NRG Energy (NYSE:NRG) and Exelon (NASDAQ:EXC) have funded a white paper that proposes an answer to the ERCOT energy-only market’s reliable electricity supply problems by “leverag[ing] the highly competitive retail market.”

The Load Serving Entity Reliability Obligation would directly address resource adequacy concerns by introducing a formal reliability standard and a mechanism to ensure sufficient resources meet this standard. The paper’s authors say the proposal would preserve the market’s competitive and customer choice elements while ensuring there are enough resources able to perform during reliability events.

Written by consulting firm Energy and Environmental Economics (E3) with the help of R Street Institute senior fellow Beth Garza, ERCOT’s former market monitor, the suggested market design is one of dozens of proposals and recommendations supplied to the Public Utility Commission as it works to address flaws laid bare during the February winter storm in its blueprint for a redesigned market (52373).

“This discussion was coming whether we wanted to have it or not,” Beth Garza told RTO Insider. “It’s time for an examination of what we want from the ERCOT energy market. As always, it takes a crisis to force that decision.”

“It offers the best pathway I’ve seen on electric reliability in the state of Texas,” tweeted former Montana regulator Travis Kavulla, now NRG’s vice president of regulatory affairs. “We’re at a seminal moment where Texas decides either to have a centralized or [government]-led procurement for reliability — or where the hard work of reliability is done by the decentralized, competitive retail market that’s flourished in the state.”

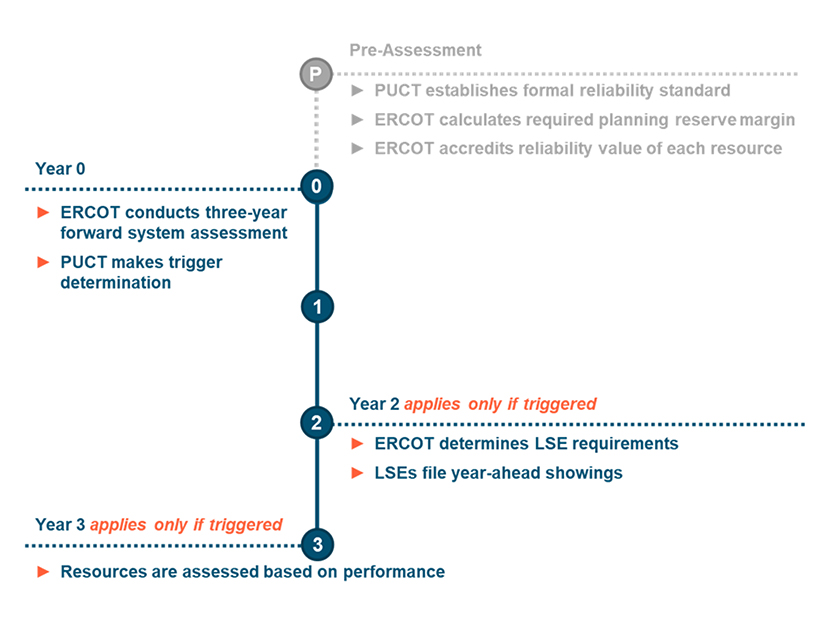

Under E3’s proposal, the PUC would determine a formal system reliability standard, such as one day in 10 years, and ERCOT would calculate the required seasonal reserve margin to meet the standard.

The grid operator would then accredit each resource’s reliability value for each season. Intermittent resources and others with dispatch limitations would be accredited according to their expected performance during reliability events. ERCOT would then give a three-year forward assessment of whether it has sufficient accredited resources to satisfy the seasonal reserve margin necessary to meet the reliability standard.

That would trigger the PUC’s LSE Reliability Obligation, with each load-serving entity — retail electric providers, cooperatives and municipalities — assigned a seasonal reliability requirement based on its projected firm load during critical system hours. LSEs serving interruptible loads would receive a reduced reliability requirement. Any LSEs unable to reach their seasonal requirement on a year-ahead forward basis would be assessed a penalty that the grid operator could use to procure accredited resources and correct the deficiency.

Resources accredited with a reliability value and obligated as part of an LSE’s portfolio would be required to offer into the energy market during designated reliability events, with penalties assessed for nonperformance.

“We had to offer enough specificity so that people had a working understanding of what this proposal looks like, but to be careful of not being too prescriptive of what’s being defined,” Garza said. “The ERCOT energy-only market does a lot of things really well. What it doesn’t do, and never will, is provide any certainty for installed capacity. It incents and hopes people will react and respond.”

Garza, who was brought in by NRG and Exelon to provide an independent analysis of ERCOT’s market design and to recommend “practical reforms,” said the paper leans on proposals from the Australian and Albertan markets, the only two similar to the Texas grid. Those markets have also been the subject of restructuring discussions and legislation intended to ensure resource adequacy, the report says.

To reach greater certainty in resource adequacy, Garza said, ERCOT first needs to specify quantities, how they will be measured and who is going to provide the capacity.

“If you need requirements, the best place to put those is on the LSEs,” she said. “We’re acknowledging the competitive retail world here. We will allow those retailers to figure out how to make those obligations in a way that suits the customers’ needs and expectations. That’s what makes this mechanism much more practically attractive than a centrally dispatched market.”

The LSE Reliability Obligation differs from a capacity market in that instead of one entity buying capacity on behalf of everyone else and spreading the costs to them, Garza said, LSEs will “go out and figure out the best way to do that.”

“We would describe [the proposal] as a really good idea,” she said. “It’s not a good idea [that] you can snap your fingers and it’s implemented. Significant processes and mechanisms have to be developed and defined. There are some market power issues that have to be addressed. The PUC has to make those decisions.”

The PUC will review the various recommendations to modify the market and prevent a repeat of February’s near collapse. Several workshops will be held before the final blueprint is released in December.