Markets and Reliability Committee

Energy Price Formation Charter Endorsed

PJM stakeholders last week approved revisions to the Energy Price Formation Senior Task Force (EPFSTF) charter while questioning changes requested by Exelon.

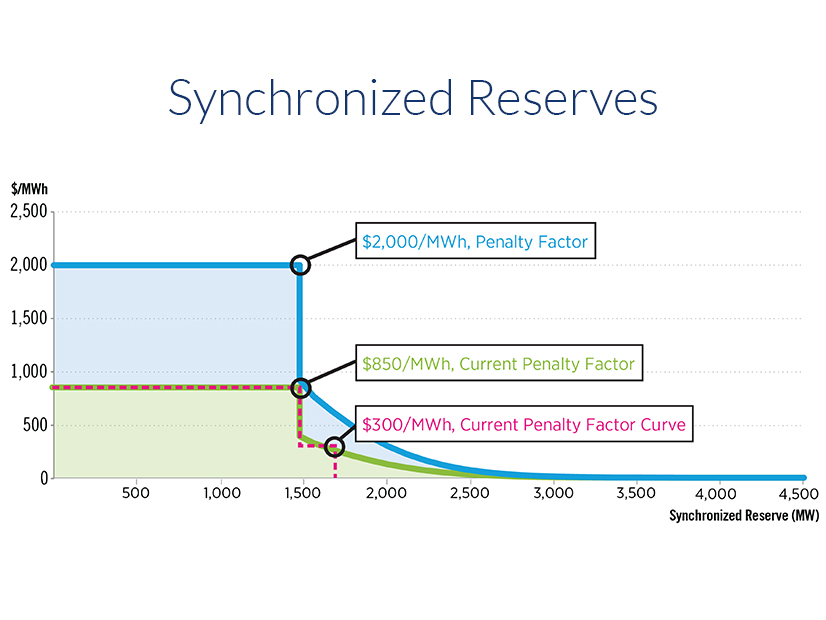

In a sector-weighted vote of 2.88 (57.6%) at the Markets and Reliability Committee meeting Wednesday, members approved the charter revisions resulting from an issue charge endorsed at the June MRC meeting. The previous issue charge was aimed at examining PJM’s operating reserve demand curve (ORDC) and transmission constraint penalty factors and the possible creation of a “circuit breaker” to control energy prices in an emergency. (See PJM Reserve Price Formation Issue Charge Approved.)

Susan Kenney, PJM markets automation manager, reviewed the revisions to the EPFSTF charter, saying those in the original version were “strictly a copy-paste” from the June issue charge as well as closing out the prior work efforts of the EPFSTF.

The first key work activity in the revisions featured education on the current and pending market rules for use of the ORDC and transmission constraint penalty factors in LMPs, including the input assumptions for the curve.

The second key work activity from the issue charge featured exploring potential circuit breakers or other stop-loss approaches that could limit extreme pricing when the cost “likely far exceeds the value of any contribution to preserving grid reliability.”

Language in the expected duration of work section calls for an effort to “expedite voting” on the first two key work activities before the downward sloping ORDC takes effect in PJM on May 1, 2022. FERC approved the new curve in May 2020, allowing PJM’s LMPs to reach or exceed $12,050/MWh in cases of extreme reserve shortages. (See FERC Approves PJM Reserve Market Overhaul.)

The third key work activity features exploring potential enhancements to PJM’s ORDC rules to address the impact of recent changes in the RTO’s dispatch protocols on forecast uncertainty and to examine and address the additional market and credit risks of the ORDC changes related to the recent pricing events in ERCOT, SPP and MISO from the polar vortex in February.

A second version of the charter introduced by Exelon included additional clarification to some of the out-of-scope items in the second key work activity, stating, “Changes to PJM’s ORDC, reserve product structure and penalty factors outside of use in the circuit breaker are out of scope.”

Stakeholders were unable to reach a consensus at the EPFSTF meeting Aug. 26 over Exelon’s suggested revisions, and members chose to endorse the original revised charter without them, supporting it 60%.

Sharon Midgley of Exelon said the company’s proposal “provides important clarifications” to the second key work activity in order to “focus and expedite” the group’s work on the circuit breaker.

Paul Sotkiewicz of E-Cubed Policy Associates said he was supportive of the Exelon alternative because it would allow stakeholders to concentrate on the circuit breaker and not on other issues.

Adrien Ford of Old Dominion Electric Cooperative said she was concerned Exelon’s proposal could limit the scope of the work of the task force. Ford said the additional language in the second key work activity “presupposes things that are out of scope.”

“We would not want to see any changes that would limit the scope of the work effort,” Ford said.

Steve Lieberman, assistant vice president of transmission and PJM affairs for American Municipal Power (AMP), said that the Exelon changes appeared to be “an end-around of getting something that people didn’t get when we voted on the issue charge.”

Natural Gas and Electric Markets Issue Charge Approved

Members will begin examining the alignment of natural gas and electric markets this month through a new senior task force assigned to the MRC after an issue charge presented by Dominion Energy was approved with a sector-weighted vote of 4.26 (85.2%).

Jim Davis, regulatory and market policy strategic adviser for Dominion, reviewed the problem statement and issue charge at last week’s meeting. Davis first presented them at the August MRC meeting. (See “Natural Gas and Electric Markets Issue Charge,” PJM MRC Briefs: Aug. 25, 2021.)

Davis said one major change was made to the issue charge since August: removing an item that called for avoiding discussions on gas market reforms that can only be resolved by FERC or the North American Energy Standards Board (NAESB). He said Dominion decided to eliminate the item after stakeholders questioned the language.

“We think there’s some compelling arguments to have discussions on items that can be reformed [in] the gas markets,” Davis said.

The key work activity in the issue charge includes providing education on topics like the history of pipeline and electricity coordination, pipeline tariffs, products, procurement, the impact of intermittent generation on the system, and imbalance charges and penalty structure.

Davis said education is “going to be critical” for the coordination effort to be successful.

Susan Bruce, counsel to the PJM Industrial Customer Coalition (ICC), said the work to be conducted is an “important conversation” that “links to so many other big-picture issues that we are tackling.” Education will be a key piece, she said, but some of the issues involved won’t be able to be solved through the stakeholder process because of FERC’s and NAESB’s jurisdictions.

Bruce also said the ICC has “reservations” about PJM load “bearing the burden” of some of the lack of flexibility that may exist on the gas side. “This conversation in some respects becomes an economic flexibility conversation.”

Independent Market Monitor Joe Bowring said he appreciated Dominion’s changes to the issue charge on the jurisdiction item and requested that discussions also include an examination of the reasons for pipeline inflexibility. Bowring said stakeholders should also consider recommendations to make to FERC regarding “gas pipeline business models and practices.”

Greg Poulos, executive director of the Consumer Advocates of the PJM States (CAPS), said coordination between energy generation and natural gas is “not an easy effort” to tackle and has been a concern across the country for years.

Poulos said the scope of the issue charge was a concern for the advocates because it could include areas in which PJM has no decision-making ability but could later incur costs depending on what path stakeholders decide to follow. “We don’t want to see those kinds of costs included in the PJM wholesale cost,” he said.

Poulos requested a motion to defer a vote on the issue charge until more discussions could be conducted to work on the scope, but that failed with a sector-weighted vote of 2.5 (50%), falling short of reaching the required 3.33 (66.6%) threshold.

Market Suspension Vote Delayed

The MRC delayed a vote to endorse a proposed solution and Operating Agreement revisions to address rules related to market suspension after representatives from Calpine and Vistra made a motion to defer until further discussions take place at the Market Implementation Committee.

Stefan Starkov, senior engineer for PJM’s day-ahead market operations department, reviewed the proposal and revisions. The proposed rules were first endorsed at the June MIC meeting. (See “Proposed Rules for Market Suspension Endorsed,” PJM MIC Briefs: June 9, 2021.)

Starkov said PJM wanted to “address a gap” in the tariff language regarding market suspensions, specifically how to settle the real-time market if prices couldn’t be determined for a certain period. Starkov said the revisions were designed to provide clear business rules to account for a market suspension where the RTO cannot clear or produce market results.

Some of the proposed OA revisions include updating language on day-ahead market suspension by removing existing language on settlements of day-ahead and financial transmission right target allocations at real-time quantities and prices in the event PJM cannot clear day-ahead prices; and adding language on notifying participants of a market suspension.

Another section clarifies the real-time market suspension definition as the “inability to produce economic zonal dispatch solutions for at least seven five-minute intervals.”

Starkov said the new section, Declaration of Market Suspension, outlines the scenarios for determining real-time market prices. Starkov said that if the market suspension is less than or equal to six hours, then the real-time prices associated with the market suspension would be the average of the real-time prices for all intervals of the proceeding and subsequent hours.

If the suspension is greater than six consecutive hours and day-ahead prices are available, Starkov said, then the real-time prices would be the day-ahead prices for each corresponding hour. If there are no clear day-ahead prices, then the real-time prices would be set to $0/MWh.

Calpine and Vistra said they were concerned that the rules were inadequate.

Calpine’s David “Scarp” Scarpignato said they may not adequately address longer‐term market suspension scenarios, including those lasting a week, a month or longer. The concern stems from the concept of compensating generators for an extended period of time “based only on their cost‐based offers, which are based solely on short‐run marginal costs,” he said.

Scarp said longer‐term compensation at only cost‐based offers “diverges from market dynamics and expectations.” He said Calpine and Vistra are proposing to add another time‐segmented solution that would kick in if a market suspension were to last for one week and that the compensation should include an adder above the short‐run marginal cost represented by cost‐based offers.

“All these market suspensions are highly unlikely, but if they do occur, it is important to get things right,” Scarp said.

Scarp made a motion to defer the vote on the tariff and OA revisions until the MIC considers and votes upon supplemental procedures that would govern in the event of a longer-term market suspension, which could then be added to the existing proposal. He said the longer-term scenario wouldn’t change the original proposal but would simply be added to it for a future vote at the MRC.

Stakeholders approved the deferral with a sector-weighted vote of 4.05 (81%). The longer-term scenario will now go to the MIC for further discussions.

Resource Adequacy Charter

David Anders, director of stakeholder affairs for PJM, reviewed a proposed charter during a first read to create a new senior task force addressing resource adequacy topics.

Anders cited a letter issued by the Board of Managers on April 6 that urged stakeholders to address a series of topics related to the capacity market after the completion of the Critical Issue Fast Path (CIFP) process addressing the minimum offer price rule.

The letter cited several topics to be discussed, including:

- evaluating all aspects surrounding the appropriate level of capacity procurement;

- examining the need to strengthen the qualification and performance requirements on capacity resources;

- considering clean capacity/energy auctions as an option to allow for procurement of clean resources; and

- evaluating the need for PJM’s procurement of additional reliability-based services, with a particular focus on reliability needs in the face of the changing resource portfolio and increased penetration of intermittent resource technologies.

Anders said PJM is proposing the creation of the Resource Adequacy Senior Task Force (RASTF) to discuss the topics listed in the board letter and to recommend possible changes to the capacity market. Anders said the new senior task force would report to the MRC and be the “central clearinghouse” for consideration of all the capacity-related issues.

To ensure proper coordination, Anders said, the charter includes reporting protocol for work on the capacity market performed at other PJM groups like the Quadrennial Review currently being discussed at special sessions at the MIC, load forecasting at the Load Analysis Subcommittee, and reliability products and services at the Operating Committee.

Individual issue charges discussed at the RASTF would ultimately be developed and approved by the MRC to address the specific capacity market work streams, Anders said, including the timing of the work.

Anders said PJM is still working on the final language contained in the RASTF charter and is looking for more comments on the existing language from stakeholders. The committee will vote on the charter at the Oct. 20 MRC meeting.

Energy Efficiency Add-back

Jeff Bastian, senior consultant with PJM’s market operations, provided a first read of the joint Monitor/PJM proposal addressing the calculation of the energy efficiency (EE) add-back mechanism. Members had unanimously endorsed an issue charge presented by the Monitor at the August MIC meeting. (See “Energy Efficiency Add-back Issue Charge Endorsed,” PJM MIC Briefs: Aug. 11, 2021.)

Bastian said the EE add-back mechanism is applied to capacity auctions to prevent the “adverse reliability impact” associated with double-counting EE as a capacity resource and as a reduction in the forecasted peak load. The problem is the current method of determining the add-back megawatt quantity applied to a Base Residual Auction does not require it to match the megawatt quantity of EE resources that clear in that auction. Bastian said the add-back quantity in a BRA will normally exceed the cleared quantity, resulting in an artificial increase in the clearing price.

The proposed solution calls for rewriting the manual language to permit PJM to calculate the EE add-back in the capacity market clearing so that the total EE add-back megawatts offset the total cleared EE megawatts in the BRA.

Bastian said the work timeline is anticipated to take two months to ensure that the modified EE add-back method is implemented with the next BRA for the 2023/24 delivery year. PJM is currently asking FERC for a delay of the BRA, pushing the date from Dec. 1 to Jan. 25. (See PJM Proposing 2-Month Capacity Auction Delay.)

The Monitor initially requested that the “quick-fix” process be used to complete work for the upcoming BRA, but some stakeholders requested an additional month of discussion to explore options. The issue charge was amended to use the “CBIR Lite” (Consensus Based Issue Resolution) process and take two months instead of one to complete it.

“We thought that waiting another month to get MRC endorsement would be cutting the timing awfully close,” Bastian said.

Erik Heinle of the D.C. Office of the People’s Counsel said his office views EE as an “important tool to get to [D.C.’s] decarbonization goals” and would like a better understanding from PJM and the Monitor on the approach being proposed and the impacts.

“While we obviously want accuracy in the process, I want to make sure we’re not devaluing that resource in a way that will be detrimental to our ratepayers,” Heinle said.

PJM will seek endorsement of the proposal at the Oct. 20 meeting.

Consent Agenda

Stakeholders unanimously endorsed revisions to the Regional Transmission and Energy Scheduling Practices document presented on the MRC consent agenda. The document was endorsed at the Sept. 9 MIC meeting and contains updates related to NAESB’s Wholesale Electric Quadrant v3.2 Business Practice Standards that take effect Oct. 27. (See “Energy Scheduling Practices Revisions Endorsed,” PJM MIC Briefs: Sept. 9, 2021.)

Members Committee

PJM Administrative Rates

The Members Committee endorsed the proposed solution and tariff revisions related to PJM administrative rates despite some members questioning the RTO’s funding methodology.

PJM’s proposal called for changing its administrative cost recovery from the current practice of initial charges at stated rate levels with a varying quarterly refund to the new practice of monthly rates based on that month’s costs and that month’s billing determinations. The proposal was endorsed with a sector-weighted vote of 3.84 (76.8%).

Jim Snow of PJM reviewed the proposal and tariff revisions that have been worked on by stakeholders and the RTO for more than a year. Snow said the proposal was developed in conjunction with the Finance Committee and is “specific only” to PJM’s cost recovery from the membership listed in schedule 9 of the tariff and received unanimous support from the Finance Committee in July.

Snow said the administrative rate review was initiated to examine “rate equity” across the PJM membership to avoid cross subsidization among the different customer classes. Snow said the review also was conducted for “overall revenue adequacy” of PJM.

The proposal “adjusts with changes in usage patterns” of the services that PJM provides and the costs of providing the services, Snow said, and is designed to avoid over- and under-collection of funds to finance the RTO.

Jason Barker of Exelon said his company prefers having the “rate predictability” in the existing system, and introducing uncertainty in the rates presents risk to load-serving entities and its customers. Barker said it seemed like PJM changed its objectives this year, prioritizing revenue adequacy and rate equity over the previous objective of maintaining low-rate volatility and multiyear rate certainty.

“We have concerns that the transition to a formula rate will introduce new risks and costs to load and load-serving entities as a consequence,” Barker said.

The ICC’s Bruce said she was in the “uncomfortable position” of not being able to support the proposal, echoing Barker’s concerns regarding changes to the formula rate. Bruce said on the equity issue, there’s going to be a “real cost consequence” to members with the changing of the billing for cost-of-service issues related to PJM settlement.

“Customers do value having an expressed rate to help in having a discipline on costs at a utility,” Bruce said.

PJM filed the new administrative rates with FERC on Friday, requesting the commission act by Dec. 1 and to have the tariff revisions take effect Jan. 1 (ER22-26).

Nominating Committee Elections

Members unanimously elected the sector representative nominees for the 2021-2022 Nominating Committee.

The committee reports to the MC and is responsible for identifying candidates to serve on the board. It includes one representative from each of the five stakeholder sectors.

This year’s nominees included: Brian Vayda, executive director of the New Jersey Public Power Authority (Electric Distributors); Delaware Deputy Public Advocate Ruth Ann Price (End-Use Customers); John Brodbeck, senior manager of transmission at EDP Renewables North America (Generation Owners); Bruce Bleiweis, of DC Energy (Other Suppliers); and Dominion’s Davis (Transmission Owners).

Transparency Forum

CAPS’ Poulos reviewed a proposed charter for the creation of a new transparency forum, which he said is designed to address issues that currently take place “in the back of the room” among PJM and its stakeholders.

Poulos said the current Stakeholder Process Forum has provided members with an “excellent opportunity” to discuss concerns and suggest improvements to the stakeholder process. The Transparency Process Forum would provide members a new venue with a similar opportunity to address matters “outside of the scope of the Stakeholder Process Forum yet equally important,” he said.

Some of the examples of discussion items sited by Poulos included establishing a formal way to request information and data from PJM and to keep track of responses. He said he would also like to see discussion around creating guidelines and expectations allowing stakeholders to provide input to PJM prior to the RTO making filings at FERC or state commissions.

Poulos said PJM has made great strides in providing more transparency in recent years, but he said CAPS traditionally has more need for information because the group actively participates in less activities in the RTO like markets and delivery of services.

Gary Greiner, director of market policy for Public Service Enterprise Group, asked how the forum would work when typical discussions in the stakeholder process already include questions around transparency. Greiner said that if an issue about transparency comes up during the stakeholder process in a committee, the issue is usually discussed as part of the process.

Poulos said the forum would look at transparency issues that have a “lingering impact” and not ones that come up during the normal stakeholder process.

Barker said that Exelon was “a bit puzzled” over what the purpose of the forum would be and asked for more examples of issues that could be discussed that warrant additional transparency. He said the MC has traditionally been the place to express concerns among stakeholders regarding PJM operations and other deliberations, as it has authority over all the other committees.

Poulos said he will provide more examples of transparency issues at the October MC meeting.

Manual 34 Revisions

Michele Greening, senior lead stakeholder affairs consultant for PJM, reviewed proposed revisions to Manual 34: PJM Stakeholder Process to address the inclusion of forums as stakeholder bodies. The proposed revisions were sponsored by PJM and discussed at the Stakeholder Process Forum, but the RTO is looking for a member to officially sponsor the revisions because the manual changes are supposed to come from the stakeholder body.

Greening said several new forums, such as the Emerging Technology Forum that was established in June 2020, have been created, but Manual 34 doesn’t currently define forum as an official type of stakeholder group. Greening said PJM wants to define what a forum is and “add some parameters” around their establishment and implementation within the stakeholder process.

The RTO is defining forums as a stakeholder body in Manual 34 to provide consistency with other defined stakeholder groups, Greening said, and to provide clarity to the purpose and role of a forum in the stakeholder process.

A forum is being defined as a “stakeholder body formed to address specific topics and scope as outlined in its Markets and Reliability Committee approved charter. Forums are non-decisional stakeholder groups.”

Members will vote on the revisions at the October MC meeting.

Consent Agenda

The committee unanimously endorsed several revisions as part of the consent agenda. They included:

- revisions to Manual 34: PJM Stakeholder Process addressing photography in meetings and media guidelines. The changes resulted from feedback by members and discussions at the Stakeholder Process Forum. (See “Manual 34 Revisions,” PJM MRC/MC Briefs: July 28, 2021.)

- revisions from the Governing Document Enhancement and Clarification Subcommittee (GDECS) addressing administrative changes and clarifications in the tariff and OA. PJM said the revisions were found to be “simple and noncontroversial enough” that they were reviewed one time at the GDECS, receiving unanimous stakeholder support. (See “Consent Agenda Manual Endorsements,” PJM MRC/MC Briefs: July 28, 2021.)

- revisions to address making cure periods uniform across the tariff and OA. PJM said appropriate cure periods defined in section 15.1.5 of the OA were originally updated in that document, but not in section 7.3 of the tariff, which involves provisions limited to transmission service customers. (See “‘Know Your Customer’ Tariff Changes,” PJM MRC Briefs: Aug. 25, 2021.)

- revisions to address making the definitions of working credit limits uniform across the tariff. The revisions eliminate duplicative definitions of “working capital limit” and leave it only in the definitions section of the tariff.