Constraint Specific Tx Shortage Pricing

The NYISO Business Issues Committee on Wednesday recommended that the Management Committee approve tariff revisions related to implementing a revised approach to the current transmission constraint pricing logic.

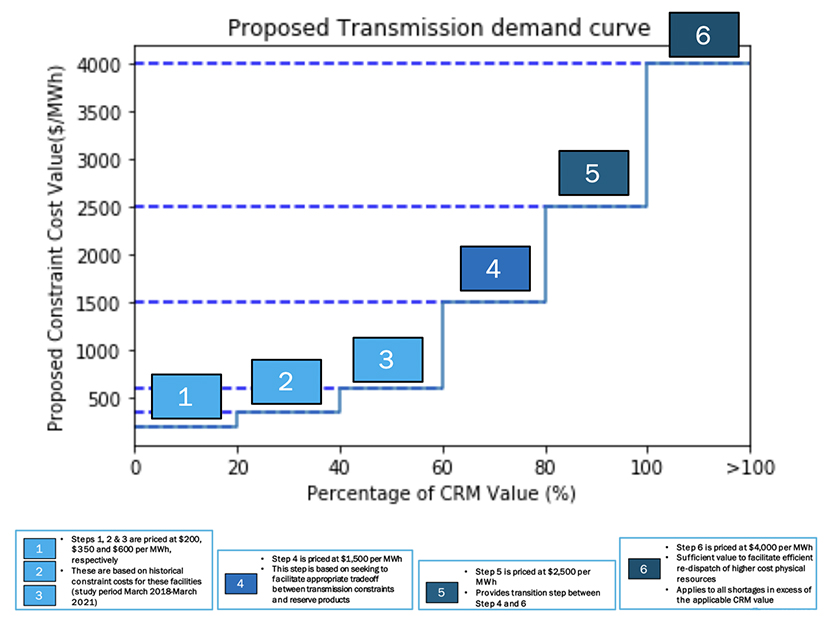

The proposal includes establishing a revised six-step transmission shortage pricing mechanism for facilities currently assigned a non-zero constraint reliability margin (CRM) value, said Kanchan Upadhyay, energy market design specialist.

Each step corresponds to a specified percentage of the applicable CRM value, and the final step will price all shortages in excess of the applicable CRM value, thereby facilitating the ability to eliminate reliance on constraint relaxation for such facilities.

Given the expanded scope of graduated transmission demand curves envisioned by the Constraint Specific Transmission Shortage Pricing proposal, the ISO is working to implement the proposal in tandem with its Lines in Series effort, which seeks to develop enhancements to the measures used for addressing the limitations arising out of the operation of graduated transmission demand curve mechanisms.

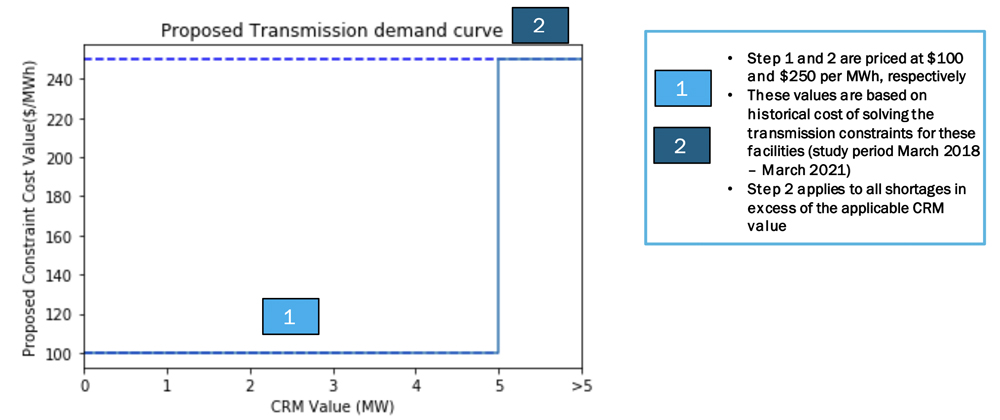

The proposal will also apply a non-zero CRM value (e.g., 5 MW) to internal facilities currently assigned a zero value CRM, with a separate two-step transmission demand curve mechanism for such facilities.

The first step is valued at $100/MWh and will price transmission shortages up to the proposed CRM value. The second step is valued at $250/MWh and will price all shortages in excess of the proposed CRM value, thereby facilitating the ability to eliminate reliance on constraint relaxation for such facilities, Upadhyay said.

The proposal will maintain the current single value $4,000/MWh shadow price capping method for external interface facilities (zero value CRM), permitting the continued use of constraint relaxation for external interfaces, she said.

One stakeholder wanted assurance that the Lines in Series initiative would in no way delay implementation of the transmission shortage pricing proposal.

“The constraint specific transmission pricing should be implemented as proposed today with Lines in Series,” said Michael DeSocio, NYISO director of market design. “Both will be implemented together in 2023, and we will be working with stakeholders to illuminate our thoughts on how to solve the Lines in Series effort later this year.”

CSR-related Tariff Revisions

The BIC also approved tariff revisions related to implementation of co-located energy storage resources (CSR) injection and withdrawal scheduling limit constraints and CSR-generator specific operating parameters.

FERC in March accepted NYISO rules allowing an energy storage resource to participate in the wholesale markets as a CSR with wind or solar, and the ISO has since been working on the market software. (See FERC Approves NYISO Co-located Storage Model.)

“In solving the market software, we found there were unique circumstances where these constraints were actually competing with other constraints in the model, specifically operating parameters of the generator specific to the CSR model,” said Zachary Stines, manager of energy market design.

In that situation the ISO had to prioritize which constraint was going to be respected and which was going to be relaxed to come up with an appropriate solution, “so this is really to prevent an issue where you could have these competing constraints on the individual units and then also this withdrawal or injection limit constraint,” Stines said.

Language will be added to the applicable manuals (likely the Day-Ahead Scheduling Manual and the Transmission and Dispatch Operations Manual) describing how the scheduling limits will interact with unit specific constraints, such as ramp, upper operating limit and lower operating limit.

If approved by the Management Committee this month and the Board of Directors in November, NYISO will make a filing with FERC and request a flexible effective date for the tariff changes that is prior to year-end.