Transource's proposed alternative plan for the eastern segment of its Independence Energy Connection project

Transmission Expansion Advisory Committee

NJ OSW Proposals

PJM received 79 proposals addressing both the onshore and offshore demands of New Jersey’s ambitious offshore wind program as part of the RTO’s “state agreement approach” under FERC Order 1000.

Aaron Berner, senior manager in PJM’s transmission planning department, presented the results of the competitive solicitation process at last week’s Transmission Expansion Advisory Committee meeting. The submission window was open from April 15 to Sept. 17.

Berner said proposals were received from both transmission owners and merchant developers and included 57 projects that featured cost commitment provisions to cap costs. He said through “multiple combinations” of different proposals, even more potential solutions are available beyond the initial 79 proposals.

Specific details of the proposals were not provided.

The four project categories included:

- Option 1a: onshore upgrades on existing facilities, with 45 proposals submitted;

- Option 1b: onshore new transmission connection facilities, with 22 proposals submitted;

- Option 2: offshore new transmission connection facilities, with 26 proposals submitted, and;

- Option 3: offshore network with eight proposals submitted.

“We’re characterizing this as a very robust response,” Berner said. “We have a number of different types of proposals that have been received for all of the options.”

Berner said PJM is “moving forward” to begin evaluating some of the issues around reinforcing networks and preparing reviews of the offshore elements of the proposals. He said PJM is collaborating with consultants with offshore wind expertise to “better evaluate” the projects.

Staff from PJM and the New Jersey Board of Public Utilities provided details last month to stakeholders during a special meeting of the Planning Committee, advising them on how the winning proposal would link to the new offshore wind projects New Jersey is soliciting. (See PJM, NJ Staff Brief Stakeholders on State Agreement Approach.)

PJM gave an example of how proposals to New Jersey’s solicitation for offshore wind transmission projects may look. | PJM

PJM gave an example of how proposals to New Jersey’s solicitation for offshore wind transmission projects may look. | PJM

The BPU has already awarded three offshore wind projects in two solicitations: the 1,100-MW Ocean Wind 1 and 1,148-MW Ocean Wind 2 projects, both developed by Ørsted, and the 1,510-MW Atlantic Shores project, a joint venture between EDF Renewables North America and Shell New Energies US. The BPU is planning to hold three more solicitations over the next five years to help the state reach its goal of supplying 7,500 MW of offshore wind by 2035. (See: NJ Awards Two Offshore Wind Projects.)

Berner said the BPU has issued a guidance document indicating certain processes to be employed going forward during the project evaluations. New Jersey retains the right to elect to move ahead with any of the projects and is targeting the end of 2022 to make final decisions.

Transource Update

Berner provided an update on the Independence Energy Connection (IEC) East and West transmission project in Maryland and Pennsylvania and its impact on the 2021 RTEP.

The Pennsylvania Public Utility Commission voted 4-0 in May to reject a series of related applications and petitions filed by Transource Energy for the siting and construction of high-voltage electric transmission lines in Franklin and York counties. The PUC denied the project based on concerns about whether the need established in the PJM planning process met the requirement for needs specific to Pennsylvania. (See Transource Tx Project Rejected by Pa. PUC.)

Transource’s plan for the eastern section of the project originally proposed extending 15.8 miles of transmission lines from a new Furnace Run substation in York County, Pa., to the Conastone substation in Harford County, Md. An updated configuration released in October 2019 increased the size of the new substation in Pennsylvania and added four miles of lines connecting to an existing right of way that would feed into two upgraded Baltimore Gas and Electric substations.

The western segment of the IEC project called for a 230-kV double circuit transmission line running 28.8 miles from Franklin County, Pa., into Washington County, Md.

Berner said PJM performed a sensitivity study to determine any reliability impacts associated with the removal of the IEC project from the RTEP. He said PJM found “a number” of thermal issues, but none of the issues needed immediate addressing.

“The magnitude of these violations is not significant at this point, so we’re not concerned about moving forward quickly with a reliability reinforcement,” Berner said.

The PJM Board of Managers endorsed the RTO’s recommendation to suspend the IEC project at its Sept. 22 meeting because of the “permitting risks” and to remove it from the pending RTEP models, Berner said. He said PJM has yet to do a benefit-to-cost ratio recalculation associated with the project.

PJM will begin to review any impacts to the interconnection queue following the determination of reinforcements for the baseline RTEP reliability, Berner said, and will include the update in future market efficiency studies.

Berner said PJM is not cancelling the IEC project at this time and will allow it to play out in the courts. Transource officially appealed the PUC decision in June, filing cases in the U.S. District Court for the Middle District of Pennsylvania and another in the Commonwealth Court of Pennsylvania. (See Transource Challenges Pa. PUC Decision in Court.)

“We’re going to let this continue to work its way through the various processes,” Berner said. “But we felt it was prudent to move forward with suspending the project.”

Planning Committee

Reserve Requirement Study Results Endorsed

Stakeholders at last week’s Planning Committee meeting unanimously endorsed an installed reserve margin (IRM) of 14.7%, up slightly from the 14.4% required in 2020.

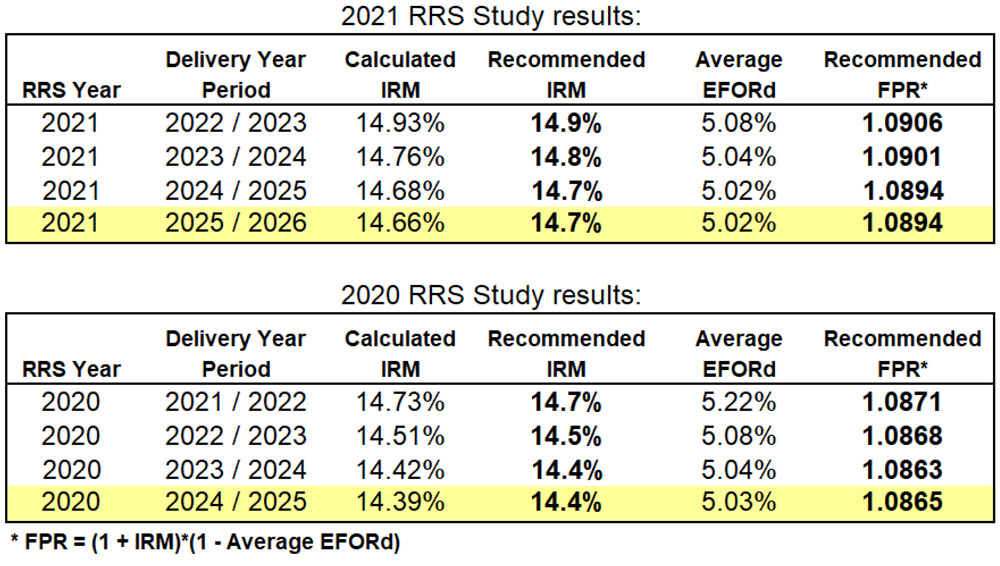

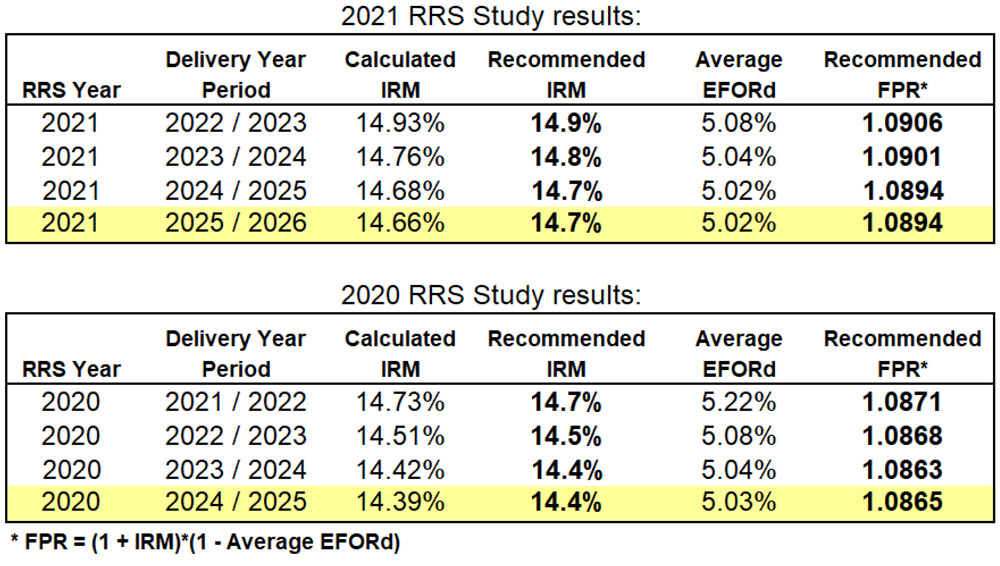

Patricio Rocha Garrido of PJM’s resource adequacy department reviewed the 2021 reserve requirement study (RRS) results, which determine the RTO’s IRM and forecast pool requirement (FPR) for 2022/23 through 2024/25 and establish the initial IRM and FPR for 2025/26. The results are based on the 2021 capacity model, load model and capacity benefit of ties (CBOT).

The 2021 reserve requirement study (RRS) results versus the 2020 RRS results | PJM

The 2021 reserve requirement study (RRS) results versus the 2020 RRS results | PJM

Rocha Garrido said the results differed slightly from the numbers presented at the August PC meeting. (See “2021 IRM Results,” PJM PC/TEAC Briefs: Aug. 31, 2021.) In the process of reviewing the preliminary results, PJM discovered that some of the generating units were duplicated and had to be removed from the study, he said.

The calculated IRM moved from 14.64% to 14.66%, Rocha Garrido said, and the recommended IRM was bumped up from 14.6% to 14.7%. The recommended FPR also went from 1.0887 to 1.0894.

Adrien Ford of Old Dominion Electric Cooperative asked if the removal of the generators impacted previous years of the RRS or if it was just this year.

Rocha Garrido said the units were introduced erroneously this year, so the error only applied to the 2021 study.

He said the recommended FPR of 1.0894 was a modest increase from 1.0865 for 2020. The FPR is the most important parameter of the study because it is used in the reliability requirement calculation for Reliability Pricing Model auctions.

The 2021 capacity model is driving the increase in both the FPR and the IRM, Rocha Garrido said, with the average effective equivalent demand forced outage rate (EEFORd) of 5.8%, compared to 5.78% in the 2020 RRS. The higher average EEFORd was caused by the increase in the average unit size, going to 175 MW in the 2021 RRS compared to 159 MW in 2020 because of the removal of effective load-carrying capability (ELCC) resources from the model.

“Having more smaller units is better for reliability than having larger units,” Rocha Garrido said.

The CBOT — the help PJM can expect from imports during peak loads — is also estimated to increase pressure on the FPR and IRM. Rocha Garrido said imports from neighboring grid operators as a share of all generation decreased from 1.54% in 2020 to 1.47% in 2021.

A review and vote on FPR and IRM will take place at the November Members Committee meeting with final approval at the December PJM board meeting.

Manuals 14A and 14B Updates

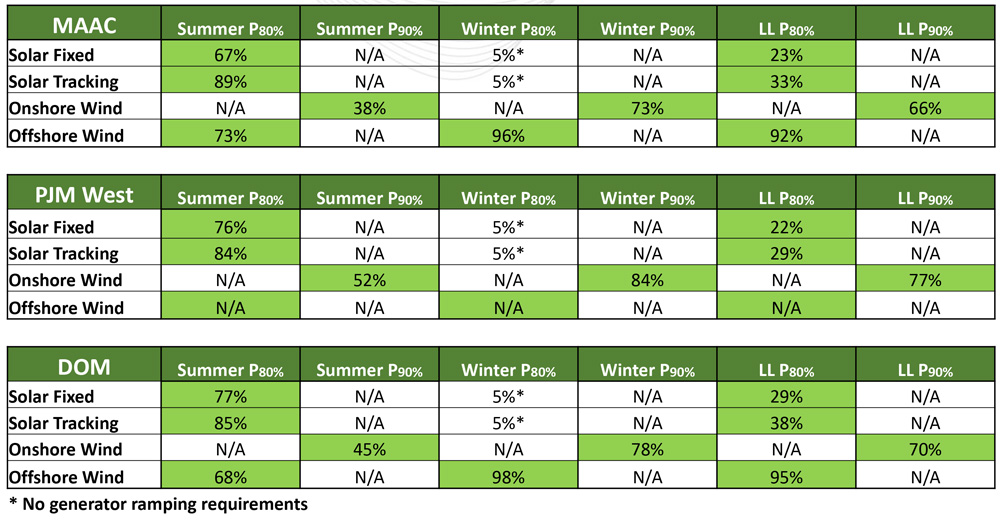

Jonathan Kern of PJM’s transmission planning department provided an update to Manual 14A: New Services Request Process and Manual 14B: PJM Region Transmission Planning Updates reflecting proposed changes to the generator deliverability test and related procedures. Kern presented the initial draft of the proposed changes at the August 10 PC meeting. (See “Winter/Light-Load Generator Deliverability Update,” PJM PC/TEAC Briefs: Aug. 10, 2021.)

The purpose of the changes is to consider the “evolving resource mix” in PJM’s planning process, Kern said, and is relevant to the interconnection queue studies and the RTEP baseline studies.

The proposed default deliverability requirements for wind and solar under PJM’s proposal for generator deliverability test modifications of light-load, summer and winter periods | PJM

The proposed default deliverability requirements for wind and solar under PJM’s proposal for generator deliverability test modifications of light-load, summer and winter periods | PJM

Kern said PJM intended to provide a first read of the manual updates at the PC meeting, but the RTO is still in the process of “fine-tuning the procedure to ensure repeatability” and that the results “make sense.” He said PJM is also examining the impacts to the interconnection queue.

Most of the analysis is expected to be completed by November, Kern said.

“Since there are a lot of changes, this extra time will allow stakeholders some time to digest the proposed changes,” he said. PJM has added proposed changes to the summer period to go along with the winter and light-load periods since the information was first presented in August to “harmonize” the three tests, Kern said. He added that the ramping limits for wind and solar were also refined for the three periods using ELCC studies.

Manual First Reads

Several manual updates resulting from cover-to-cover reviews received first reads:

- Michael Herman of PJM’s transmission planning department provided a first read of Manual 14B: PJM Region Transmission Planning Process Update. Herman said one of the most significant changes came with the addition of a new section adding detail around the incorporation of end-of-life (EOL) needs in the RTEP, which were part of the tariff attachment M-3 discussions. In December, FERC rejected a stakeholder proposal to move EOL projects under the RTO’s planning authority, siding with transmission owners who argued that it would violate their rights. (See FERC Rejects PJM Stakeholder EOL Proposal.) The commission also accepted the TO sector’s own tariff amendments concerning EOL projects in August 2020, rejecting arguments in rehearing requests by more than a dozen load-side stakeholders. (See FERC Accepts PJM TOs’ End-of-life Revisions.)

- John Reynolds of PJM’s resource adequacy planning department provided a first read of Manual 19: Load Forecasting and Analysis Update. Reynolds said the most significant change was adding battery storage to the list of forecasted items in the load forecast model overview in Section 3.1.

- Joseph Hay of PJM’s infrastructure coordination department provided a first read of Manual 14F: Competitive Planning Process Update changes to the proposal fee structure to conform to the PJM Operating Agreement. Hay said the language in Manual 14F was not in agreement with the latest changes to the OA, which states, “All proposals in any RTEP window are subject to a non-refundable deposit of $5,000, except for project proposals submitted with cost estimates of $5 million or less. In addition to the $5,000 non-refundable deposit, the proposing entity must pay all actual costs incurred by PJM to evaluate the submitted project proposal.”

The committee will be asked to vote on the manual changes at next month’s meeting.