A divided FERC means the proposed Southeast Energy Exchange Market (SEEM) agreement took effect on Oct. 12, the commission announced Wednesday (ER21-1111, et al.), bringing relief for the proposal’s supporters and criticism from its opponents.

The agreement became effective “by operation of law” because FERC had failed to take action by Oct. 11, 60 days after SEEM’s supporters — a consortium of electric utilities including Southern Company (NYSE:SO), Dominion Energy South Carolina, Louisville Gas & Electric, the Tennessee Valley Authority, and Duke Energy (NYSE:DUK) — filed their response to the commission’s latest deficiency letter. (See SEEM Members Push for FERC’s Decision on Market Proposal.)

With commissioners “divided two against two as to the lawfulness of the change,” the measure automatically took effect in accordance with Section 205 of the Federal Power Act. It is the second time in two months that a deadlocked FERC allowed approval of a proposal, after the passage of PJM’s minimum offer price rule in September (ER21-2582). (See FERC Deadlock Allows Revised PJM MOPR.)

SEEM supporters issued a release Wednesday promising the platform would be operational by the middle of next year. The release listed a number of “founding members of SEEM” in addition to Duke, Southern, TVA and Dominion. Some utilities that have not yet made “firm decisions” are expected to do so as a result of the FERC ruling, and membership is open to any additional entities that meet the requirements.

A decision on SEEM was expected at the commission’s most recent open meeting, where the proposal was on the agenda, but the item was removed at the start of the meeting. FERC’s statement Wednesday did not reveal which commissioners supported the proposal. Commissioners are required by the FPA to provide written statements explaining their views, but the law does not specify when they must do so. So far, none of the commissioners have done so regarding the PJM MOPR decision.

Currently the commission has two Democratic members and two Republicans; President Joe Biden nominated D.C. Public Service Commission Chair Willie Phillips to fill the seat vacated by Republican Neil Chatterjee in August. (See Biden to Nominate Phillips to FERC.)

Critics Warn of Entrenching Current Winners

SEEM’s supporters submitted the proposed agreement to FERC in February, promising that the planned expansion of bilateral trading in 11 Southeastern states would reduce trading friction while promoting the integration of renewable resources. The proposal is intended to reduce trading friction by introducing automation, eliminating transmission rate pancaking, and allowing 15-minute energy transactions.

Criticism has dogged the project from the start, with opponents skeptical of the promises of its supporters. In multiple filings to FERC, a collection of environmental groups, including the Sierra Club, the Southern Alliance for Clean Energy, the North Carolina Sustainable Energy Association, and the Southern Environmental Law Center (SELC), warned that SEEM would allow transmission-owning utilities to “favor their own generated electricity and to exclude competitors from the market.” (See SEEM Critics Repeat Call for Technical Conference.)

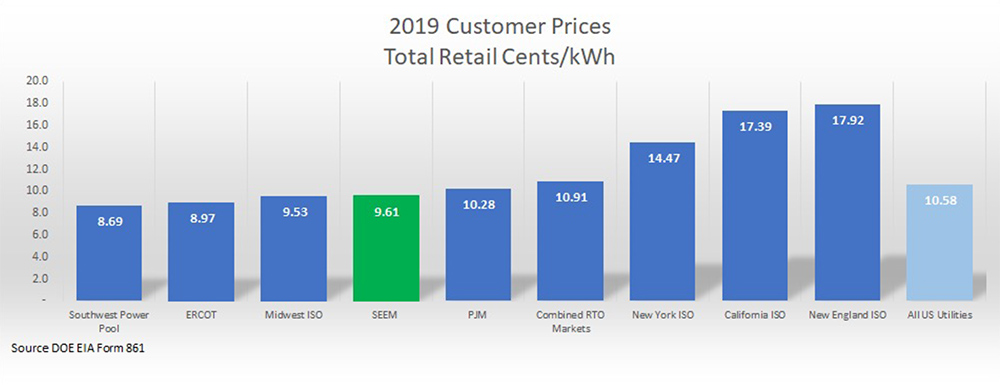

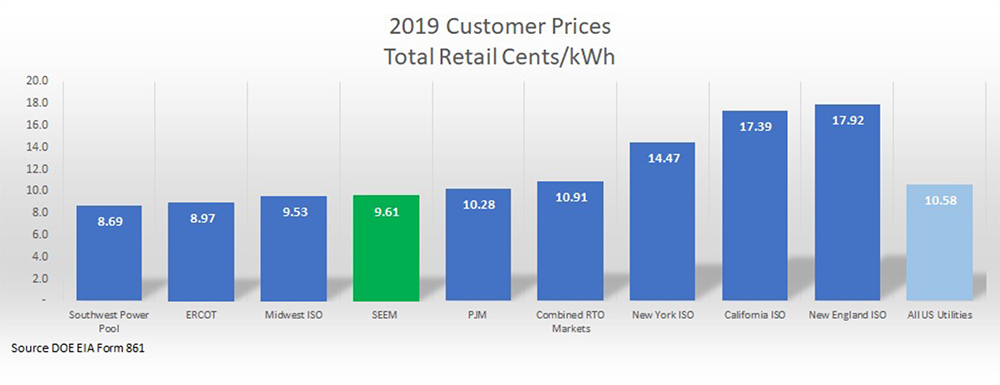

Average retail prices for utilities in SEEM versus the RTO markets. | SEEM

Average retail prices for utilities in SEEM versus the RTO markets. | SEEM

In addition, a September report by the American Council on Renewable Energy (ACORE) suggested that other models surpassed the supposed benefits of SEEM. The report simulated SEEM against three alternative energy market models in the same footprint and found that all three outperformed SEEM in terms of financial savings, integration of renewable energy resources, and reduction in carbon emissions over 20 years. (See Report: SEEM’s Benefits Beaten by Other Models.)

Following FERC’s announcement, SELC attorney Maia Hutt called SEEM’s supporters “some of the largest monopoly utilities in the country” and stressed that “SEEM … cannot be the last step towards wholesale market reform in the Southeast.”

Gizelle Wray, director of regulatory affairs and counsel at the Solar Energy Industries Association (SEIA), said in a statement that the proposal was “not a real market,” and would merely help “entrenched monopoly utilities” to consolidate their power.

“We need a true market that encourages new entrants and competitive bidding, all of which could help bring Southeast utilities into the 21st century. We are in a race against the clock on climate change, and structures like SEEM will only hinder our progress,” Wray said. “This decision is a clear sign of what can go wrong when there’s a 2-2 split on FERC and proposals go into effect by law. We urge the Senate to quickly confirm [Chairman Phillips] so we can have a fully functioning commission.”

Changes Promised After Deficiency Letter

Given the way the SEEM proposal was approved, it is not clear whether supporters will follow through on the changes they promised in a filing in June. FERC sent SEEM organizers a deficiency notice in May, submitting 12 detailed questions about how the plan to automate matching buyers and sellers would operate. In response, proponents suggested several modifications to the agreement, including:

- confidential weekly submissions of market data to FERC and the market auditor.

- disclosure of regulators’ questions and answers, as well as market auditor reports, to participants, subject to restrictions on access to confidential information by marketing function employees.

- a clarification that available transfer capability calculated by participating transmission providers must be provided to the SEEM administrator and must be used in the algorithm for each leg of any contract path to ensure transmission will not exceed available capacity.

- making the “just and reasonable standard” the default for most SEEM rules rather than the lower Mobile-Sierra public interest standard. (See SEEM Members Offer Rule Changes.)

SEEM’s release on Wednesday made no mention of these changes, only thanking FERC and its staff “for their thorough review” and pledging to follow “all FERC-approved rules and requirements for existing bilateral markets today, but with additional transparency.” Advanced Energy Economy, a national association of companies promoting clean energy and electrified transportation, warned that the lack of a FERC order “allows the sponsoring utilities to move forward without any commission direction” on implementation or transparency.