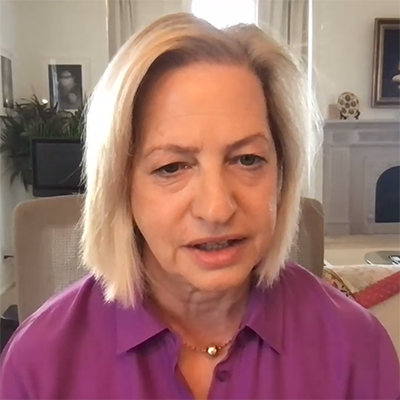

“Once you get past 20 to 30% penetration of renewables, the whole system changes. It becomes faster; it becomes much more granular in terms of the information you require. It becomes certainly much more complex,” said Audrey Zibelman, who at the end of 2020 left her position as managing director and CEO of the Australian Energy Market Operator to join X, Google’s Moonshot Factory, as vice president for the electric grid.

“But [what] all that gets down to is that you need a huge amount of flexibility in the system; you need to be able to respond instantaneously to changes,” Zibelman said. “And you need to recognize that as weather [solar and wind] becomes some of your biggest fuels, storage becomes an increasingly critical feature both in managing the grid so that it can take advantage of the free fuel of weather and become much more efficient, as well as resilient, as well as reliable.”

Renewables and electrification of transportation, buildings and other sectors of the economy could result in some states seeing their electric grids shift from summer-peaking to winter-peaking systems, as is already beginning to happen in North Carolina, said Christopher Ayers, executive director of public staff at the North Carolina Utilities Commission.

With the state’s strong solar market pumping out excess power, “we need that energy that is produced in the afternoon in large quantities; we need it at 6, 7 and 8 in the morning on January, February and March mornings,” Ayers said. “Right now, we don’t have the technology that allows us to bridge that gap. Once we have long-duration storage and start integrating [that power] into the system, we can become more cost-effective by also leveraging low-cost energy generation.”

In the remote town of Cordova, Alaska, Clay Koplin, CEO of the Cordova Electric Cooperative, sees long-duration storage as “the holy grail.” Working with the DOE, the town of about 2,200 has been able “to modernize our grid and be very efficient with the resources we have, but [that] just can’t replace the need for storage,” Koplin said.

Long-duration storage would mean the town would be able to store excess solar energy from its long summer days to use during the winter, and eventually run 100% on clean power, Koplin said.

Data: A Two-fold Problem

Beyond cost-cutting, a major challenge for scaling long-duration technologies is validating their performance, a process that often requires a huge amount of data collected over years, said Ben Kaun, program manager for energy storage and distributed generation at the Electric Power Research Institute.

“Utilities are used to very long-life assets,” Kaun said during the panel on ROVI. “Battery energy storage technologies that are available right now typically are guaranteed for 10 to 20 years. That already raises some eyebrows for the stakeholder group. In addition, there’s only been a few years that most of these technologies have in-the-ground experience that we haven’t had the chance to prove out.”

And, with the grid constantly evolving, Kaun said, “This creates a situation where there’s insufficient predictive data about what’s going to happen to these assets in the future.”

Craig Horne, managing director of energy storage at natural gas and solar developer Wellhead Electric Company, agreed. “You really have a two-fold problem where you have a limited amount of data that predicts performance and then a limited amount of insight as to how that performance needs to manifest in order to bring in revenues and provide service to the customers,” he said.

A platform like ROVI would allow developers to “see that no matter how a use case may evolve, that we can get a high degree of confidence that this storage asset would be able to respond appropriately,” Horne said.

Getting the system up and running, however, will mean collecting and sharing performance data — including proprietary information — from a range of industry players, a problem the labs are already working on, Dufek said.

“If something is proprietary and not necessarily something you want the entire world to see, we can also deal with that,” he said. “We can clearly link and coordinate between those two sets so that we continue to evolve the entire system without actually developing or creating the need to develop a specific tool for every single activity.”